Dow Chemical (NYSE:DOW) and DuPont (NYSE:DD) said that Brazil's Administrative Council for Economic Defense (“CADE”) has conditionally approved their proposed $130 billion mega-merger. This represents another important milestone for the planned merger transaction.

The approval is subject to the implementation of certain remedies that include the sale of a select portion of Dow AgroSciences' corn seed business in Brazil. These include certain seed processing plants and seed research centers, a copy of Dow AgroSciences' Brazilian corn germplasm bank and a license for the use of the Dow Seeds brand for a specific period of time.

This is in addition to the earlier announced sale of certain parts of DuPont's crop protection business and R&D pipeline and organization and Dow's global ethylene acrylic acid copolymers and ionomers business, which is in sync with commitments already made to the European Commission (“EC”) and regulatory agencies in other jurisdictions.

The EC conditionally approved the merger in Mar 2017 after both companies committed to sell major portions of different businesses. Moreover, the companies, earlier this month, secured conditional regulatory approval in China for the planned merger.

Dow and DuPont continue to work constructively with regulators in the remaining relevant jurisdictions to obtain approval for the merger. The companies continue to expect the closing of the deal to take place between Aug 1, 2017 and Sep 1, 2017.

Dow and DuPont also recently declared the members of the board of directors for the proposed merger. The board of the combined entity will consist of 16 directors – eight incumbent Dow directors and eight current DuPont directors. The appointments will be effective on completion of the merger.

Moreover, Dow recently provided an update on the transition of its CEO Andrew Liveris. The company noted that Liveris will serve as the executive chairman of the combined entity from closing of the merger through Apr 1, 2018, when he will become the chairman of the integrated company. Liveris will then retire from the company and the board on Jul 1, 2018.

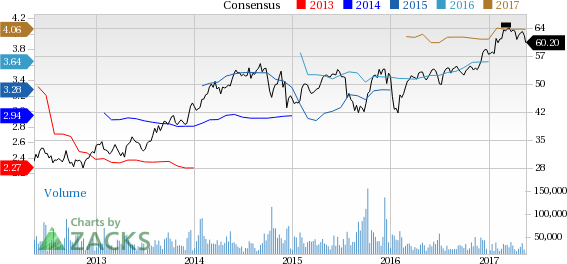

Dow’s shares have rallied around 18.6% over a year, modestly underperforming the Zacks categorized Chemicals-Diversified industry’s gain of roughly 20.5%.

Dow topped earnings expectations in first-quarter 2017, helped by its cost-cutting and productivity actions and continued focus on consumer-driven markets. The company is seeing strong demand across major consumer-focused markets such as packaging, infrastructure, transportation and consumer care, which is contributing to volume and earnings growth.

The company is witnessing signs of positive economic momentum globally amid sustained geopolitical risks and volatility. Dow believes that the strength of its portfolio coupled with its focus on consumer-led markets will continue to serve it well in this backdrop.

Dow is a Zacks Rank #3 (Hold) stock.

Stocks to Consider

Better-placed companies in the chemical space include Huntsman Corporation (NYSE:HUN) and The Chemours Company (NYSE:CC) , both sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Huntsman has expected long-term growth of 7%.

Chemours has expected long-term growth of 15.5%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

E.I. du Pont de Nemours and Company (DD): Free Stock Analysis Report

Dow Chemical Company (The) (DOW): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Original post

Zacks Investment Research