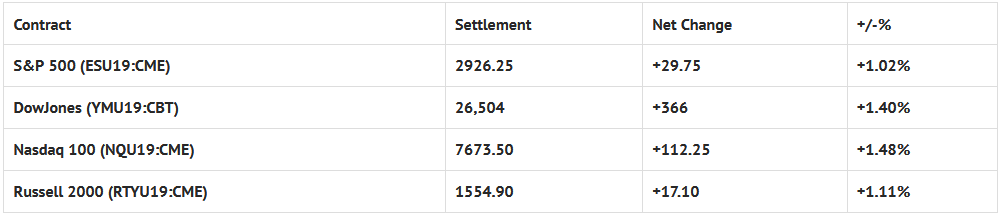

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 11 out of 11 markets closed higher: Shanghai Comp +0.96%, Hang Seng +2.56%, Nikkei +1.72%

- In Europe 7 out of 13 markets are trading higher: CAC +0.11%, DAX +0.07%, FTSE -0.26%

- Fair Value: S&P +5.13, NASDAQ +29.51, Dow +17.79

- Total Volume: +2.24 million ESU & 9.4k SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, FOMC Meeting Announcement 2:00 PM ET, FOMC Forecasts 2:00 PM ET, and Fed Chair Press Conference 2:30 PM ET.

S&P 500 Futures: #ES 2936.50, #NQ 7722.00

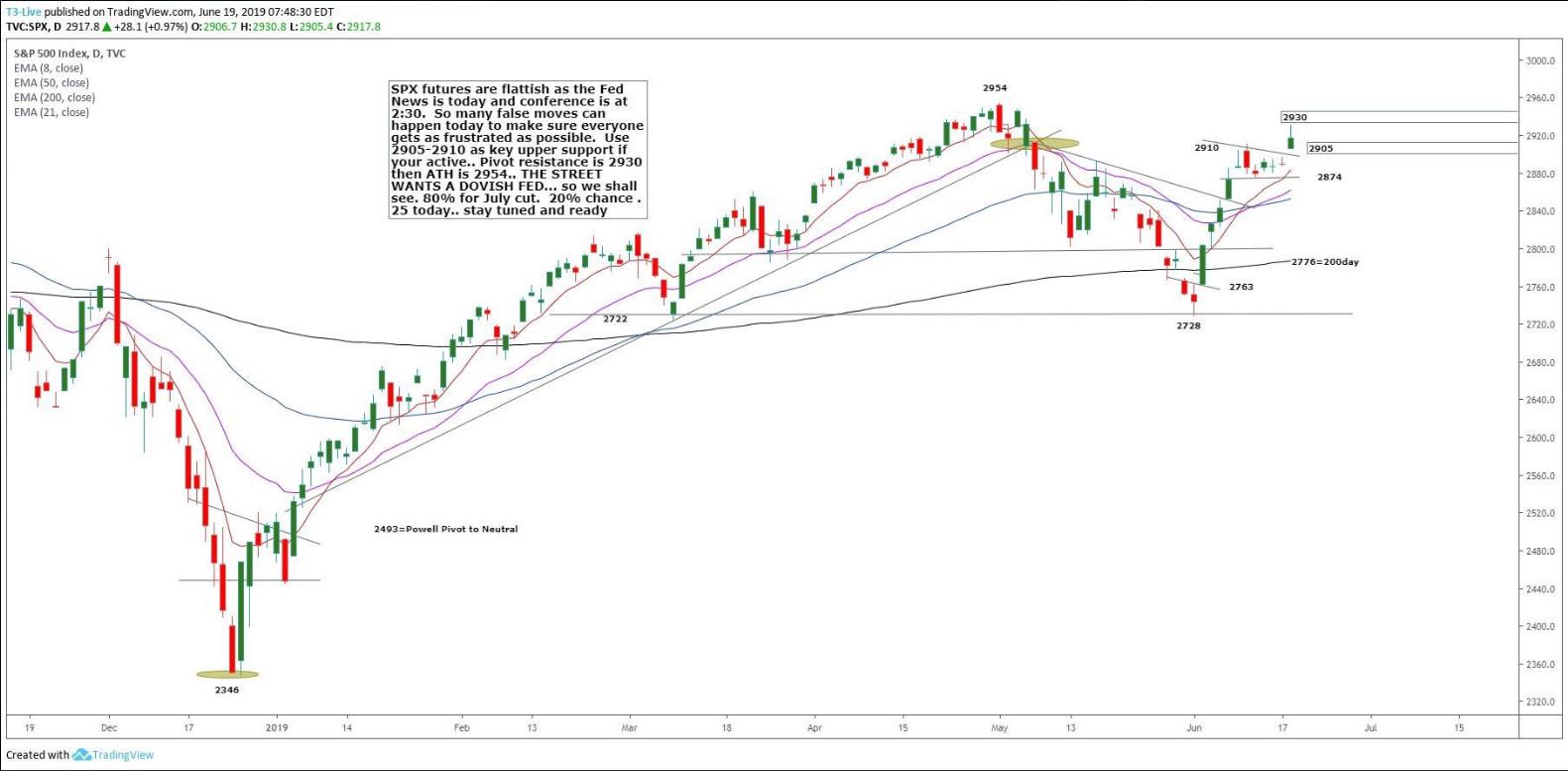

Chart courtesy of Scott Redler @RedDogT3 – $spx futures flattish ahead if the Fed. Have your levels and terms handy come 2:00-2:30 and watch the False Moves as they try and test both sides usually.

After rallying during Monday nights Globex session, the S&P 500 futures initially pulled back a little after the 8:30 CT bell, and then Trump posted a tweet about extended talks with President XI of China at the G20 summit next week, and the markets EXPLODED! In a matter of minutes, the ESU had rallied 22.25 handles, and the NQU rallied 86.75 points.

Once the initial thrust subsided, the futures continued to grind higher, and eventually topped out at 2936.50. From there, sellers stepped in, and for the rest of the day there was a steady grind lower.

Heading into the final hour, the ES had retraced nearly half of its RTH gains, and when the MiM reveal came out showing $691 million to sell, it was trading at 2823.75. There was a little late strength going into the close, and the futures went on to print 2923.50 on the 3:00 cash close, and 2926.75 on the 3:15 futures close.

We all like a market that trends, but with the ES up 208 handles since making its 2728.75 low just two weeks ago, one has to wonder when the boys with the better seat will hit the breaks. The ECB lowering rates and Trump boasting a meeting with Xi at the G20 is now old news. What’s not old news is today’s rate decision. While odds favor no rate hike, I would like to add that the stock market trades off ‘wild cards’, and this afternoon is clearly a wild card.