Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

I am fond of the phrase…”It’s not the odds of an event happening that is key, it’s the impact if it does!”

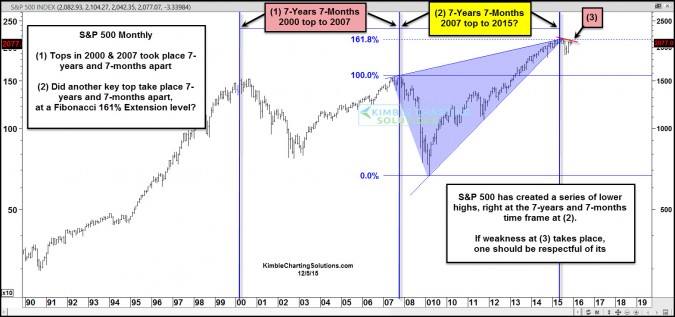

The S&P 500 peaked in 2000 and 2007. The time between these historical tops was 7-years and 7-months apart. Could the S&P 500 have created another key high, 7-years and 7-months apart, following the 2007 highs?

The odds of this are low, the impact would be high if it's true.

We keep our readers informed of the ratio below, which we think is very important for the macro picture. This ratio is the Equal Weighted/Cap weighted S&P 500 ratio (via Guggenheim Invest S&P 500 Equal Weight (N:RSP):SPDR S&P 500 (N:SPY)).

This ratio historically sends a bullish message when it is rising and at least a cautionary signal when falling. As you can see above, when the ratio broke support in 2007 and 2011, the broad market turned weaker.

Since last year, the ratio has diverged against the S&P 500 and now it's attempting to break a 5-year support line above. This softness is “at least” a cautionary message for the broad markets.

Did the S&P 500 create another top 7-years and 7-months apart? Still too soon to tell. Again, it's not the odds of this being true, it's the impact if it does.