After suffering its worst month since the financial crisis in October, the Nasdaq Composite (IXIC) sent up a rare technical signal to start November. Specifically, the tech-rich index made seven straight triple-digit point moves -- the longest streak on record. The previous streak of triple-digit gains or losses was five days, set back in April 2000, according to Schaeffer's Quantitative Analyst Chris Prybal. Below is what we might expect after the Nasdaq's recent stretch of extreme volatility.

The recent streak started with a drop of more than 300 points on Oct. 24, which represented the index's worst daily point loss since April 2000. It was the index's worst daily percentage loss since August 2011. Over the next few sessions, the IXIC suffered two more triple-digit losses and four triple-digit gains.

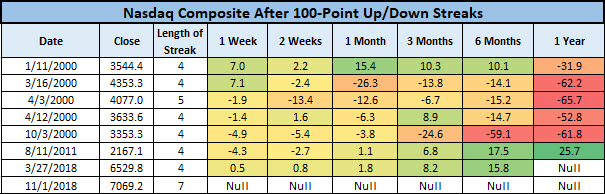

There have been just seven streaks of at least four straight triple-digit point moves for the Nasdaq. The most recent was this past March, and prior to that you'd have to go back to the aforementioned rough patch in August 2011. The others all occurred as the dot-com bubble burst in 2000.

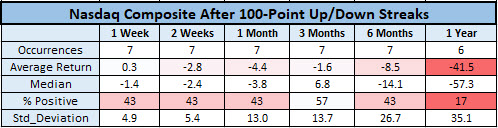

Because more than half of the signals happened during the tech crash of the early 2000s, long-term returns after these signals are extremely poor. On average, the Nasdaq was down a whopping 41.5% one year later, and positive just 17% of the time. It's a similar situation six months after streaks, with the IXIC down 8.5%, on average, and higher just 43% of the time. The only marker at which the Nasdaq was higher more than 50% of the time was three months after a signal, though the average return was still a loss of 1.6%.

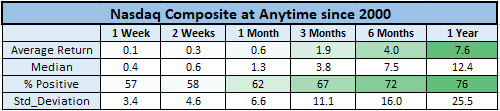

Those stats are clearly way worse than the index's average anytime returns. Since 2000, the IXIC has been higher more often than not at every checkpoint, and averages a one-year gain of 7.6%, with a win rate of 76%.

In conclusion, at a glance, the signals above seem very bearish for the Nasdaq Composite. Again, though, one must consider that most of those signals occurred before or during a notorious stock market crash. Plus, as the Nasdaq has moved higher, triple-digit moves have become more common; a 200-point drop from 3,000 is much more significant than a 300-point drop from 7,000. What's encouraging is the index's ability to rebound after the last two stretches of multiple 100-plus-point moves.

In the short term, at least, several things could factor into stocks' trajectory. To start, tomorrow's midterm elections, which tend to precede big gains over the next six months. In addition, the Fed is expected to stand pat on interest rates at this week's meeting, which has also been bullish for stocks in the short term, since the current tightening cycle began in December 2015. But traders looking to speculate on the stock market without putting a ton of dollars on the line should consider buying options, with premiums likely to deflate as earnings season winds down.