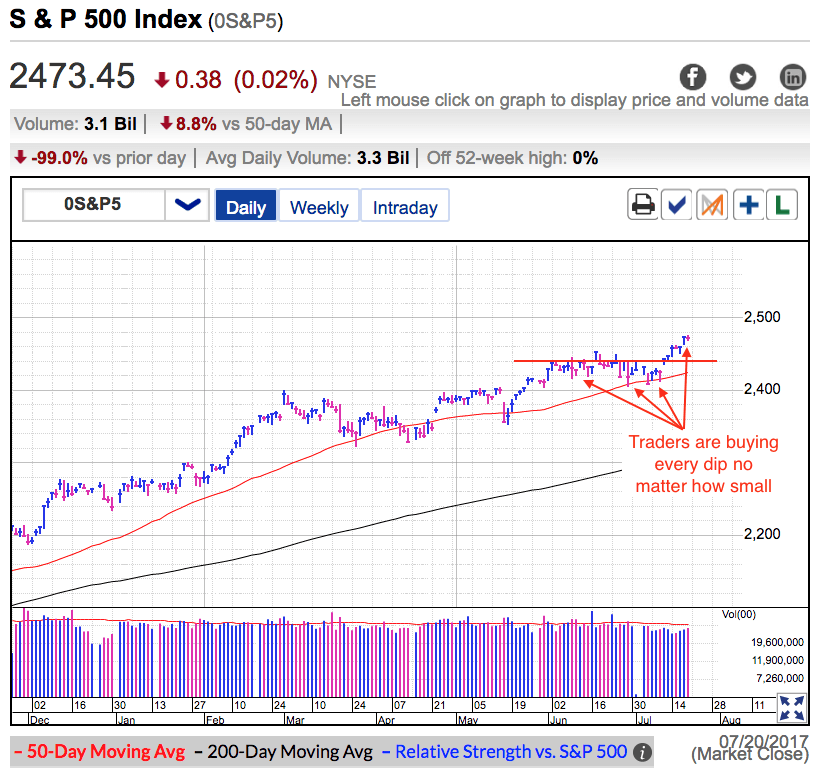

Even though the S&P 500 traded flat Thursday, holding near the highs was a win for bulls. We opened the day with modest losses, but little more than an hour later traders were enthusiastically buying a five-point dip. Selloffs that used to last multiple days and set us back several percent are now being bought within hours and a handful of points. But this shouldn’t come as a surprise. Any defensive sale over the last 12-months was a costly mistake and traders have learned their lesson. Hold no matter what. Headlines stop mattering when no one sells them.

Conventional stock market wisdom warns us about this type of complacency, but what conventional wisdom fails to mention is that these periods of complacency can last a long, long time. Confident owners don’t sell and that keeps supply tight. It is really hard for any selloff to build momentum when so few owners sell the weakness.

More recently this market transitioned from a fearful, half-empty outlook to today’s everything is fine, half-full attitude. Rate-hikes? Political dysfunction? Expanding investigation into our president? Meh, whatever. The market is giving the benefit of doubt to Trump, Congress, and the Fed. Since we trade the market we are given, we need to give them the benefit of doubt too. But that doesn’t mean we trust absolutely.

I get nervous when everyone else is calm and confident. And right now this is the most nervous I’ve been since the 2009 market bottom. This market used to be afraid of its own shadow and that uneasiness kept prices in check. But that is no longer the case. Risk is a function of height and these record highs make this the riskiest place to own stocks since the 2007 top. The path of least resistance remains higher and it is definitely premature to fight this market, but we need to be careful.

As small traders we have the nimbleness that allows us to jump in and out of the market at a moment’s notice so we don’t need to adopt a defensive strategy prematurely. Unlike big money managers, we can wait for the market to tell us it is time to take profits and start trading the other direction. But we are not there yet. This remains a buy-and-hold market at least until the end of summer. After that things will get a lot more interesting. Until then enjoy the slow climb higher.