The cherry-picked narrative that a recession is just around the corner is a little off the mark. Don’t forget the demand side of the inflation equation.

As you’ve read in my (extra) Saturday analysis, the technical outlook for the precious metals market remains bullish in the near term. And the market already agrees—gold was already up in Monday’s pre-market trading, and the odds were that our profitable long positions will be even more profitable shortly. As I indicated on Saturday, today’s analysis will focus on fundamentals.

Take The Ball And Run With It

With the new narrative on Wall Street proclaiming that a destitute U.S. consumer is all tapped out and a recession looms, investors have succumbed to the same pitfalls that led them astray in 2021. When market participants were blindly following the Fed’s “transitory” narrative, I wrote on Dec. 23:

Please note that when the Fed called inflation “transitory,” I wrote for months that officials were misreading the data. As a result, I don’t have a horse in this race. However, now they likely have it right. Thus, if investors assume that the Fed won’t tighten, their bets will likely go bust in 2022.

To that point, with the same merry-go-round on full display now, the permabears and the media are running in circles once again.

Likewise, Bloomberg published an article on May 21 that stated:

“The retailers now find themselves flush with clothes, televisions and other discretionary items that customers aren’t buying as they channel more spending into basic needs and services. As a result, the companies took markdowns that eroded profits.”

Source: Bloomberg

Again, please remember that I don’t have a horse in this race. I expect the U.S. to fall into a recession as the prospect of a “soft landing” is highly unrealistic. However, the recession should come as the Fed’s rate hike cycle intensifies, not now.

Moreover, those that cry wolf until one finally arises lack objectivity, and therefore lead investors astray. Thus, the bond bulls that saluted “transitory” died a slow death in 2021/2022, and the investors that cried wolf about a recession for the last two years are louder than ever. However, objective analysis suggests otherwise.

For example, the narrative crowd focuses all their attention on Walmart (NYSE:WMT) and Target (NYSE:TGT) while turning a blind eye to Home Depot's (NYSE:HD) outperformance. For context, I wrote on May 20:

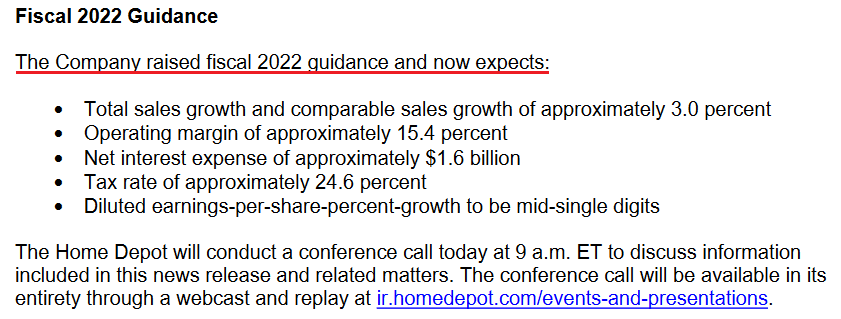

Home Depot – the fourth-largest retailer in the U.S.—had a phenomenal quarter. Moreover, the company primarily sells discretionary items (products purchased with disposable income), and management raised their 2022 guidance. As a result, with the U.S. housing market more affected by higher interest rates than any other sector, Home Depot hasn't seen any demand destruction.

Source: Home Depot

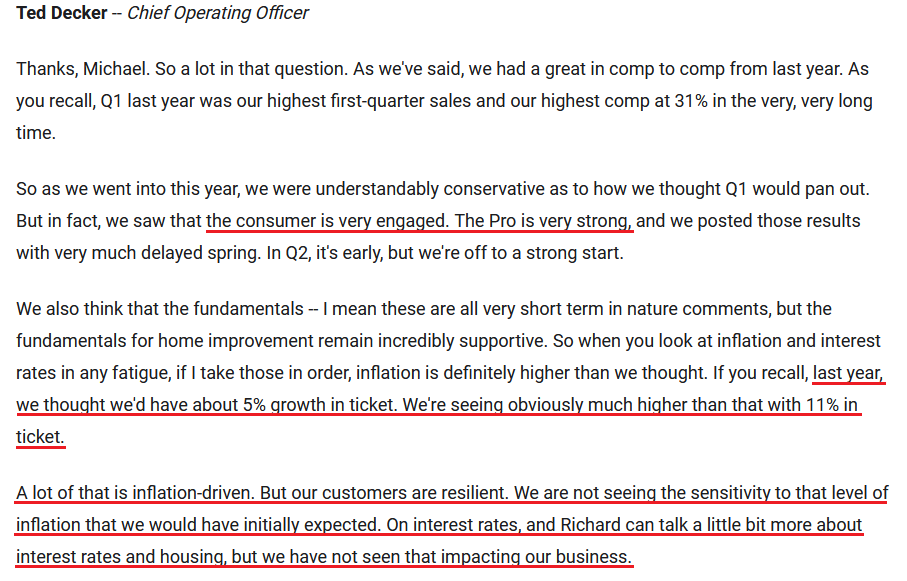

Moreover, I noted the optimistic comments from now CEO Ted Decker previously:

Source: Home Depot/The Motley Fool

Likewise, Foot Locker (NYSE:FL) released its earnings on May 20. For context, the retailer sells apparel and footwear from brands like Nike (NYSE:NKE), Adidas (OTC:ADDYY), and New Balance. CFO Andrew Page said:

“Based on our current visibility, we now expect to achieve the upper end of our revenue and earnings guidance for the full year. While supply chain volatility continues, we are pleased with our receipt flow so far this year, which gives us incremental confidence in our ability to fill demand for the balance of the year.”

As a result, while the demand destruction narrative percolates, Foot Locker isn’t sounding the alarm.

Source: Foot Locker/Seeking Alpha

Furthermore, Canada Goose (NYSE:GOOS) released its earnings on May 19. For context, the luxury retailer sells parkas at price points of more than $1,000; and after increasing its guidance, CEO Dani Reiss said:

Source: Canada Goose/Seeking Alpha

Continuing the theme, Deere & Company (NYSE:DE)—which manufactures agricultural machinery, heavy equipment, forestry machinery, and lawn care equipment—released its earnings on May 20. In-house economist Kanlaya Barr said:

“We expect U.S. and Canada industry sales of large [agriculture] equipment to be up approximately 20%. Order books for the remaining of the current fiscal year are mostly full, and we already see signs of strong demand for model year '23 equipment, with some order books opening in June.”

Moreover, Brent Norwood, head of investor relations, said:

“We expect our price for the full year will more than offset increases in material and freight…. With respect to price, so far what we've seen in 2022 is it hasn't had much of effect on demand. And as we noted, we're already seeing indication of interest for '23, even though some products may be above trend line price realization already for '23.”

As a result, not only has demand remained resilient, but management expects more price increases in the second half of 2022.

Source: Deere & Company/Seeking Alpha

Norwood added:

“With respect to our crop care or the order program, where we do have prices set, we are seeing pricing for crop care products in the high single digits for next year. So, we would expect pricing to be above trend line for those products going into next year.”

Moreover, with crop care pricing “fairly correlated” with the rest of Deere & Company’s products, the overlooked results are highly inflationary.

Source: Deere & Company/Seeking Alpha

Also noteworthy, Palo Alto Networks (NASDAQ:PANW)—the largest cybersecurity company in the U.S.—released its earnings on May 19. CEO Nikesh Arora said:

“If you compare and contrast what we're seeing today with what we saw about two and a half years ago, two years ago when the pandemic hit, believe it or not, there were more industries impacted by the pandemic than are impacted right now by inflation concerns….

“And even when it is felt, you'll see it in some constrained industries because the service is boom right now. There are more jobs than people being hired. So, we're not seeing the pressure from an inflation or reduced economic activity perspective.”

Thus, resilient demand and higher prices remains the story at Palo Alto Networks.

Source: Palo Alto Networks/The Motley Fool

Therefore, while a recession remains the most likely outcome over the medium term, cheering it on won’t make it come to fruition. Moreover, cherry-picking data that supports one’s narrative is neither objective nor profitable.

As such, while commentators issue dire warnings about Walmart and Target’s performances, other retailers are still flourishing.

In addition, it’s important to remember that Walmart and Target sell a lot of generic clothing items that don’t have brand power. Therefore, it’s easy to see the dichotomy between Walmart—where management said that “we started being aggressive with rollbacks in apparel”—and the strong results from companies like Foot Locker and Canada Goose.

Finally, the New York Fed released its Empire Manufacturing Survey on May 16. The data is largely neutral for Fed policy since “the headline general business conditions index dropped thirty-six points to -11.6.”

However:

“The index for number of employees increased seven points to 14.0, and the average workweek index held steady at 11.9, indicating a modest increase in employment levels and the average workweek.”

In addition:

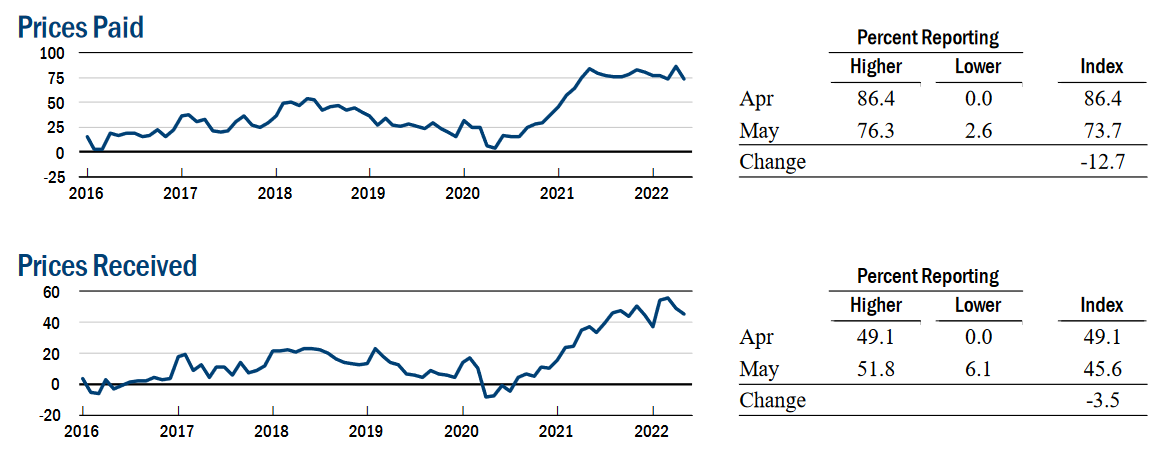

“After reaching a record high last month, the prices paid index fell thirteen points to a still elevated 73.7, and the prices received index edged down to 45.6, signaling ongoing substantial increases in both input prices and selling prices, though at a slower pace than last month.”

Thus, the mixed results show employment and inflation increasing while output decelerated sharply. However, the data compiled from May 2-9 highlights how inflationary pressures remain problematic.

Source: New York Fed

Singing a similar tune, the Philadelphia Fed released its Manufacturing Business Outlook Survey on May 20. For context, the data was compiled from May 9-16. The report stated:

“The survey’s current general activity index declined, while the indicators for new orders and shipments rose. The employment index decreased, and the price indexes remained elevated but edged down…. The firms continued to report increases in prices for inputs and their own goods.”

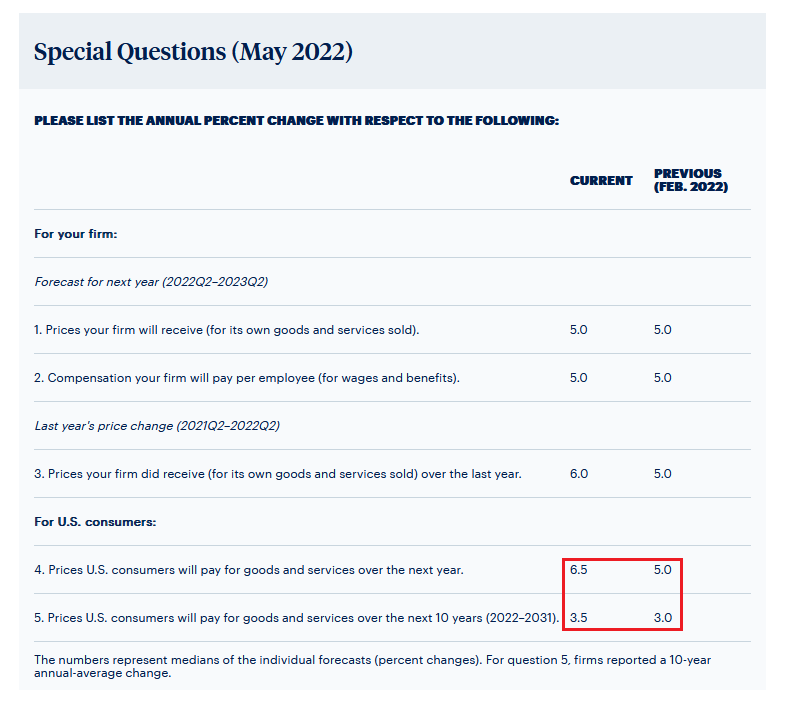

However, the release added that “the firms’ median forecast for the rate of inflation for U.S. consumers over the next year was 6.5 percent, up from 5.0 percent from when the question was last asked in February,” and that “the firms’ median forecast for the long-run (10-year average) inflation rate was 3.5 percent, up from 3.0 percent in February.”

As a result, the Fed still has plenty of work to do to keep inflation expectations in check.

Source: Philadelphia Fed

The bottom line? While narratives move markets, the doom-and-gloom crowd is cherry-picking data to support their conclusion. Moreover, I don’t care if/when the U.S. falls into recession. I’m simply presenting an objective analysis. Also, I’ve noted on numerous occasions that investors underestimated the demand side of the inflation equation.

In addition, the recession crowd doesn’t realize that a penniless consumer is actually bullish for the S&P 500 because demand destruction reduces inflation and allows the Fed to resume QE.

In contrast, resilient consumer spending keeps the Fed’s foot on the hawkish accelerator. As a result, with the latter stronger than many believe, inflation should remain uplifted, and the Fed’s liquidity drain should result in more medium-term pain for the PMs and the general stock market.

In conclusion, the PMs were mixed on May 20, as gold managed to close in positive territory. However, with our long position in the VanEck Junior Gold Miners ETF (NYSE:GDXJ) still in the green, and more short-term upside poised to materialize, relief rallies should reign before pessimism dominates in the months ahead.