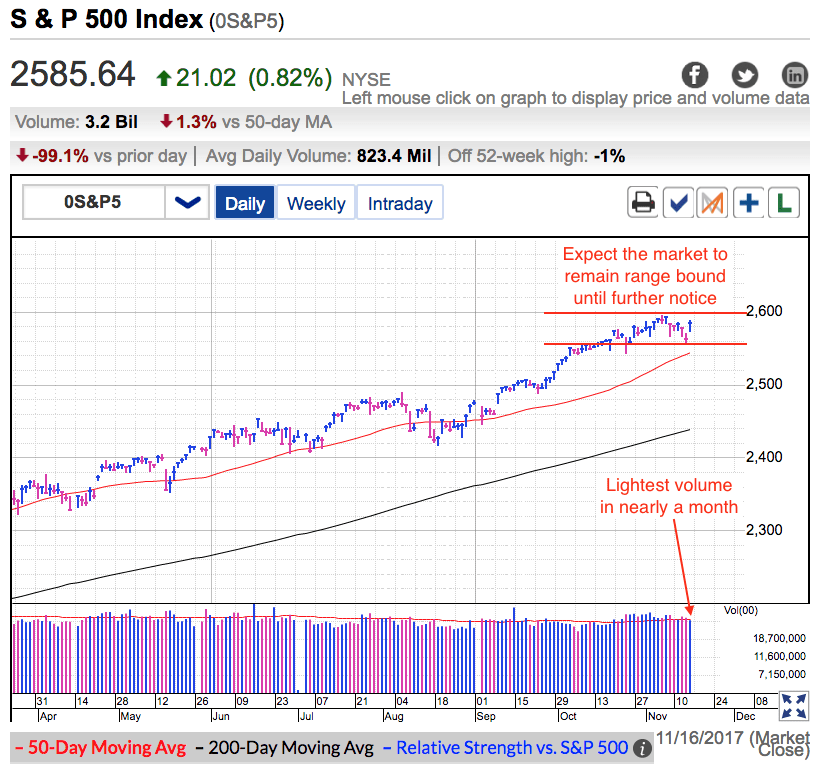

The S&P 500’s whipsaw continues as Wednesday’s crash turned into Thursday’s rip. Even though prices rebounded decisively, volume was conspicuously absent and Thursday’s turnover was the lowest in nearly a month. The light volume tells us this rebound was driven more by a lack of selling than a surge of buying. This isn’t a surprise given how stubbornly confident owners have been. No matter what the headlines and price-action have been, confident owners don’t care and refuse to sell. No matter what the bears think, when owners don’t sell, headlines stop mattering.

Unfortunately demand near the highs continues to be a problem. While confident owners don’t care about the headlines, prospective buyers with cash do. Valuations are stretched and most would-be buyers want more clarity before they are willing to chase prices even higher. Little selling and little buying means we will remain range bound over the near-term.

This volatility is doing a good job of humiliating reactive traders. Anyone who sold Wednesday’s dip is suffering from regret as they watched Thursday’s rebound from the sidelines. The only people more upset by this strength are the bears who shorted Wednesday’s weakness. Breakout buying and breakdown shorting are great strategies in directional markets. Unfortunately they are costly mistakes in sideways markets like this.

The thing to remember about range-bound markets is that they include moves to the extreme edges of the range. There is still downside left in the recent dip and we will likely test 2,550 and the 50dma before this is all said and done. And not only that, expect us to also poke our head above 2,600. Keep this in mind when planning your next trade. Just like how Wednesday’s weakness was a good buying opportunity, Thursday’s strength is an interesting selling/shorting point. In range bound markets we trade against the price-action and that means buying weakness and selling strength.

Tax Reform continues to dominate financial headlines. On the half-full side, the House passed its version of Tax Reform with several votes to spare. On the half-empty side, a Republican Senator announced his intention to vote against the Senate’s version. That leaves the GOP with only a single vote to spare. But this isn’t unusual. Threatening to blow everything up unless you get your way is a how modern politics works and this is simply a negotiating tactic.

If the market cared about infighting within the Republican Party, it would have shown up in the price-action already. For the time being most owners are giving the GOP the benefit of doubt and are not worried about these interim speed bumps. If the market doesn’t care, then neither should we.

That said, I still think this market hinges on the outcome of Tax Reform. Pass something worthwhile and the rally continues. If Republicans crash and burn again, the market will follow. Until then I expect the market to remain range bound. If I’m not getting paid to hold risk, then I’d rather watch safely from the sidelines. Long-term investors should stick with their favorite positions, but traders are better served waiting for a more attractive opportunity.