From BlackRock: Will the rally in foreign stocks finally put an end to American investors’ home country bias? Martin Small explains how ETFs can help make it easy to plant a flag internationally.

Consider these numbers: Markets outside the U.S. represent half of the total value of the 47 developed and emerging stock markets that make up the MSCI All-Country World Equity Index (Source: MSCI). Yet more than 80% of U.S. investors hold only domestic stocks, according to Morningstar. We suffer from a chronic case of home country bias, and in the process we may miss a lot of chances to potentially improve the risk/return in portfolios. It’s understandable. With years of supernormal returns from U.S. stock markets, investors with diversified global portfolios may feel fatigued by trailing the U.S. market.

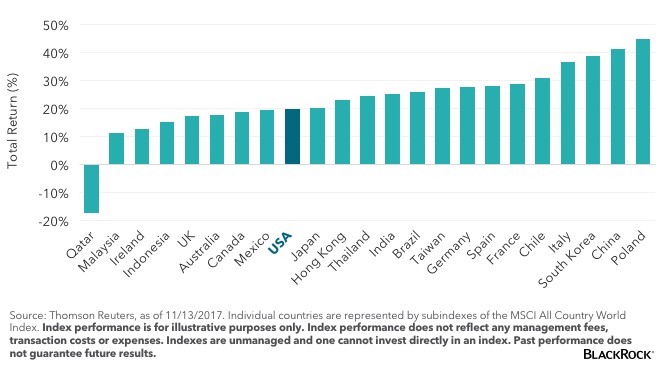

Perhaps the current bull market in foreign stocks will help nudge U.S. investors in the international direction. Many of these markets have seen positive performance throughout 2017. Flows into non-U.S. exchange traded funds (ETFs) have followed suit. Unusually, that growth is occurring across countries and regions.

Trailing 12-Month Total Return ($)

I recently moderated a roundtable discussion with a panel of international investing experts. They included my colleague Gerardo Rodriguez, who managed BlackRock’s emerging markets multi-asset strategies, a representative from index provider MSCI and several asset allocation specialists.

While we briefly covered the upsurge in stock prices, the bulk of our conversation focused on the future. We agreed that this era of globally synchronous growth, while highly welcome, may eventually become more idiosyncratic, potentially creating opportunities within specific countries and sectors. At the same time, we shared a concern that most U.S. investors are poorly positioned to capture these opportunities, as they tend to view international exposures as an in-and-out, “risk play” rather than a long-term strategy.

With that in mind, here are three ways to use ETFs to get more comfortable leaving home.

1. Go Broad

If your core portfolio is very concentrated in U.S. stocks, consider building out a broad allocation to developed and emerging markets. Then, step away and don’t touch it except to rebalance once or twice a year. For broad international exposure, consider iShares Core MSCI Total International Stock ETF (NASDAQ:IXUS).

2. Get Specific With Countries And Themes

Investing at a country level can be a great way to add diversification or growth potential to a portfolio. It’s worth digging into long-term factors that drive an economy’s growth. For example, countries with attractive demographics like Brazil, or a strong reform agenda like India, may offer opportunities that you can access using a country ETF. Digging even deeper, investors can apply the same level of granularity to international markets that they do to U.S. markets. Smart beta and currency hedged are also available to further diversify your portfolio. For specific countries and themes, consider iShares MSCI India Small-Cap ETF (NYSE:SMIN) or iShares MSCI Brazil Small-Cap ETF (NASDAQ:EWZS).

3. Consider Adding Foreign Bonds

Finally, for those who are skittish about potential volatility abroad, adding international bonds to the mix may help offset equity risk, just as they tend to do in U.S. portfolios. iShares Core International Aggregate Bond ETF (NYSE:IAGG) and iShares J.P. Morgan USD Emerging Markets Bond ETF (NASDAQ:EMB) are two to think about.

It remains to be seen whether the return to international is a sea change on how investors view the asset class; we won’t know until the next pullback. My suggestion: Keep the door open. If you’ve come for the rally, consider staying for the long-term possibilities.

Martin Small is the Head of U.S. iShares and a regular contributor to The Blog.

The iShares Core MSCI Total International Stock ETF was unchanged in premarket trading Wednesday. Year-to-date, IXUS has gained 24.99%, versus a 20.45% rise in the benchmark S&P 500 index during the same period.

IXUS currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #6 of 59 ETFs in the Foreign Large Cap Blend ETFs category.