How do you even begin to visualize $277 trillion?

If we convert it into seconds, 277 trillion is the equivalent of 8.8 million years. I’m not sure what was happening that long ago, but I guarantee you it didn’t involve people.

It’s been estimated that Jeff Bezos increases his net worth by about $321 million a day. At that rate, you’d have to work for close to 863,000 days, or 2,364 years, to reach $277 trillion.

You get the point. It’s an unfathomable sum.

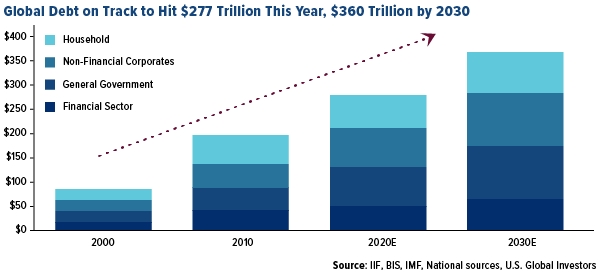

It’s also the total amount of debt the world is expected to hit by year-end. That’s according to the Institute of International Finance (IIF), whose members include some 400 banks and financial firms around the globe.

This year alone, as of the end of September, the world added $15 trillion to the debt pile, with government borrowing accounting for half of the increase, the IIF says. Debt in developed markets is set to hit 432% of gross domestic product (GDP). For emerging markets, it’s closer to 250%.

By 2030, the IIF estimates, we could be looking at $360 trillion in total debt.

So how did we get here, and what can investors do to protect their own wealth?

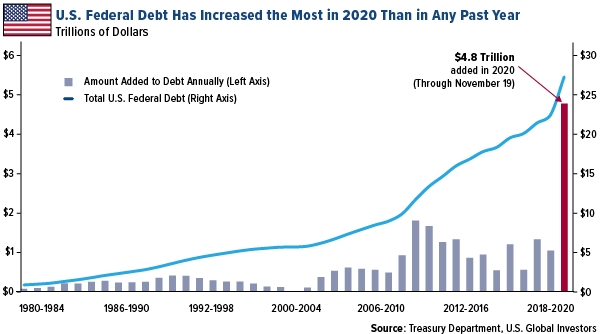

As you may expect, the economic fallout from the pandemic has dealt a huge blow to government coffers. So far in 2020, the U.S. has added more than $4.8 trillion to the federal debt, the most ever for a single year.

This has brought total federal debt up to a record $27 trillion, or 143% of U.S. GDP. Debt per U.S. taxpayer now comes in at a staggering $218,450.

We can’t blame everything on the pandemic. According to the IIF, the past four years have seen the largest debt buildup on record, with $52 trillion accumulated since 2016.

What this means is that, even during the pre-pandemic economic boom years, governments were not practicing sound fiscal management. Granted, governments weren’t the only contributors to the debt buildup, but they represent a huge part of it.

Knowing this, there’s no way we can reasonably expect them to get us out of this mess.

“There is significant uncertainty about how the global economy can deleverage in the future without significant adverse implications for economic activity,” IIF economists say.

Jared Dillian: Gold Is A Hedge Against Bad Government Decisions

Last week, Bloomberg published an article by Jared Dillian, investment strategist at Mauldin Economics. In the article, titled “Gold Is a Hedge Against Bad Government Decisions,” Dillian argues that investors mistakenly believe that gold is a hedge against inflation and stock market crashes.

Instead, he writes:

“[Gold] is a hedge on policymakers screwing up, and there has been a lot of screwing up in the last 20 years.”

Since the year 2000, U.S.-denominated gold has surged roughly 555% versus 146% for the S&P 500 Index. The reason for this, according to Dillian, is that “significantly looser financial conditions” have meant that there are “no constraints on monetary and fiscal policy.”

Indeed, the world is stuck in a low-rate environment. As of right now, no 10-year government bond in any major economy in Europe or North America has a yield higher than 1%. Several countries—including France, Germany, Sweden, the Netherlands and Switzerland—issue debt with a negative yield. And that’s the nominal yield, before factoring in inflation.

On Friday, in fact, the amount of government debt around the world trading with a negative yield rose to $17.1 trillion, a troubling new record.

Currency devaluation is real, and it’s only likely to accelerate. If you’re seeking to protect your family’s wealth against the failures of governments and central banks, I don’t believe there’s a more prudent option than hard assets. That includes not just gold and precious metals but also real estate, housing and, if you can stand the volatility, cryptocurrencies such as Bitcoin and Ethereum.

Disclosure: All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.