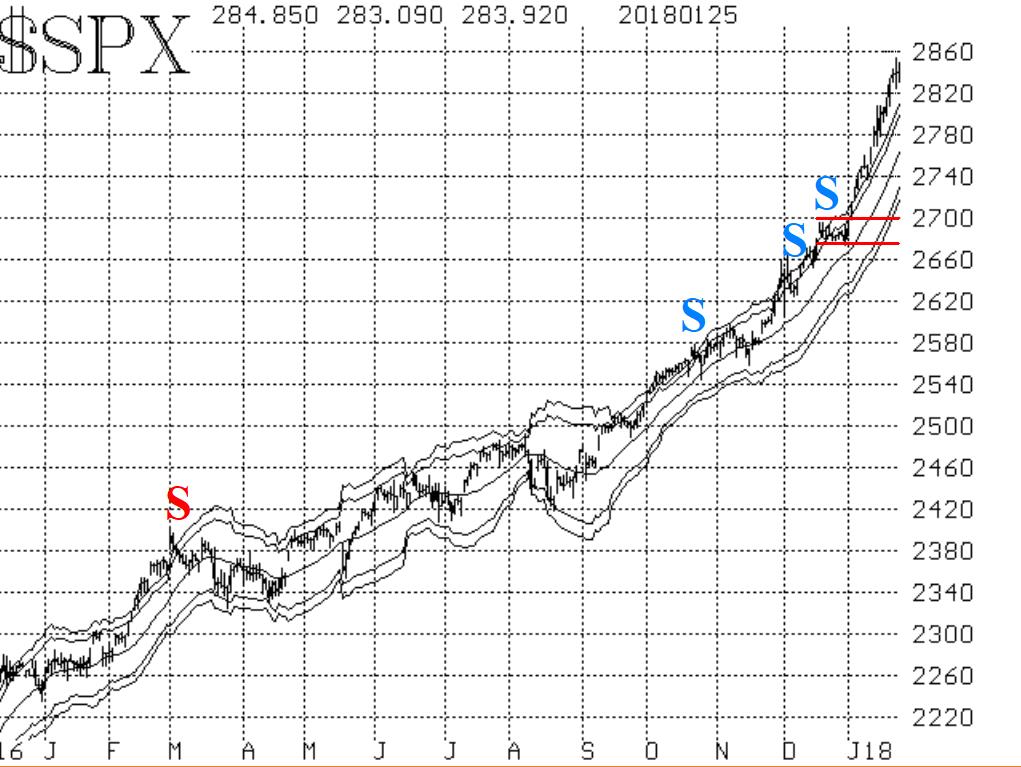

The superlatives that are being used to describe this market are well-deserved. S&P 500 (SPY (NYSE:SPY)) has advanced so fast that there really isn’t any support, unless you want to declare the low of the “half-day” correction at 2825 a minor support area.

The one clearly defined support area is the 2680-2700 area that was formed in late December and from which this

January rally was launched.

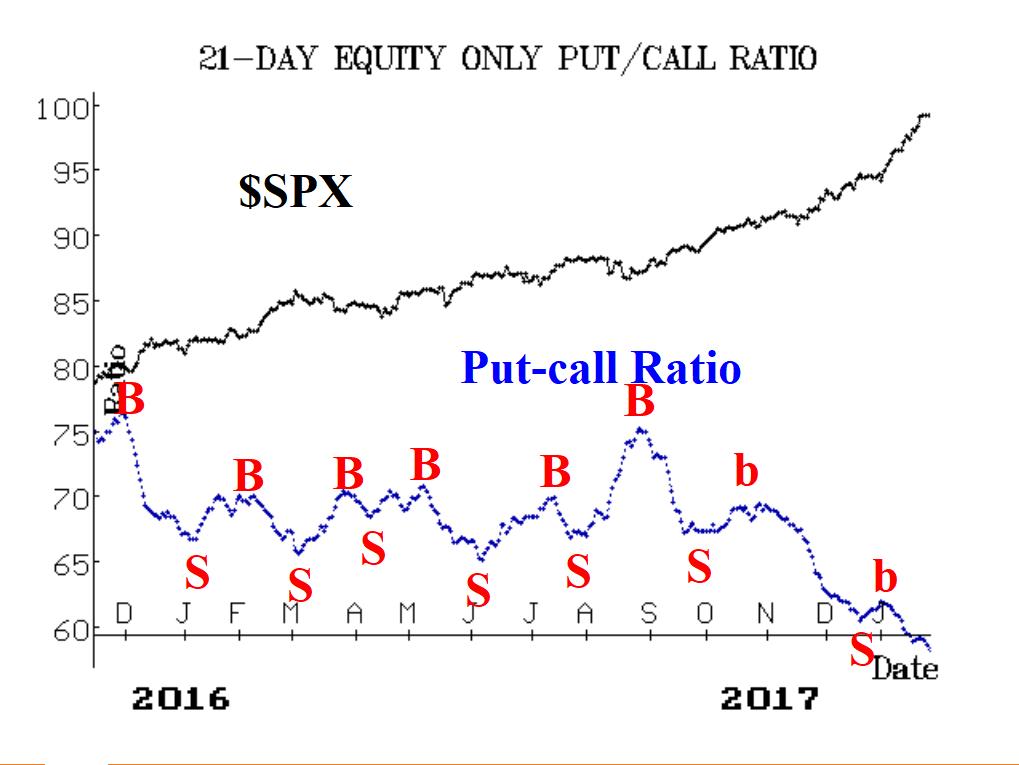

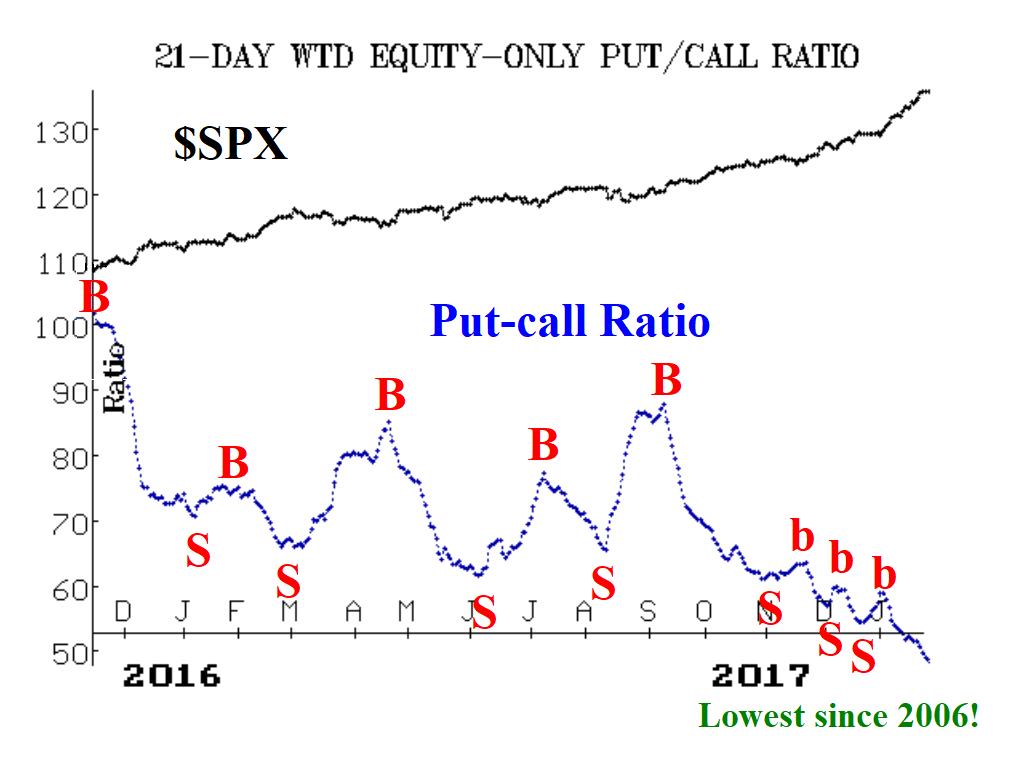

Call buyers are making money in this market, and they are piling in with a vengeance now. The equity-only put-call ratios are dropping even more rapidly than they previously were. That makes them overbought, but they are on buy signals.

As usual, market breadth is the killjoy among the technical indicators. But the market hasn’t much cared what breadth has to say, and it doesn’t right now, either. Both breadth oscillators are on buy signals, albeit just barely.

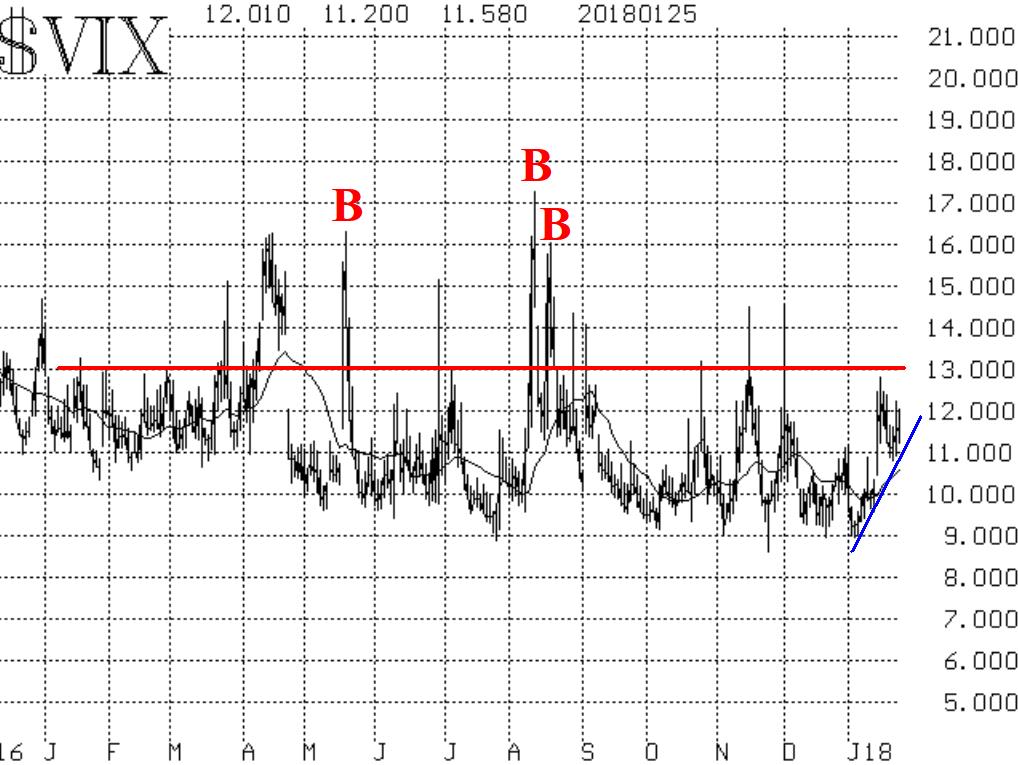

Volatility indices remain at low levels, although not as low as they were at the beginning of the year. CBOE Volatility Index has a minor uptrend in place (see blue line on the chart in Figure 4). But VIX has still not been able to close above 13, so it’s not too worrisome at this point.

In summary, SPX remains in a bullish state, and VIX remains below 13. So the intermediate-term outlook is positive. The growing overbought conditions will certainly have to take a sharp toll eventually, but one cannot blindly short this market — that would have been a disastrous approach. Rather, wait for confirmed sell signals before trying to trade what could be a sharp, but likely short-lived, correction down to support near 2700.

The SPDR S&P 500 ETF Trust (AX:SPY) was trading at $286.58 per share on Friday afternoon, up $3.28 (+1.16%). Year-to-date, SPY has gained 7.39%.

SPY currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #1 of 144 ETFs in the Large Cap Blend ETFs category.