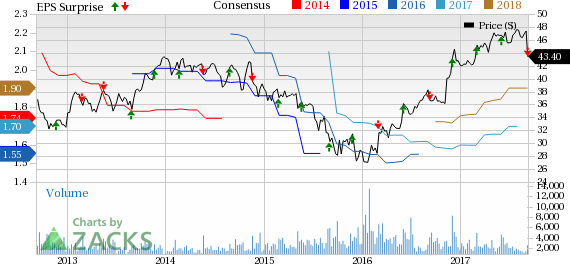

Donaldson Company, Inc. (NYSE:DCI) reported fourth-quarter fiscal 2017 adjusted earnings of 51 cents per share, which missed the Zacks Consensus Estimate of 53 cents by 3.8%. This ended the premium filtration products provider’s earning streak of three quarters. However, the bottom line was up 10.9% from the prior-year quarter figure of 46 cents.

For fiscal 2017, the company’s adjusted earnings per share rose 11.2% to $1.69 on a year-over-year basis. The bottom-line improvement can primarily be attributed to successful strategic initiatives and improving market conditions in Engine segment.

Quarter in Detail

Donaldson reported total sales of $660.1 million, up 11.2% on a year-over-year basis. Further, revenues surpassed the Zacks Consensus Estimate of $634.4 million comfortably. Impressive performance in Engine Products segment boosted the top line.

For fiscal 2017, Donaldson reported revenues of $2,371.9 million, up 6.8% from the prior-year figure.

Coming to the segments, Engine Products revenues increased 17.8% year over year in the fiscal fourth quarter to $ 431.9 million. Three of the four sub-segments under Engine Products — Off-Road, On Road and Aftermarket — recorded a jump in sales, which led to the overall strong performance. Sales in Aftermarket, On-road and Off-Road business increased by 19.1%, 4.4% and 28.3%, respectively. However, sales in Aerospace and Defense recorded a marginal decline of 0.1%.

Revenues at the Industrial Product segment were up 0.4% year over year to $228.2 million. Sales in Industrial Filtration Solutions and Special Applications business increased by 5.3% and 0.8%, respectively. However, sales in Gas Turbine Systems were down by 15.4%.

Donaldson’s fourth quarter adjusted operating margin declined to 14.3%, compared with its value of 15.8% recorded a year ago. Margins were negatively impacted by adverse sales mix, higher raw material costs and other charges. The company’s Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”) came in at $116.2 million compared with $106.4 million recorded a year ago.

Liquidity

As of Jul 31, 2017, Donaldson had cash and cash equivalents of $308.4 million compared with $243.2 million recorded a year ago. The company had long-term debt of $537.3 million as on Jul 31, 2017, compared with $350.2 million as on Jul 31, 2016.

2018 Guidance

Concurrent with the earnings release, the company provided guidance for fiscal 2018. Donaldson expects fiscal 2017 GAAP earnings in the range of $1.79-$1.93 per share compared with fiscal 2017 adjusted earnings of $1.69. Based on the current market scenario, the company expects a 4-8% year-over-year increase in full-year sales.

In terms of segments, Donaldson expects Engine Products sales to increase in the range of 6-10% compared with the prior year. While robust Aftermarket, Off-Road and On-Road sales are expected to act as tailwinds, poor sales of Aerospace and Defense are anticipated to restrict growth to some extent for Engine Products.

Donaldson anticipates Industrial Products sales to be a range of flat to 4% increase compared with the prior year, mirroring strong performance from Industrial Filtration Solutions.

Our Take

Going forward, the company believes that strong Off-Road and Aftermarket sales will continue to act as solid growth drivers. Overall, positive industry trends, including restocking and the pickup from oil and gas, innovative product and short cycle wins, are likely to act as tailwinds.

In addition, this Zacks Rank #3 (Hold) company is continually making strategic investments in sales-driving initiatives, expanding technology portfolio, and strengthening infrastructure. Donaldson is also building an e-Commerce platform, which will enable easier customer engagement. In terms of expansion of core business, the company’s programs in Engine air and liquid market enjoy a win rate of over 75% which has the potential to generate minimum half a billion dollars in future revenues.

However, the company derives more than half of revenues from outside the United States. Hence, strengthening of the U.S. dollar, against local currencies in which the company operates, produces a negative impact on its financial results. Going ahead, the company anticipates foreign currency fluctuations to act as a headwind.

Stocks to Consider

Some better-ranked stocks from the same space are AGCO Corporation (NYSE:AGCO) , Caterpillar, Inc. (NYSE:CAT) and Barnes Group, Inc. (NYSE:B) . While AGCO Corporation and Caterpillar sport a Zacks Rank #1 (Strong Buy), Barnes Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO Corporation has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 39.7%.

Caterpillar has outpaced estimates in the preceding four quarters, with an average earnings surprise of 41.4%.

Barnes Group has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 11.6%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Caterpillar, Inc. (CAT): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Donaldson Company, Inc. (DCI): Free Stock Analysis Report

Original post

Zacks Investment Research