Recently, I have been seeing more and more bearish warnings from chartists about deteriorating breadth (example here). Even though I am bullish, I always pay attention to people who have the opposite viewpoint to make sure I didn't miss anything in my analysis.

Much of the concern stems from the deteriorating breadth shown by the NYSE Advance-Decline Line, which has been showing a series of lower highs and lower lows.

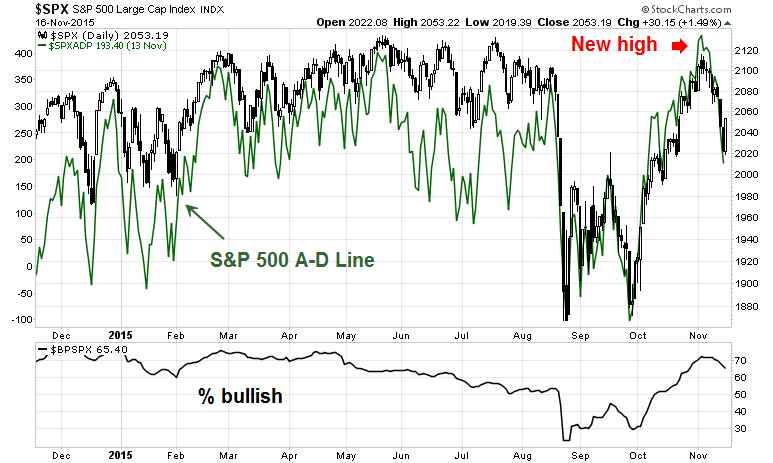

The NYSE A-D Line is based on the components of the NYSE Composite, which is a broad based index with many more stocks than the SPX. On a hunch, I decided to look at the SPX A-D Line, as an apples-to-apples comparison for the SPX. Lo and behold, the SPX A-D Line actually made a new high in the latest advance from the August low, which confirms the strength of the rally. As well, the % bullish metric (bottom panel) is not showing any negative divergence either.

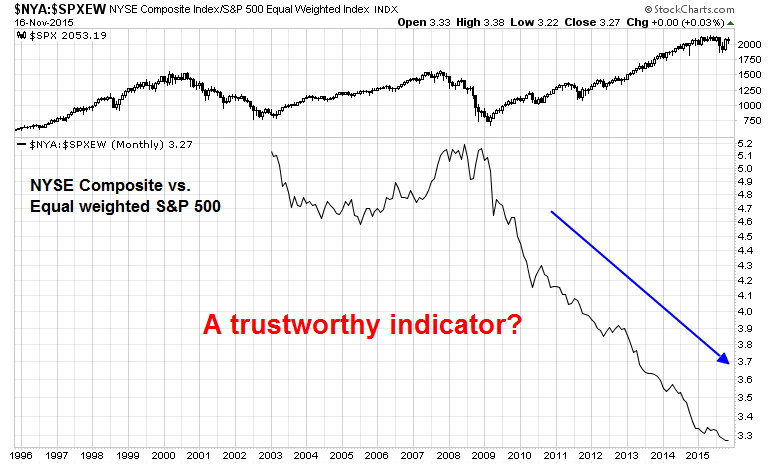

How the NYSE Composite differs from the S&P 500

What's going on? One of the criticisms of the NYSE Composite is that it has a number of closed-end funds, whose price action may not be relevant when calculating an A-D Line. As well, the NYSE Composite has more small cap stocks, which does measure whether the "generals" or the "troops" of the market are leading the latest advance—and that's what we are really trying to measure with breadth.

The chart below shows the NYSE Composite to Equal-weighted SPX ratio as a way of measuring the small and large cap effect. As the chart shows, this ratio has been falling since the 2009 low. Can this (and therefore the NYSE Composite) be a trustworthy indicator of market breadth?

Small vs. large caps

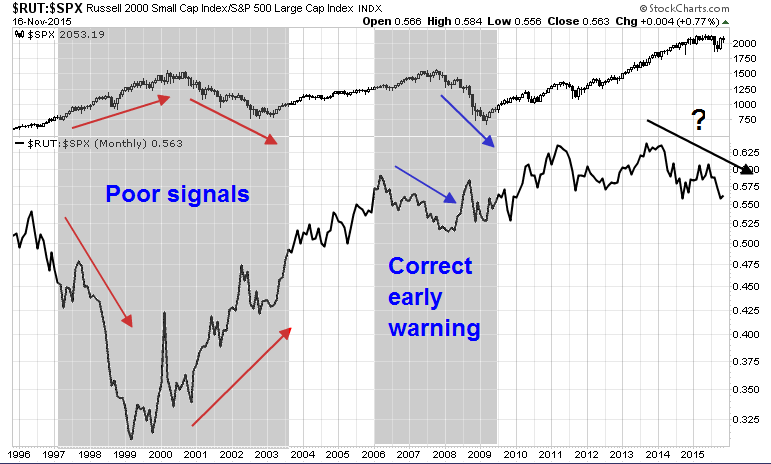

Another way of thinking about underlying strength of the "troops" and "generals" is to look at the relative performance of small and large cap stocks. The chart below shows the Russell 2000 to SPX ratio. In theory, improving market breadth, as measured by the small vs. large cap ratio, "should" be a signal of underlying strength.

The history of this indicator has had a mixed result in the last 20 years. Large caps dramatically outperformed small caps during the Tech Bubble of the late 1990s and underperformed in the bear market afterwards—which were false signals. On the other hand, this ratio did flash advance warning of breadth deterioration leading into the 2007 top. Today, it topped out in late 2013 and it has been showing a series of lower highs and lower lows.

Mixed breadth signals

In summary, evidence of deteriorating breadth comes mainly from broad based indices like the NYSE Composite, which is really a measure of small vs. large cap performance. This has shown itself to be a unreliable indicator of market tops. An apples-to-apples measure of SPX breadth using SPX only components made a new high during the most recent advance, which confirms the strength of the rally from the August bottom.

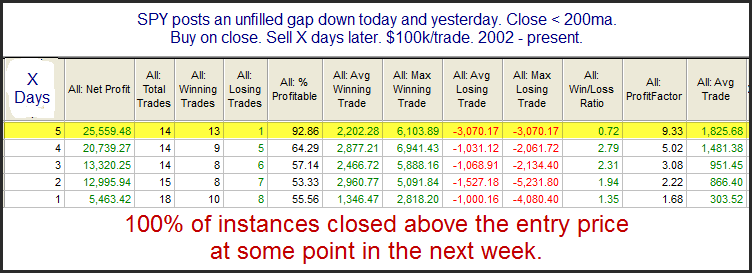

As a tactical bonus for the next two weeks, consider this analysis from Rob Hanna about what happens to the market when it experiences two unfilled gaps down and the SPX is below its 200 dma:

Based on this analysis, the US equity market should have a bullish tailwind this week. Moreover, next week is Thanksgiving week, which is also seasonally bullish.

The path of least resistance for stock prices is therefore up.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. (""Qwest""). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.