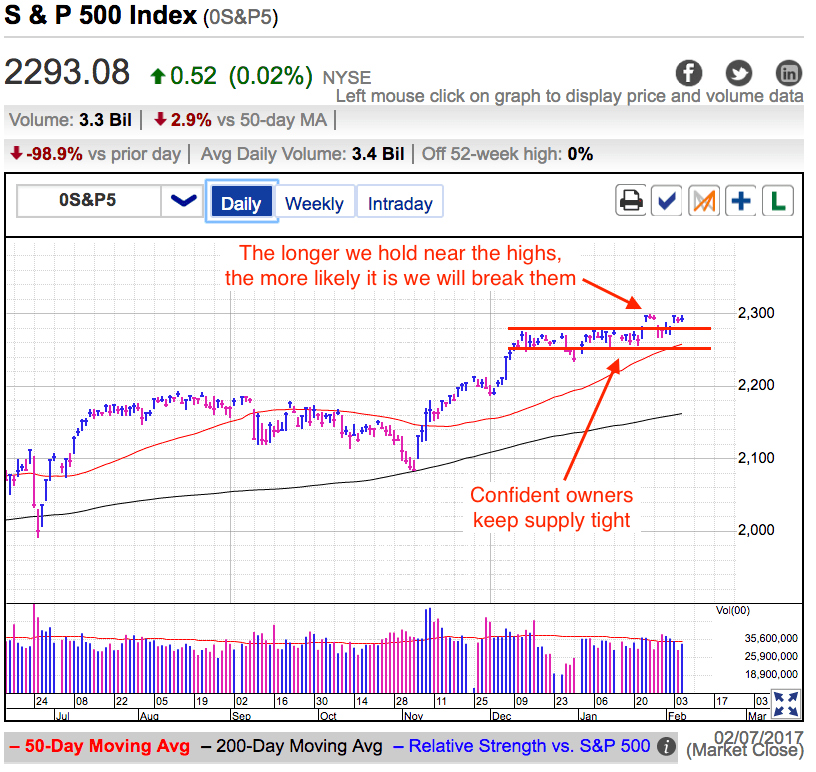

The S&P 500 flirted with 2,300 resistance Tuesday, but yet again failed to break through. Is this a healthy and normal pause before the next leg higher? Or are we running out of steam and on the verge of rolling over? That’s the question on everyone’s mind.

2,280 has been a ceiling for this market since early December. We broke through briefly at the end of January but failed to hold those gains. This is our second assault on 2,300 and thus far things don’t look any different. But the thing to remember is we tumble from unsustainable levels quickly. We have been hanging out near these record highs for two-months.

If this market was fragile and vulnerable, we would have crashed a long time ago. There have been more than enough reasons for this market to selloff, yet every time it refuses the invitation and we run out of sellers. Say what you will about the fundamentals of this market, but when confident owners don’t sell bearish headlines and weak price-action, supply stays tight and prices remain resilient. If the sellers failed to materialize over the last eight weeks, why would they show up now and sell far more benign headlines and price-action? That is the question every bear needs to answer. If it didn’t happen then, why is it going to happen now?

That said, tepid demand has been a major headwind for the market at the upper end of the trading range. While confident owners are keeping supply tight, those with cash prove just as stubborn when it comes chasing record highs. When no one is selling and no one is buying, we trade sideways. We know this stalemate cannot last forever, and at least for the near-term, the path of least resistance is higher. What happens after we breakout is less clear, but unless something unexpected happens, don’t bet against this market just yet.