I hope your Easter holiday was filled with joy. I had the pleasure of spending mine with my family, seizing the opportunity for some rejuvenating hikes.

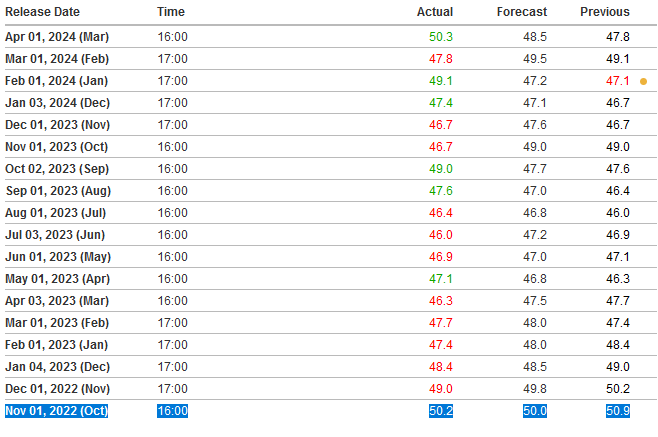

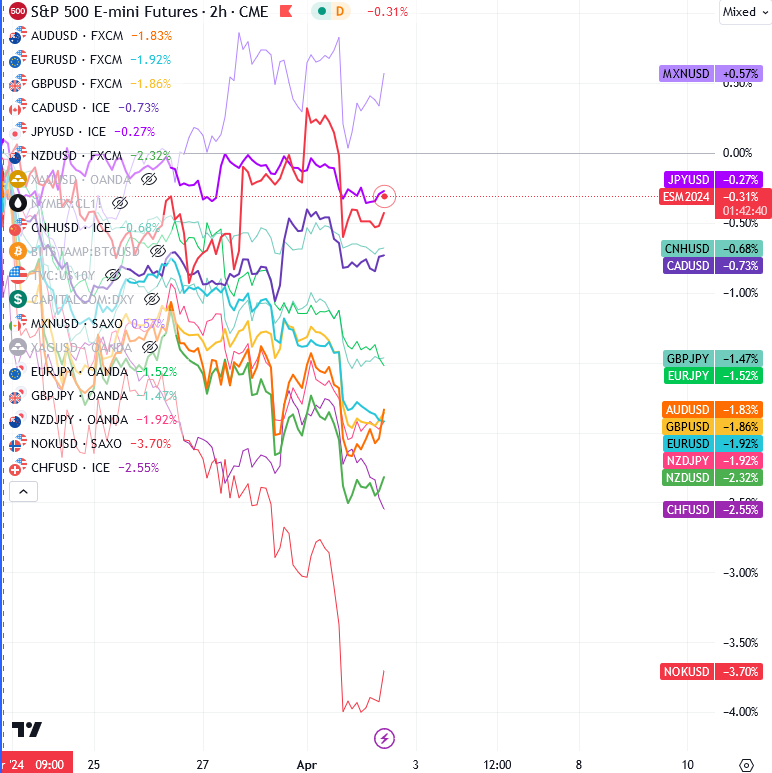

Turning our attention to the financial markets, the USD has shown an uptick in value, with the DXY index surpassing its February highs, indicating a resurgence in dollar strength. This trend comes in the wake of the latest sessions, where both US treasuries and the S&P 500 experienced declines. A pivotal factor contributing to the dollar's fortitude is the recent ISM US Manufacturing PMI report, which marked a return to expansion territory for the first time since November 2022, posting a figure of 50.3 against the anticipated 48.5.

This suggests that the US economy may be on a path to recovery, potentially maintaining current inflation rates for a duration exceeding the Federal Reserve's projections and, consequently, postponing any anticipated rate cuts.

Nonetheless, the upcoming Non-Farm Payroll (NFP) data this Friday will be critical in assessing the true state of economic health.

In the context of global central banks' dovish stances since the Swiss National Bank's rate cut on March 21, the Norwegian Krone (NOK) emerges as the weakest link, with the Swiss Franc (CHF), New Zealand Dollar (NZD), and Euro (EUR) trailing closely. This dynamic suggests that if the dollar continues its upward trajectory, these currencies merit close observation for potential movements and short opportunities vs USD, after pullback of course.

Grega

US ISM M. PMI FX correlations

FX correlations

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar's Rise and Market Shifts Following ISM Manufacturing PMI Data

Published 04/02/2024, 04:51 AM

Dollar's Rise and Market Shifts Following ISM Manufacturing PMI Data

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.