- Dollar and Treasury yields see-saw after miss in US core inflation rate

- Euro under renewed pressure after Putin dashes hopes of peace, stocks mixed

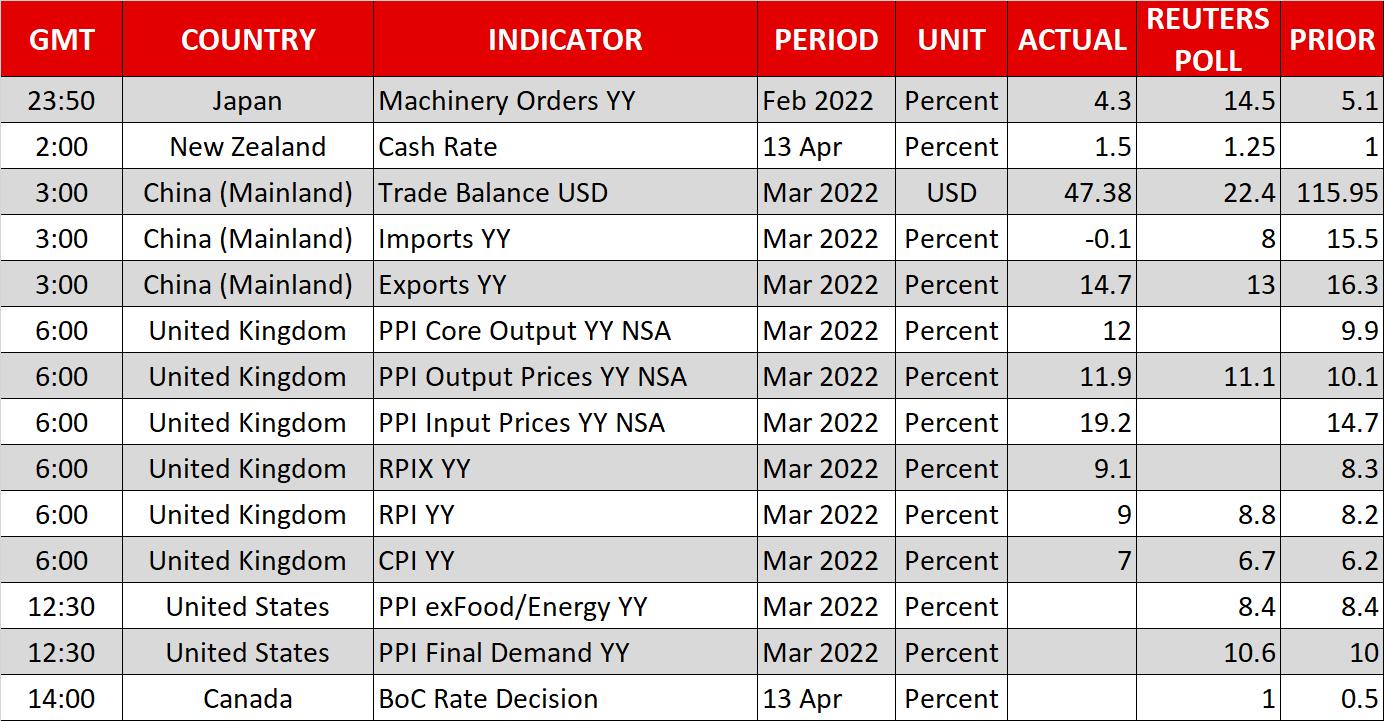

- RBNZ first to hike by 50 bps, BoC likely to follow

US inflation may be peaking, but risk-on tone falters quickly

A glimmer of hope that the relentless rise in American consumer prices may be slowing lifted the market mood on Tuesday, sending Treasury yields lower and Wall Street higher. But the optimism didn’t last long as the reality about the ongoing conflict in Ukraine soon came back to haunt investors.

The US consumer price index rose by 8.5% year-on-year in March, a fresh four-decade high and in line with expectations. However, markets cheered the smaller-than-expected increase in the core figures, which missed both the monthly and yearly forecasts, interpreting it as a sign that inflation has started to peak, at least in the US.

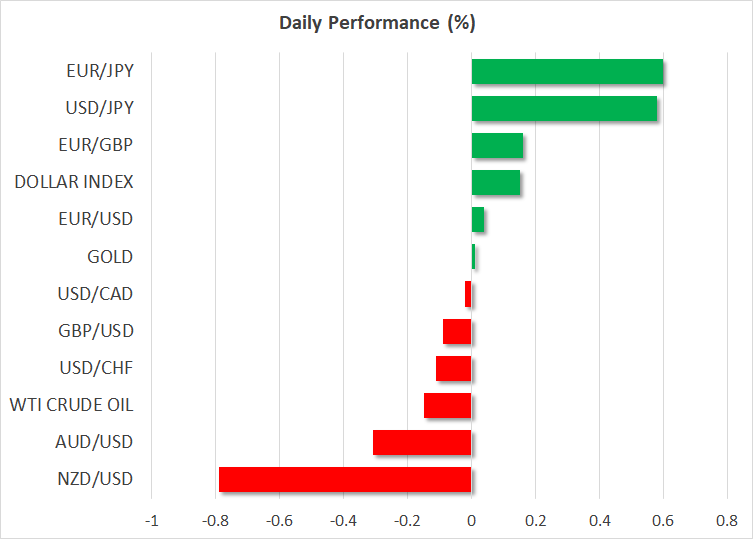

Treasury yields slipped across the curve after the data, with the 10-year yield snapping a seven-day winning streak, having touched a more than three-year high of 2.8360% yesterday. The US dollar also fell back, providing a temporary respite to beaten-down currencies like the yen and euro.

Given all the gloom around the worsening inflation landscape and worries about stagflation, some investors are likely grabbing any piece of optimism that they can. However, yesterday’s reversal in some of the recent moves in the bond market was probably as much down to an overdue correction following the sharp selloff in Treasuries over the past week.

Bond yields are headed back up today and the greenback has just scaled a 20-year high of 126.31 yen. Aside from downbeat remarks by President Putin about the prospect of peace in Ukraine, a hefty rate hike by the RBNZ and strong CPI numbers in the UK were more reminders for the markets that nothing has really changed about the outlook.

Putin adds to euro’s pain

Although some of the fighting in Ukraine has eased, there’s been little progress in the negotiations for a ceasefire since the last face-to-face meetings by Russian and Ukrainian officials two weeks ago. The Russian leader yesterday accused Ukraine of constantly changing its position in the talks, describing it as a “dead-end situation”.

The euro came under renewed attack following the comments, slipping to a five-week low of $1.0809 overnight. The European Central Bank will decide tomorrow whether to provide some kind of a timeline on when interest rates will begin to rise amid soaring prices across the euro area. But even if the ECB adopts a somewhat more hawkish stance than anticipated, it will not be able to match the Fed’s rhetoric, so the euro’s prospects look grim in comparison regardless of any further possible tilts in the hawkish direction.

Kiwi slumps despite RBNZ’s double hike; Can the BoC lift the loonie?

This has been evident in the New Zealand dollar today, which could only enjoy a knee-jerk spike after the Reserve Bank of New Zealand hiked the cash rate by a bigger-than-expected 50 basis points. It seems that the RBNZ has merely frontloaded its rate increases as policymakers kept their projections of the terminal rate unchanged at 3.35%.

After a brief brush with the $0.69 level, the kiwi is now the worst performer against the US dollar, tumbling to a four-week low of $0.6783.

The pound also slid to fresh lows, hitting a 17-month trough $1.2970. However, it is currently attempting to reclaim the $1.30 handle, finding some support from hot UK inflation data.

Annual CPI in Britain jumped to 7.0% in March, beating forecasts of 6.7%. This puts pressure on the Bank of England, which is being cautious about tightening too aggressively amid stalling growth. In the meantime, there was little reaction in sterling to the news that Prime Minister Boris Johnson and Chancellor Rishi Sunak were fined by the Metropolitan police for breaching lockdown rules in 2020, as both are holding onto their positions for now.

The Canadian dollar will be the next to come into focus later today as the Bank of Canada is widely expected to hike its overnight rate by 50 basis points. But unless policymakers outline a steeper rate path than currently predicted, the loonie might also not gain much from the decision.

Stocks could be poising for another rebound

In equity markets, there was some positive sentiment on Wednesday even though Wall Street failed to retain its earlier session gains yesterday to close lower. US futures are edging higher today, shrugging off firmer Treasury yields.

Some traders might be seeing this as a good opportunity to buy into the latest dip before the Q1 earnings season kicks off today with the likes of JPMorgan Chase (NYSE:JPM), Delta Air Lines (NYSE:DAL) and BlackRock (NYSE:BLK).

Shares in Asia closed mostly up today, led by a near 2% gain by the Nikkei 225 index, in spite of heightened worries of a slowdown in China following an unexpected drop in March imports. Investors could be hoping that this means that more stimulus is on the way in China.

European stocks were lacking direction, however, with Wall Street’s response to the launch of the earnings season and tomorrow’s ECB meeting likely being awaited to set the tone.