Dollar stays soft on cautious comments from Fed officials. Testifying before the Senate Banking Committee, Fed CHair Janet Yellen indicated that risks from inflation are two-sided, and it was premature to conclude that the underlying inflation trend would continue to fall below the 2% target, despite the slowdown in the price gains in recent months. Dallas Fed President Robert Kaplan advocated a cautious approach to rate hike and said that "future removals of accommodation should be done in a gradual and patient manner."

The budget director of White House Mick Mulvaney revealed US President Donald Trump's economic plan in an articled titled "Introducing MAGAnomics". MAGA was from Trump's slogan of "Make America Great Again". A seven-point plan was laid out targeting to boost US GDP growth to 3% on annual basis. Part of the article was published at the White House website here. At the end of the extract, there is a link to read the full op-ed which points to a Wall Street Journal page. Then, the WSJ page requests readers to "subscribe" to read the full story. It's unsure whether the article is for the wealthiests in Wall Street, or those common people you can find on the street.

Instead of looking at the plan, let's look at the response from other professionals. The Congressional Budget Office said in the report that "because details of the proposed policies are not available at this time, CBO cannot provide an analysis of all their macroeconomic effects." Fed chair Janet Yellen said that Trump's 3% growth aspiration is "something that would be wonderful if you can accomplish it". She added, however, that "it would be quite challenging".

In the markets, DOW rose 20.95 points, or 0.1% to close at 21553.09 but it's kept below Wednesday's high at 21580.79. S&P 500 rose 4.58pts or 0.19% to close at 2447.83, below recent high at 2453.82. NASDAQ rose 13.27 pts, or 0.21% to close at 6274.44, well off recent high at 6341.70. 10 year yield rose 0.021 to close at 2.348, well off last week's high at 2.936. The financial markets were not too impressed by the MAGAnomics.

Today's set of economic data from US will be crucial in Dollar's near term trend. Headline CPI is expected to slow to 1.7% yoy in June while core CPI is expected to be unchanged at 1.7% yoy. Retail sales and ex-auto sales are both expected to grow 0.2% in June. Industrial production, business inventories and U of Michigan confidence will also be released. Elsewhere, Eurozone trade balance will be featured in European session.

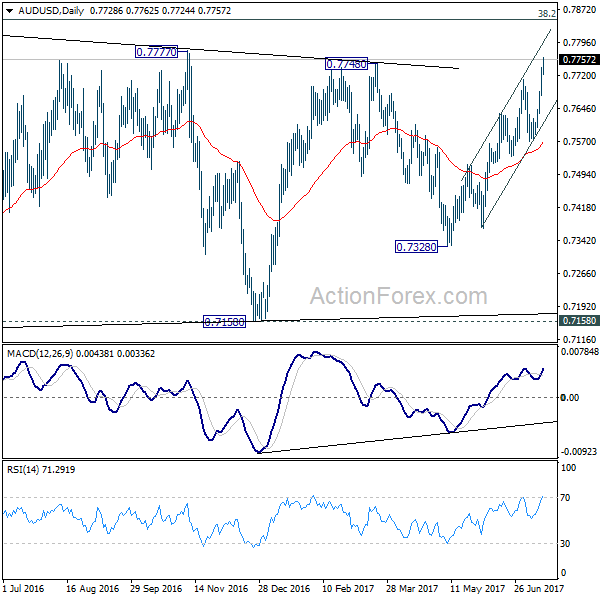

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7688; (P) 0.7713; (R1) 0.7754

AUD/USD's rally continues today and reaches as high as 0.7762. Break of 0.7711 confirms resumption of rise from 0.7328. Intraday bias remains on the upside for 0.7833. Still, there is no clear sign of range breakout yet. Hence, we'd be cautious on topping again as it approaches medium term fibonacci level at 0.7849. On the downside, below 0.7713 minor support will turn intraday bias neutral first. But near term outlook will remain bullish as long as 0.7570 support holds.

In the bigger picture, we're still treating price actions from 0.6826 low as a corrective pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8082) and above.