The dollar headed for its lowest close in almost a year as signs of slowing growth in the U.S. dimmed prospects for a Federal Reserve interest-rate increase. Stocks fell and commodities extended gains in their best month since 2010.

The U.S. currency weakened against 13 of its 16 major peers, while the yen headed for its biggest weekly jump since 2008. Declines in the greenback are proving a boon for raw materials, helping lift gold and silver to 15-month highs. Crude oil has jumped 20 percent this month to more than $46 a barrel in New York. European equities trimmed their biggest monthly advance since November.

The dollar’s third straight monthly drop and the prospects for the Fed moving gradually on interest rates are spurring the outlook for inflation, with the 10-year U.S. break-even rate at the highest since July. Reports today on consumer confidence and personal spending will provide clues on the trajectory of the world’s largest economy after data on Thursday showed the slowest pace of expansion in two years.

“I want to buy break-even inflation in the U.S. because the Fed wants that higher and that’s what undermines the dollar,” Kit Juckes, a global strategist at Societe Generale (PA:SOGN) SA, said in an e-mailed report.

Currencies

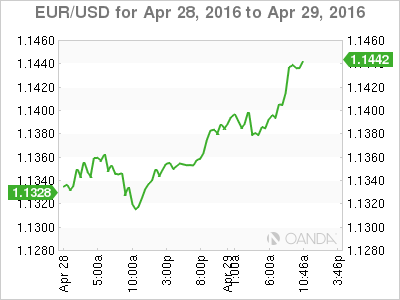

The Bloomberg Dollar Spot Index, which tracks the greenback against 10 major peers, slipped 0.3 percent as of 9:55 a.m. in London and was set for a 1.8 percent weekly loss. Fed Funds futures show odds of the central bank boosting borrowing costs in June fell to 12 percent following Thursday’s update on gross domestic product, having held at around 21 percent when the Fed concluded its policy meeting on Wednesday.

The South African Rand and Russian ruble advanced 0.5 percent against the dollar while the euro and Swiss franc gained at least 0.3 percent.

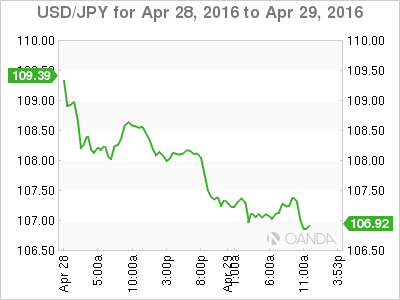

The yen strengthened against all 16 major peers for the second day in a row, climbing as much as 1.1 percent to 106.91 a dollar, the strongest level since October 2014. It surged 4.3 percent this week as the Bank of Japan defied economists’ expectations that stimulus would be stepped up. Governor Haruhiko Kuroda told reporters after the review that he wants to wait and see how the introduction of negative rates in January affects the economy.

“The BOJ seems to have descended into a haze of confusion,” said Richard Jerram, the chief economist at Bank of Singapore. “They mismanaged expectations running up to the meeting — and that is clear from the market reaction.”

The yuan was little changed versus the greenback after China’s central bank boosted its daily reference rate by 0.6 percent, the most since a dollar peg ended in July 2005. The steep increase in the fixing reflects the dollar’s slide rather than any policy intentions, according to Ken Cheung, a currency strategist at Mizuho Bank Ltd. in Hong Kong.

Stocks

The Stoxx Europe 600 Index fell 1.1 percent, heading for its biggest drop since April 5 and paring its monthly increase to 2.3 percent. All its industry groups declined, with Sanofi (PA:SASY) down 2.6 percent after reporting sales that missed estimates.

Royal Bank of Scotland Group (LON:RBS) Plc lost 2.7 percent as it posted a deeper loss, and British Airways parent IAG (LON:ICAG) fell 4.1 percent after saying demand for flights has been hurt by the Brussels terror attacks, weaker bookings in oil-based economies and the possibility of the U.K. exiting the European Union.

Futures on the S&P 500 Index expiring in June was little changed. The gauge dropped the most since April 7 on Thursday and is heading for a 0.8 percent monthly advance.

Amazon.com Inc (NASDAQ:AMZN). surged 12 percent in early New York trading as it reported sales and profit that topped estimates. Synaptics Inc. sank 11 percent after people familiar with the matter said it will miss an end-of-April target date to announce its sale to a Chinese investment group, and may accept a lower offer than previously discussed.

The MSCI Emerging Markets Index dropped 0.6 percent, trimming this month’s advance to 0.3 percent. The gauge has climbed 5.6 percent this year, compared with a 0.9 percent gain the MSCI World Index of developed markets.

Commodities

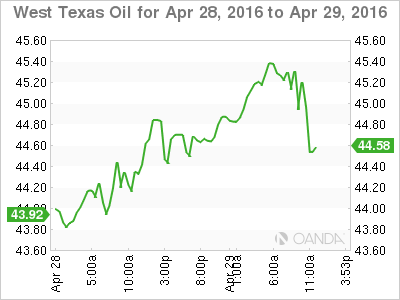

The Bloomberg Commodity index, a measure of returns on 22 raw materials, rose 0.4 percent, extending this month’s gain to 8.1 percent.

Base metals rallied, with Aluminum set for its biggest monthly advance since 2012 amid signs of improved demand in China, the world’s biggest consumer. Raw materials have recovered as China’s property and construction industry rebounded after a slow start to the year. Copper, Zinc, Lead and Nickel climbed at least 1 percent.

Gold and Silver rose, both due to close at the highest since January 2015.

Oil is poised for the biggest monthly advance in a year as U.S. production slumped to the lowest level since October 2014. West Texas Intermediate for June delivery rose 0.7 percent to $46.37 a barrel.

Bonds

The 10-year break-even rate, which measures the difference between yields on 10-year notes and equivalent Treasury Inflation-Protected Securities, widened for a 10th day. The gauge of the expected annual inflation pace over the next decade climbed to 1.72 percentage points, the highest since July.

The Bloomberg U.S. Treasury Index declined 0.3 percent in April, set for the first monthly loss of 2016. The 10-year yield increased by one basis point to 1.83 percent on Friday, having started the month at 1.77 percent. Similar-maturity bonds in Japan yielded minus 0.085 percent at the end of their final trading session in April.

Travelodge Hotels Ltd. was offering sterling-denominated junk bonds, according to a person familiar with the matter who asked not to be identified as they aren’t authorized to speak publicly. The deal is only the second high-yield sale in pounds this year, based on data compiled by Bloomberg.