- USD – slips as Treasury yields resume slide

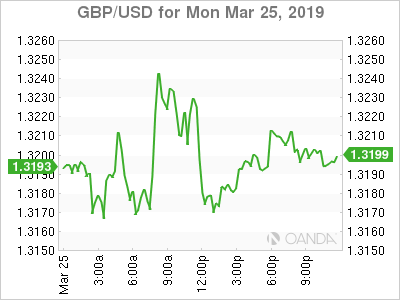

- Brexit – PM May’s time may be running out

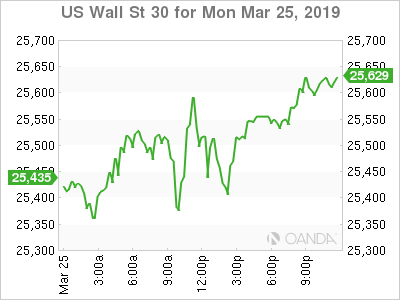

- Stocks – Have a seesaw session as growth worries remains dominant theme

- Apple – New product launch tries to disrupt Cable and credit card industry

- Oil – extends slide as traders focus on backwardation

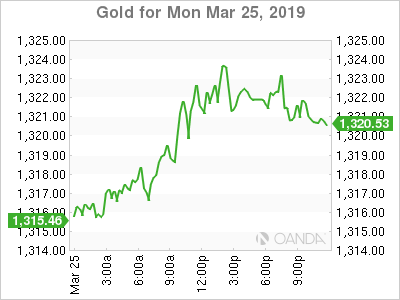

- Gold – creeps higher on market nervousness

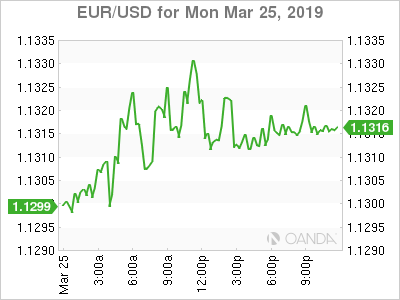

USD

Today’s FX moves were modest, but the main theme was a slightly softer dollar. The catalyst for the weaker dollar was the decline with Treasury yields. The 10-year yield at one point fell below 2.40% for the first time since December 2017. Earlier in Europe, the euro was bid after business morale in Germany showed signs of stabilizing for the first time in 6 months.

The euro and the other high-beta currencies also got a boost from news that a trade deal between the US and China could be reached by the third or fourth week of May. Currency markets are now an ugly dog contest and the most attractive outlook may see their respective currencies rally.

Brexit

PM May does not have the votes for a third meaningful vote and she may lose control over the next step. A lengthy debate on the amendable motion went deep into the London night. Parliament will once again vote on control of Brexit, if Parliament takes over, they will then allow so-called indicative votes on different Brexit options on Wednesday. The end could be near for PM May.

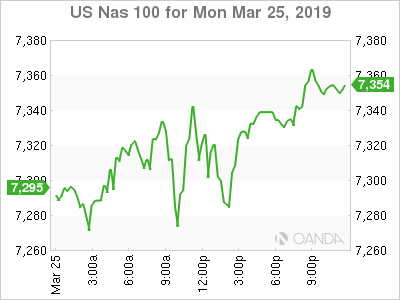

Stocks

US stocks seesawed between positive and negative on light volumes as traders can’t shake global growth concerns. Markets were still processing the yield curve inversion that initially started last week with the 3-month and 10-year Treasury yields. Recession worries may be premature for the US, but the negative signals are consistent with the recent data. Today’s path of yields initially was higher but safe-haven flows saw investors buy up Treasuries and the yields dropped sharply lower. A neutral stance on rates with by the Fed may provide a safety net for traders as long as we don’t see further deterioration of data.

Today, the Dallas Fed Manufacturing reading showed activity continued to expand at a slower pace in March. Outlooks were not as good as February and the new order growth rate turned negative. Tomorrow, key housing data may confirm further weakness in the sector.

Apple

Apple Inc (NASDAQ:AAPL) announced a bevy of new products to try to convince investors they will not remain dependant on iPhone sales growth. The tech giant announced a new streaming TV service, a credit card, online gaming, and a News+ service. Online streaming and credit card companies were under pressure following the news event.

The Apple card will have no fees, and that may be the biggest surprise of the event. Shares for Visa (NYSE:V), American Express (NYSE:AXP) and Capital One Financial Corporation (NYSE:COF), all traded lower after the news event. Netflix Inc (NASDAQ:NFLX)’s stock shrugged off the Apple news and finished higher for the day.

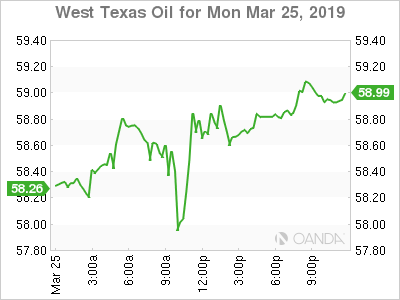

Oil

Crude prices can’t shake off global growth concerns. Last week, West Texas Intermediate crude made a fresh four-month high but finished below the psychological $60 level. Oil appears to be done rallying on news of OPEC + production cut compliance or outages in Venezuela or Iran. Right now, the oil markets care more about demand-side issues, and if we continue to see softer prints in Europe, crude may drop even lower. Rising US production will also limit any oil rallies once we see rig counts snap the current five consecutive weeks of declines.

Gold

The precious metal is rose for a fifth consecutive day as growth concerns persist and Treasury yields resumed their slide. The dollar was softer against most of its trading partners, as expectations jumped for the Fed’s next move to be a rate cut. The current implied probabilities show a 52.2% chance of a cut at the September 18th meeting and 75.8% probability of a cut at the January 2020 meeting.

In the middle of February, gold was unable to break above the $1,350 an ounce level, as optimism ran high that the US and China were close to a trade deal. This will be a key week for trade talks, as Trade Representative Lighthizer and Treasury Secretary Mnuchin will meet Chinese officials in Beijing. If the two world leaders are unable to make progress on digital trade, IP and enforcement, we could see safe-haven flows help target last year’s highs. Gold held on to most of it gains even after reports circulated that a trade deal between the US and China could be reached by the third or fourth week of May.