- Dollar at 2-year high as Treasuries rout deepens, puts Wall Street on backfoot ahead of earnings

- Euro edges up after Macron survives round 1 of election, spotlight now on ECB

- Chinese yuan and stocks slip amid lockdown havoc, oil can’t take the heat either

US real yields approach zero, dollar shines, stocks pay the price

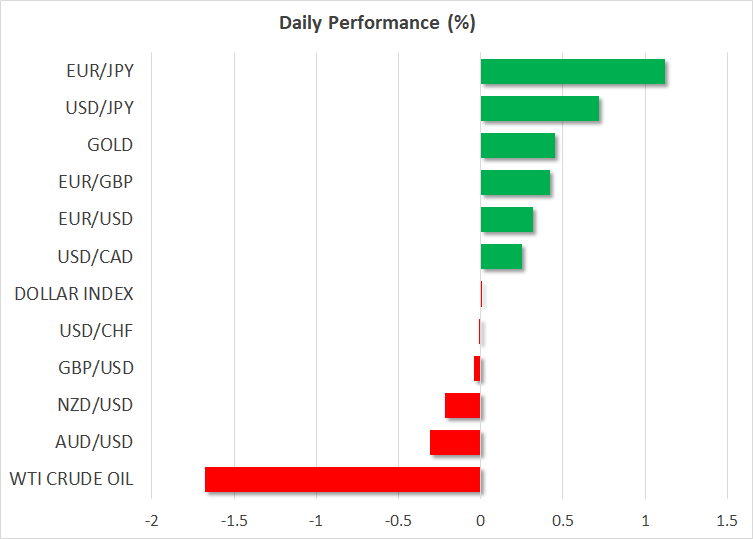

The Fed’s latest tilt towards the far hawkish end of the dove-hawk scale continued to reverberate across markets on Monday, giving the US dollar another leg up but leaving equities and bonds reeling. The dollar index, which measures the greenback against a basket of six currencies, has been flirting with the 100 level since Friday for the first time in two years as the relentless rally in Treasury yields shows no sign of easing.

The yield on 10-year Treasury notes touched an intra-day high of 2.7840% earlier today, marking a three-year top. Having been somewhat behind in the race by global central banks to normalize policy to begin with, the Fed is now leading the hawkish camp.

Although the Fed has been steadily paving the way for 50-basis-point rate hikes at the upcoming meetings, what’s stunned investors more is the rapid pace of balance sheet reduction that policymakers hinted in the March FOMC minutes. The Fed looks set to begin shrinking its asset holdings in May at nearly double the pace it did so between 2017 and 2019.

Consequently, real yields have also started to edge up, having remained negative even as nominal yields have surged. The 10-year yield on inflation-protected Treasuries (TIPS) has finally started to get fired up and at this rate, it shouldn’t be long before it turns positive.

Strikingly, this may be what the Fed intended to happen as up until now, there was little tightening in financial conditions in the US despite all the signals of multiple rate hikes, suggesting policymakers hadn’t gone far enough in removing stimulus.

Equities downbeat at start of the week

However, this is anathema for Wall Street, especially for the overvalued growth and tech stocks that thrived during the post-pandemic era of historically cheap money. The Nasdaq Composite is paring its March rebound, slipping to three-week lows on Friday. The S&P 500 and Dow Jones have fared a little better and futures indicate the Nasdaq will underperform again today, last quoted down by 1.1%.

It remains to be seen if the Q4 earnings season, which kicks off this week with JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C) and Wells Fargo (NYSE:WFC), can revive the bull market amid soaring input costs and slowing growth in many parts of the world.

European equities were in negative territory too on Monday with the exception of the CAC 40 in Paris, which climbed modestly on relief that France’s incumbent leader, Emmanuel Macron, won the first round of the presidential election with a slightly bigger lead than anticipated. Macron and his far-right rival Marine Le Pen will face each other in the run-off in two weeks’ time in what is looking like a repeat of the 2017 election.

Although the race could be tighter this time, with some polls giving Macron just 51% of the vote in the second round, markets nevertheless appear to be breathing a sigh of relief that Le Pen didn’t secure an even bigger share following her recent gains in the polls.

Kiwi and loonie slip, euro bucks the trend ahead of CB decisions

The euro was also buoyed today, opening with a bullish gap above $1.09. The European Central Bank meets on Thursday and may provide a clearer timeline as to when interest rates will be lifted.

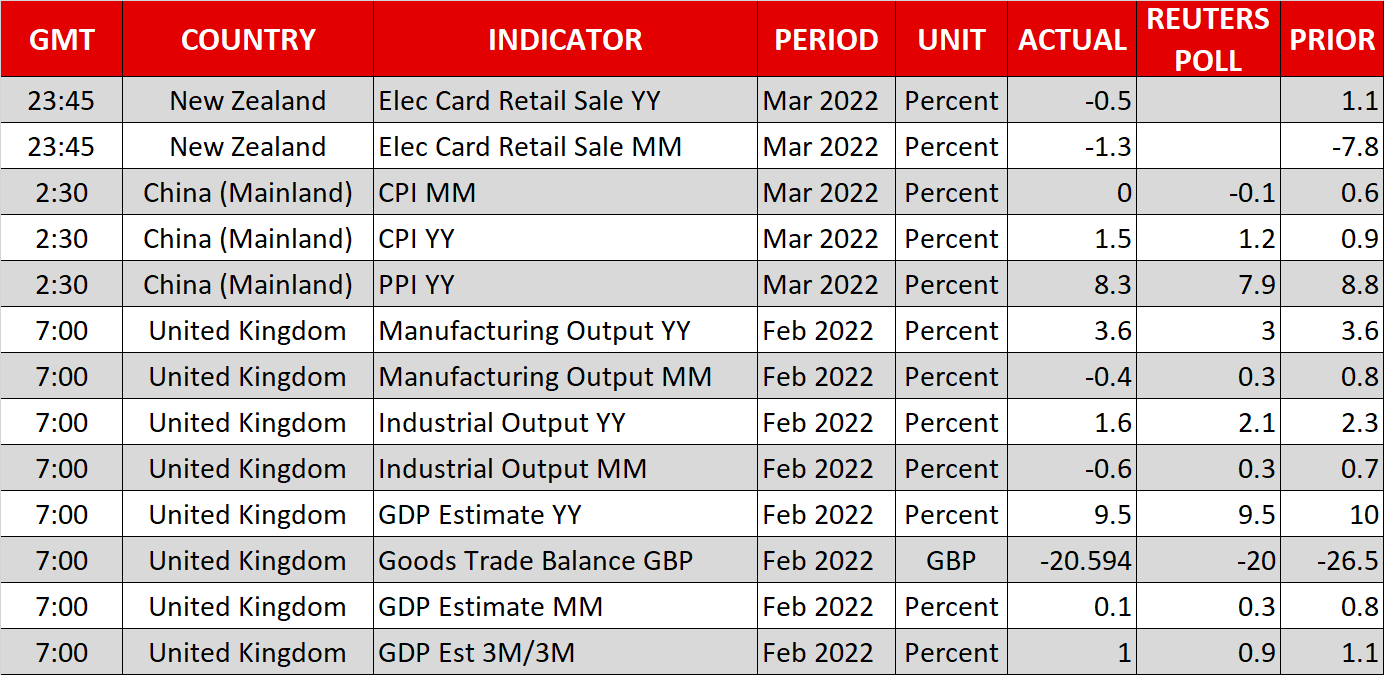

But other currencies struggled against the dollar as yield spreads favoured the latter. The pound was testing the $1.30 level, with slightly disappointing economic growth data out of the UK for February further denting its appeal versus the mighty greenback.

The yen was the worst performer again, slumping against all of its peers as Japanese yields couldn’t join the global rally. The dollar has jumped to a fresh seven-year high above 125 today. The aussie is also struggling, but the New Zealand dollar is down only marginally, supported by expectations that the RBNZ will hike interest rates on Wednesday.

The Canadian dollar was down too, weighed by lower oil prices. However, its losses seem to be contained by growing expectations that the Bank of Canada will hike rates by 50 basis points at its meeting on Wednesday.

Oil futures are headed towards last week’s three-week lows amid renewed concerns about the impact on demand from extended lockdowns in China.

Producer prices in China rose more than expected month-on-month in March, suggesting that shutdowns in Shanghai and other major cities are causing fresh disruptions for already strained supply chains. The Chinese yuan weakened for the third straight session in offshore trade today, with higher US yields also weighing, while the benchmark CSI-300 index plunged 3% at the close.