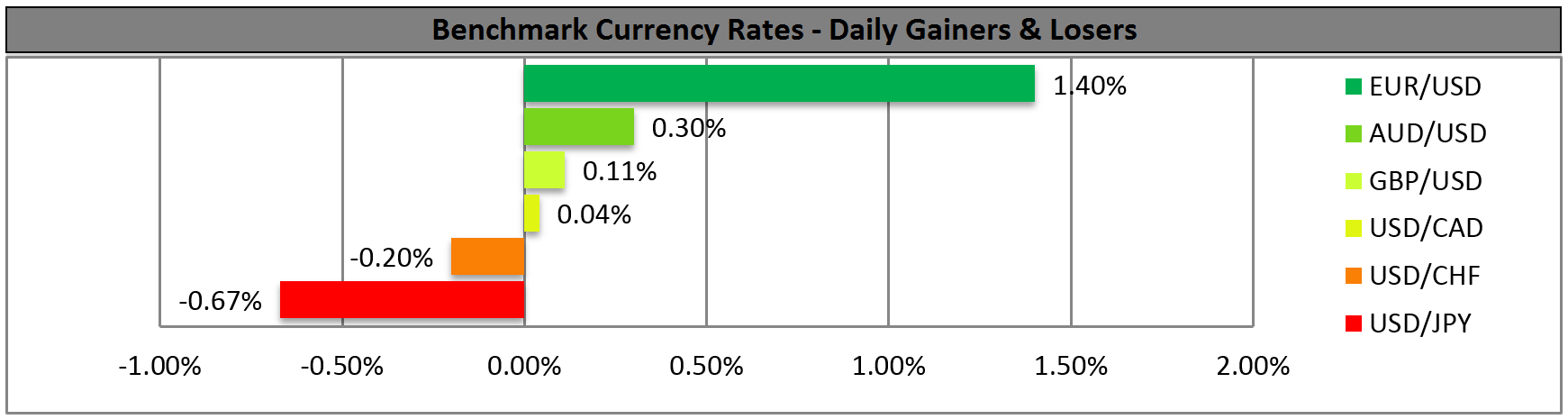

The USD continued to decline yesterday. It looks like perhaps the US currency’s unprecedented run of uninterrupted gains may be interrupted, at least this week. Even after German industrial production falling the most in over five years, EUR/USD still managed to climb and most other G10 currencies also gained. USD was stronger against some EM currencies, however.

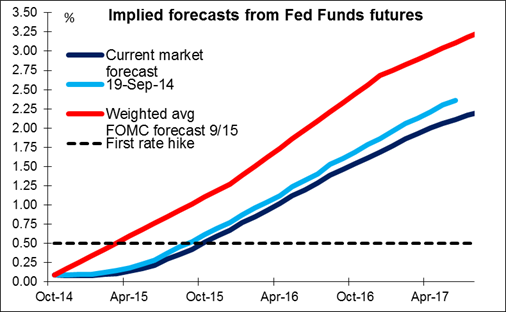

Yesterday’s US Job Openings and Labor Turnover Survey (JOLTS) showed job openings at a 13-year high. In theory this should have boosted the dollar as it’s a sign of an increasingly healthy job market. But the number of people quitting and the number of people getting hired was still weak, and it’s that kind of labor market turnover that puts pressure on wages. The market therefore concluded that the figures will not add to the pressure on the Fed to tighten any time soon.

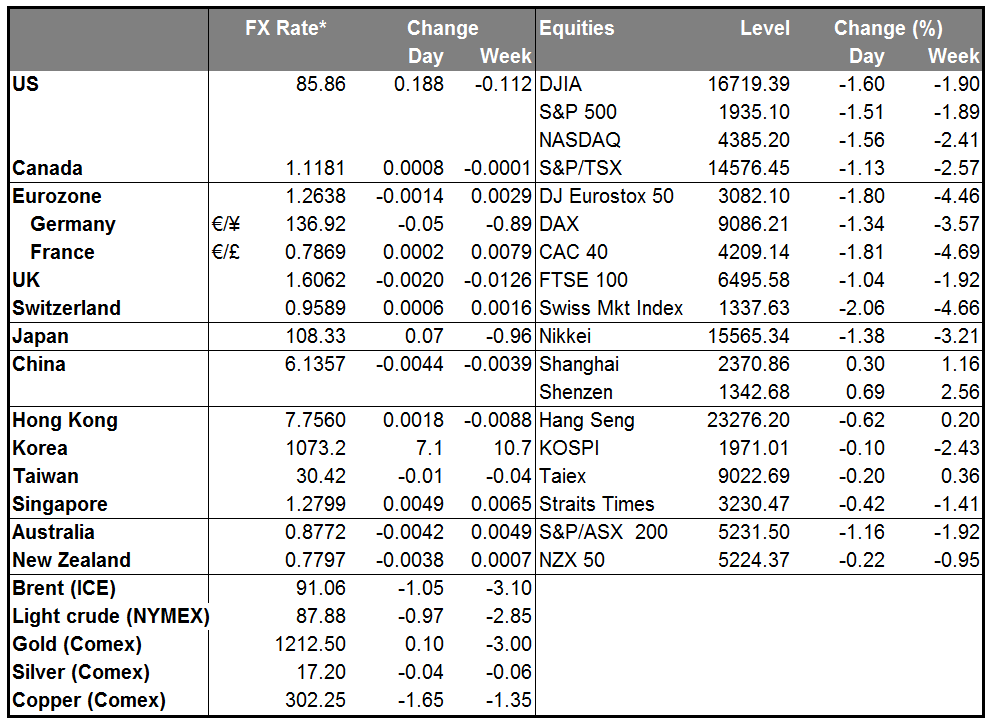

One notable point in yesterday’s action is that oil prices fell even while the dollar fell. One of the explanations for why commodity prices have been hit so hard recently is because of the strong dollar, yet WTI was down 2.6% and Brent Oil off 1.7% (not to mention Copper down 0.5%) on a day when the dollar was generally weaker. What this suggests is concern about slower global growth. Fitting in with that idea, bond yields fell and the implied interest rate on Fed funds futures dropped an incredible 8.5 bps in the long end yesterday. Expectations for 2017 have now retreated by 28 bps since the recent peak on 19 September. Stocks were down sharply too (S&P 500 off 1.5%), perhaps on slower growth fears, although there may be a self-correcting mechanism at work here: the higher dollar is causing investors to reduce earnings estimates as they lower the value of foreign earnings translated back into dollars. This causes US stock prices to fall, which then weakens the dollar.

I wouldn’t expect fears of weaker global growth to be that much of a hurdle for USD. On the contrary, it will only make the domestic-demand-led US recovery seem that much better. The currencies that are most likely to suffer would be the commodity currencies, AUD, NZD and CAD, plus SEK, which is highly leveraged to trade.

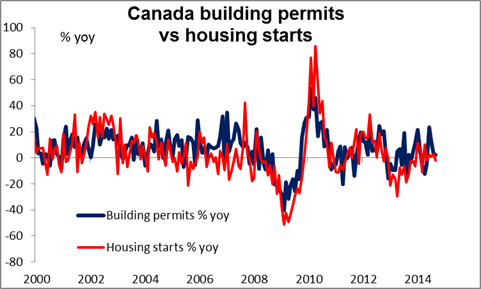

Indeed, CAD was somewhat of an outlier yesterday. Canadian building permits plunged 27.3% mom in August from 11.6% mom in July. It turns out that the biggest drop on record occurred just a month before the central bank said that the activity in the housing market has been stronger than anticipated. USD/CAD jumped approximately 0.20% at the release to end the European day as the only stable pair. Today we get Canadian housing starts for September, which the market forecasts will increase. It remains to be seen however whether the huge drop in building permits in August marks the beginning of a softening in construction activity. It’s possible that the figure may miss expectations, which could weigh on the Canadian dollar.

Japan’s current account surplus for August (SA basis) was lower than expected but still up from July. The trade deficit however widened further. The question for me is how long can the income from Japan’s overseas investments continue to cover the trade deficit. It’s amazing that this income keeps rising, since as bonds mature they are being rolled over into bonds with much lower coupons.

Today’s indicators: We have no major events or indicators coming out from Europe and the UK.

In the US, the spotlight will be on the minutes from the FOMC’s Sept. 16-17 meeting. At that meeting, the FOMC kept its “considerable time” statement, but the key point was the rise in the Fed funds forecasts. The minutes will likely reveal whether they kept intact the statement due to concerns over not sending a too hawkish signal to the markets, given the upward revision to the rate forecasts.

We have one speaker on Wednesday’s agenda, Chicago Fed President Charles Evans.

The Market

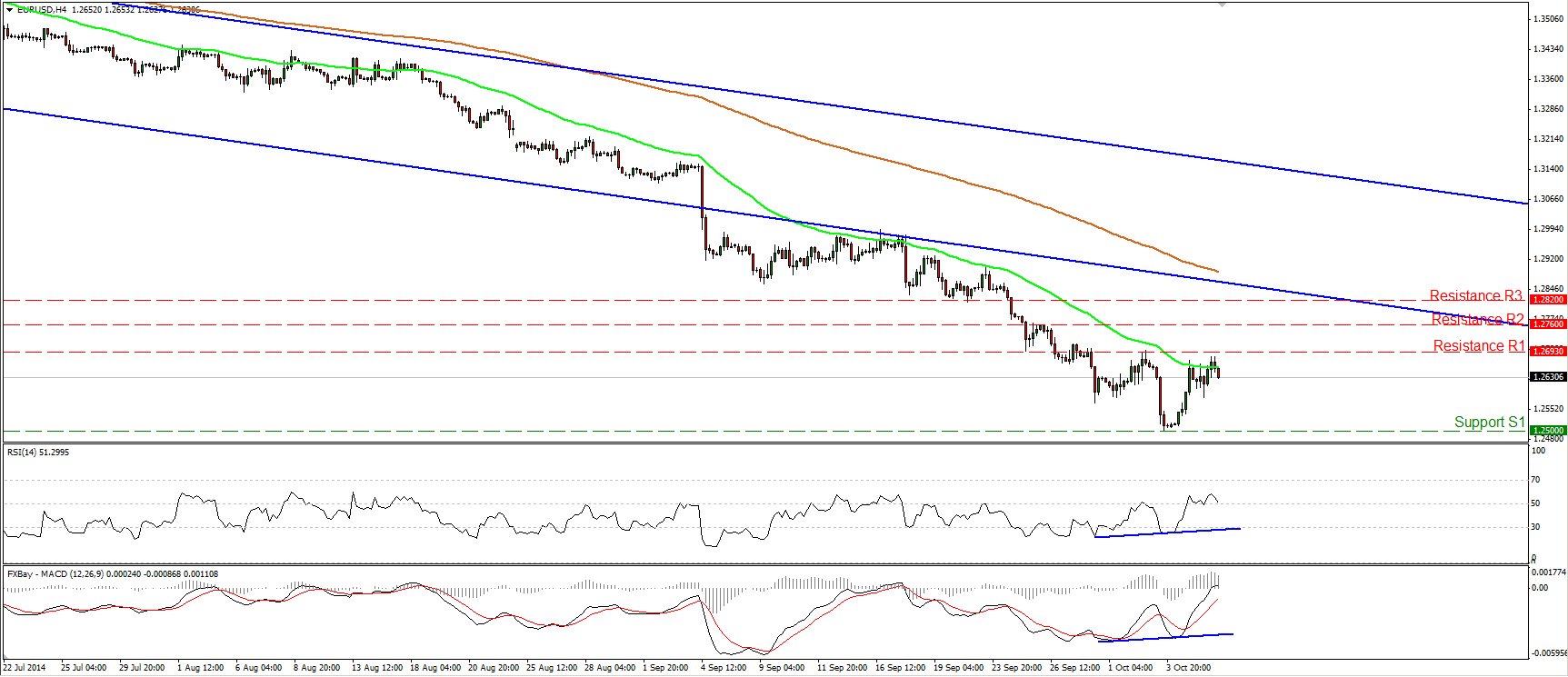

EUR/USD little changed

EUR/USD moved in a consolidative mode on Tuesday, remaining below the resistance hurdle of 1.2693 (R1). Taking into account that the pair rebounded from the psychological zone of 1.2500 (S1) on Monday, and that I still see positive divergence between our short-term oscillators, I prefer to hold my flat view. Moreover, the 1.2500 (S1) key line happens to be the 76.4% retracement level of the July 2012 – May 2014 long-term advance, something that makes it even stronger as a support. On the daily chart, the broader trend remains to the downside since the price structure remains lower peaks and lower troughs below both the 50- and the 200-day moving averages. As a result I will treat Monday’s rebound or any extensions of it as a corrective phase before the bears prevail again.

• Support: 1.2500 (S1), 1.2465 (S2), 1.2385 (S3)

• Resistance: 1.2693 (R1), 1.2760 (R2), 1.2820 (R3)

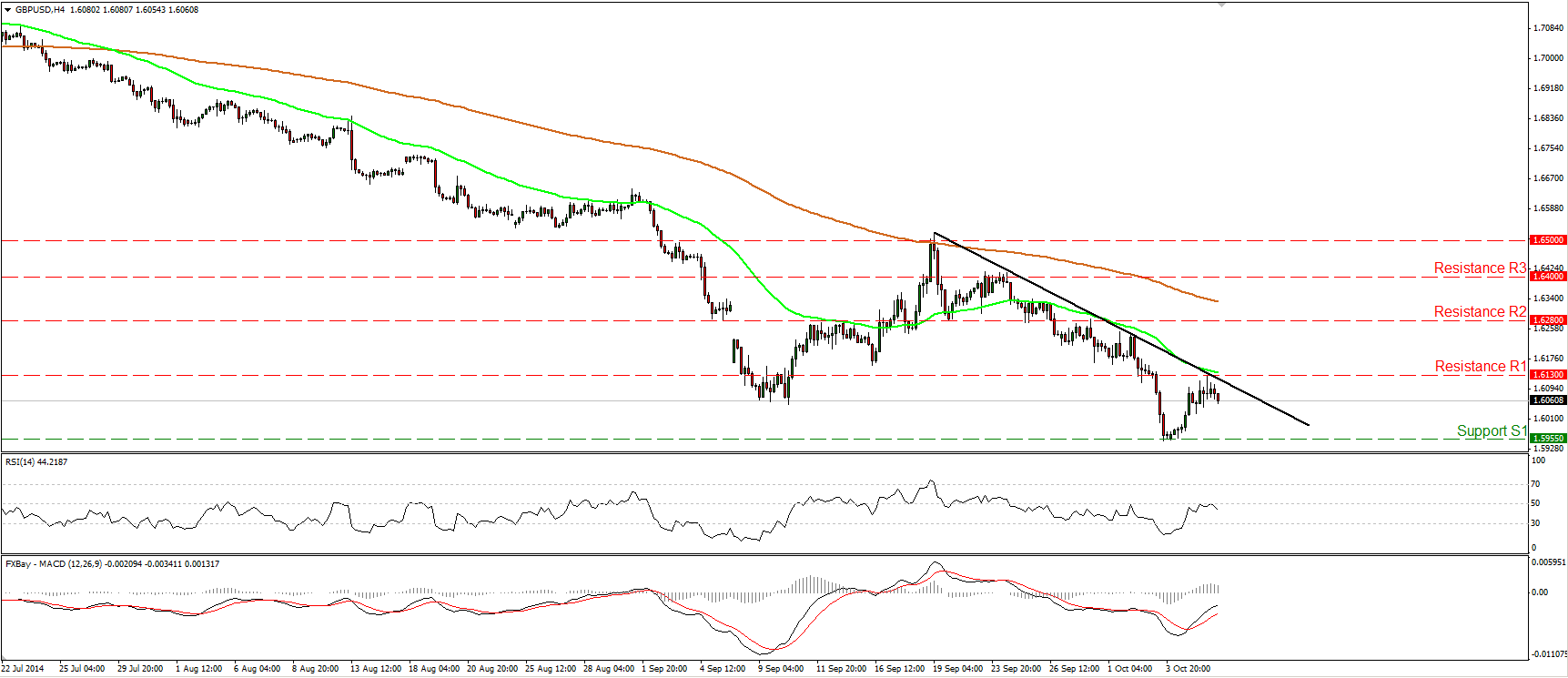

GBP/USD finds resistance at 1.6130

GBP/USD declined somewhat after finding resistance at 1.6130 (R1). The rate remains below the black near-term downtrend line and below both the 50- and the 200- period moving averages, which suggests that the short-term picture is likely to remain negative. I would therefore expect the pair to challenge again Monday’s low at 1.5955 (S1). A break below here could pave the way for our next support obstacle of 1.5860 (S2), marked by the low of the 12th of November 2013. Zooming in to the 1-hour chart, I see negative divergence between both the hourly momentum indicators and the price action, something that supports my view for a leg down in the near future, at least towards the 1.5955 (S1) low. In the bigger picture, on the daily chart, as long as Cable remains below the 80-day exponential moving average, the overall trend is to the downside.

• Support: 1.5955 (S1), 1.5860 (S2), 1.5720 (S3)

• Resistance: 1.6130 (R1), 1.6280 (R2), 1.6400 (R3)

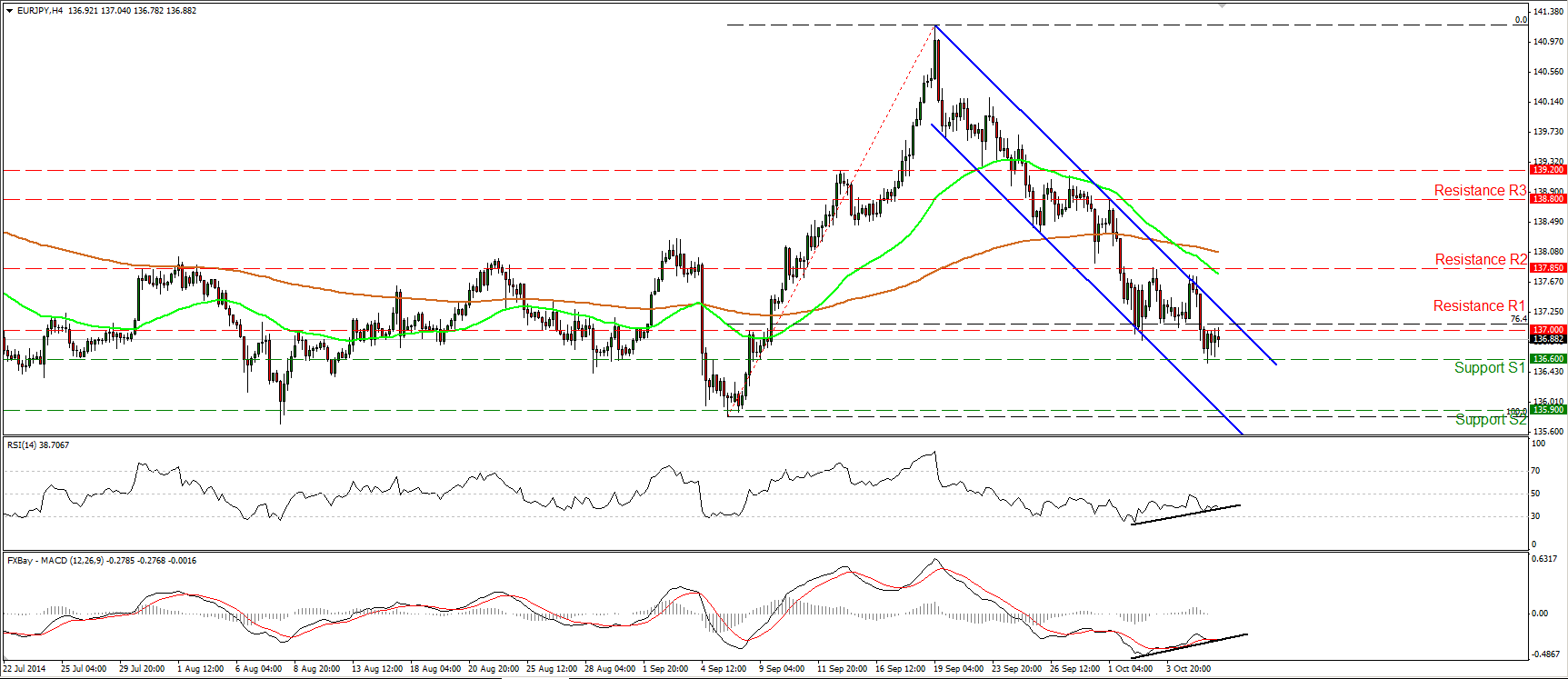

EUR/JPY stays below 137.00

EUR/JPY moved in a quiet mode yesterday, remaining fractionally below the resistance line of 137.00 (R1), which happens to lie slightly below the 76.4% retracement level of the 5th - 19th September up move. As long as the rate is trading within the blue downside channel and below both the 50- and the 200-period moving averages, I would consider the near-term bias negative and I would expect a decisive dip below the 136.60 (S1) support to pull the trigger for extensions towards the next hurdle at 135.90 (S2). My only concern is that I see positive divergence between our short-term oscillators and the price action, indicating decelerating downside momentum. As a result, alongside the price dip below 136.60 (S1), I would like to see our oscillators breaking their black upside support lines. This will designate that sellers are gaining momentum and will increase the chances for extensions towards 135.90 (S2).

• Support: 136.60 (S1), 135.90 (S2), 135.00 (S3)

• Resistance: 137.00 (R1), 137.85 (R2), 138.80 (R3)

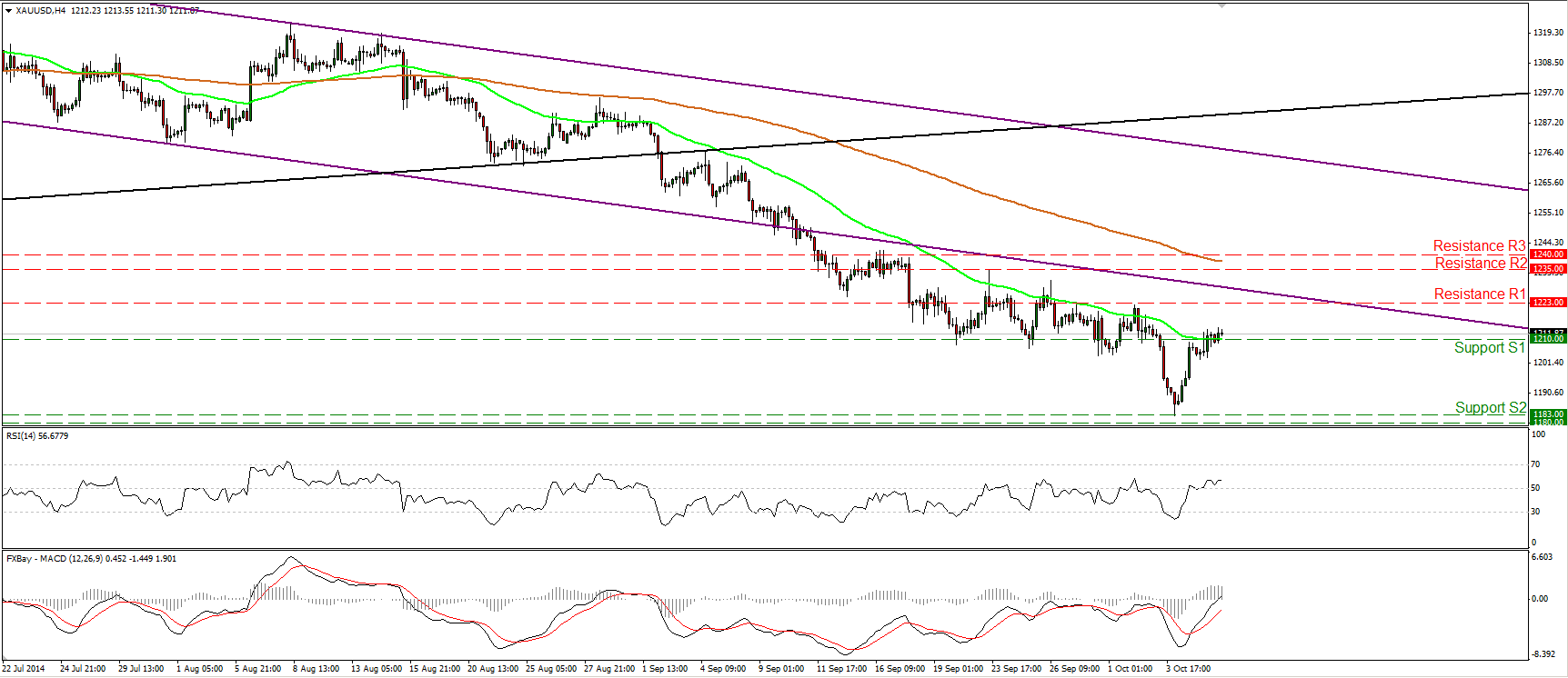

Gold continues higher

Gold advanced a bit more on Tuesday, moving marginally above the 1210 line. The RSI moved above its 50 line while the MACD obtained a positive sign and is pointing up, indicating positive momentum. Thus the upside wave is likely to continue and challenge our resistance line of 1223 (R1). However, on the daily chart the price structure still suggests a downtrend. As a result, I would maintain my “wait and see” stance for the same reasons as in my previous comments. On Monday, the metal rebounded strongly from the critical support zone of 1180/83, defined by the lows of June and December 2013, but the absence of any bullish trend reversal signals makes it too early to argue about any uptrend scenarios, in my view.

• Support: 1210 (S1), 1183 (S2), 1180 (S3)

• Resistance: 1223 (R1), 1235 (R2), 1240 (R3)

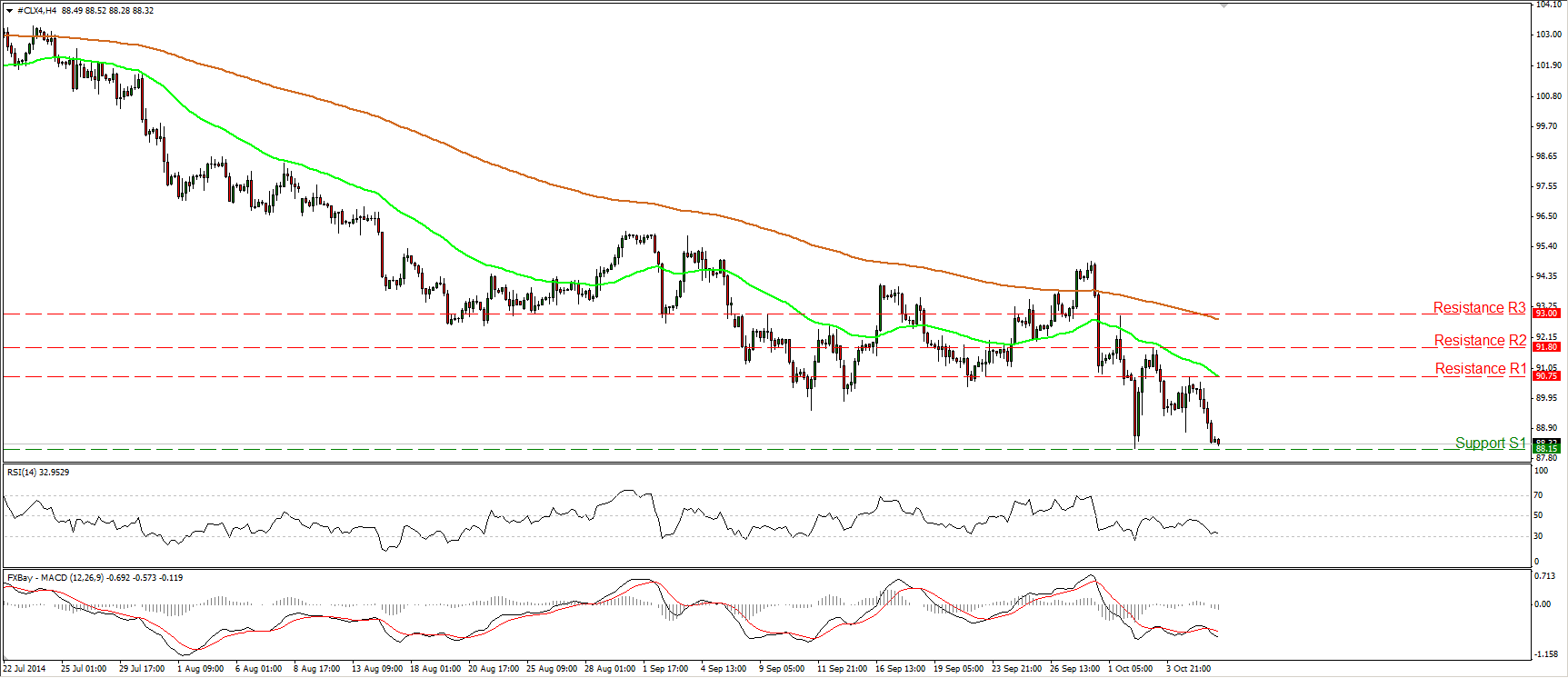

WTI ready for another test at 88.15

WTI tumbled after finding resistance at 90.75 (R1) and during the early European morning appears willing to challenge the 88.15 (S1) support line. The fact that the price printed a lower high at 90.75 (R1) keeps the overall picture cautiously negative. However, I will stick to the view that only a dip below 88.15 (S1) would confirm a forthcoming lower low on the daily chart and signal the continuation of the longer-term downtrend. Such a move could set the stage for further declines. Probably towards our next support obstacle at 86.00 (S2). Both of our daily momentum studies confirm yesterday’s negative momentum. The 14-day RSI moved lower after crossing below its 50 line, while the MACD remains below both its zero and signal lines.

• Support: 88.15 (S1), 86.00 (S2), 84.15 (S3)

• Resistance: 90.75 (R1), 91.80 (R2), 93.00 (R3)