The US dollar found itself under pressure this week as despite a run of relatively positive economic numbers, the Fed hinted that the March meeting will not really be a ‘live’ one. That is to say, a rate hike will not be on the table with markets giving a less than 1 in 20 chance for the Fed to raise rates. As a result the dollar fell while interestingly both stocks and gold managed to rally.

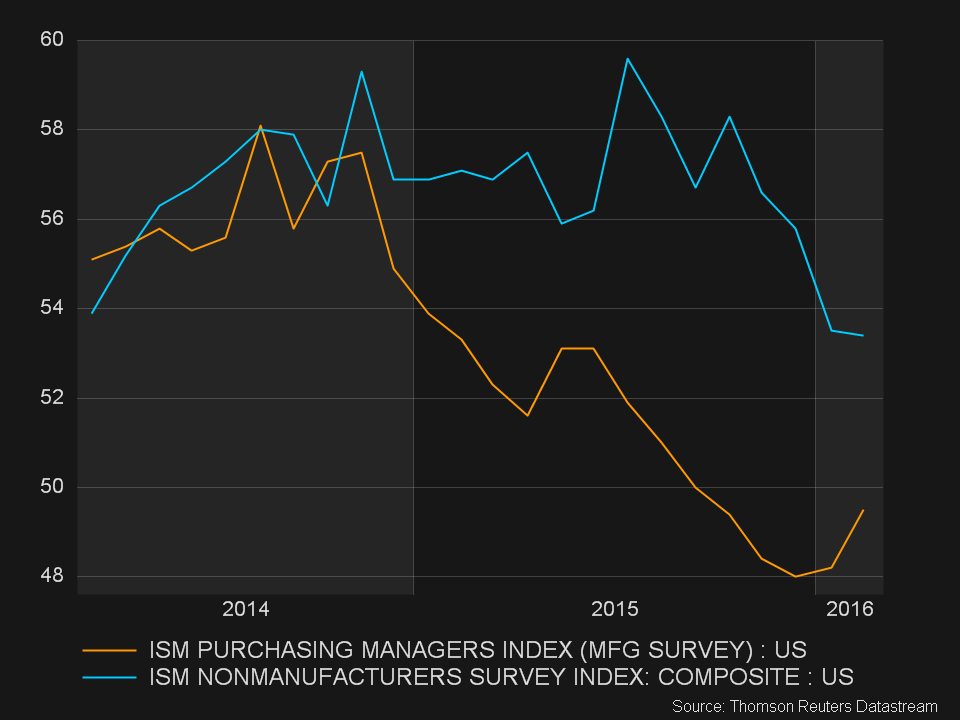

The week’s data included a relatively positive employment report for February (with the exception of hourly wages and number of hours worked), a weak services ISM business survey and a strong ISM manufacturing number. Furthermore, it is worth keeping in mind that the Fed’s favorite indicator, the core PCE deflator for January climbed to an annual 1.7% rate last week while 2 weeks ago it was reported that core consumer prices rose by 2.2% during the same month.

It is therefore challenging for the Fed to fully justify that such a low level of interest rates is warranted. The Fed should be proceeding with policy normalization given the unemployment rate of 4.9% and core inflation around 2%. However, Fed speakers such as New York Fed President William Dudley and Dallas Fed President Robert Kaplan sounded rather dovish in recent appearances. Dudley pointed out the downside risks to the economy while Kaplan called for patience in raising rates. Jim Bullard of the Saint Louis Fed, a closely-watched centrist on the rate-setting committee, said it was unwise to raise rates.

Why the hesitation to raise interest rates then? One reason is that long-term inflation expectations as implied by the bond market are lower than what the Fed would like. Critics of this argument point out that as Fed bond buying and low-rate policy has helped push down longer-term interest rates, it is not recommended to use these depressed yields in order to infer expected inflation. A second reason is that given the recent market turmoil in January and February, the Fed is reluctant to raise rates so soon after this volatile episode in fear of provoking financial market instability. This could be a problem for dollar bulls however and if markets believe the Fed is going to always offer them a helping hand, it will create the wrong incentives for risk-taking. To sum up, for the dollar to move higher, strong data is probably not enough; the Fed also has to talk and act in the direction of raising rates.

Aussie continues climb while pound rebounds

During the week that passed, it was notable to point out the positive performance of the Australian dollar and the British pound. Starting with the Australian dollar, on Wednesday it broke decisively above its 200-day moving average versus the US dollar – the first such break in 1 ½ years. The Aussie was helped by reasonably strong GDP data that day, which showed the economy doing quite well during the final three months of 2015. The annual growth rate was 3%; not bad for an economy which is affected negatively by the Chinese slowdown and in the aftermath of a mining investment boom. Furthermore, recent economic data and Monday’s statement out of the Reserve Bank of Australia, have convinced markets that a rate cut in the near future is no longer the main scenario. This, combined with a rebound in the iron ore prices and some weakness in the US dollar, have propelled the Aussie to the psychologically important 74 US cents mark. This level is important since two attempts by the Aussie to break above it in October and November last year both failed. The level might provide Aussie bears with an opportunity to re-short the currency expecting the reemergence of commodity price weakness, more bad news out of China and the RBA to start to get nervous once more about the rising exchange rate to try to push it back down.

On to the British pound, its recovery was noteworthy as it took place despite poor business survey data. All three surveys, manufacturing, construction and services’ PMIs significantly missed expectations but that did not stop the pound from rising. Perhaps the rebound in the pound can be attributed to positioning as many must have been caught short sterling in the aftermath of the referendum announcement. There is reluctance to drive the pound even lower without more evidence that the government is going to lose the vote and the UK will exit the union. Presently, the opinion of most analysts is that Britons will eventually choose against the possible economic harm an exit from the EU might bring and will vote to remain a part of the Union despite all the problems this entails. In addition, according to online bookmakers, you will get back only 1.5 times your money if you bet on ‘Remain’ instead of around 3.5 times if you bet on ‘Leave’. Given the long odds of a Brexit and keeping in mind that surprises do sometimes happen, one has to ask oneself how much lower the pound should go before speculators and bargain-hunters step in. Of course the pound is still by far the worst performing G10 currency year-to-date against both the euro and the dollar despite its gains this week. The week was therefore a timely reminder that uncertainty can go both ways following a big initial move.