Dollar General Corporation (NYSE:DG) , one of the largest discount retailers, came out with second-quarter fiscal 2017 results, wherein adjusted earnings of $1.08 a share lagged the Zacks Consensus Estimate by a penny, but remained flat from the prior-year quarter.

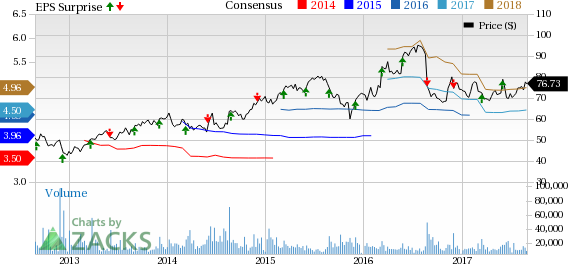

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2017 has increased in the last 30 days. Moreover, in the trailing four quarters, excluding the quarter under review, the company outperformed the Zacks Consensus Estimate by an average of 1.4%.

Revenues: Dollar General generated net sales of $5,828.3 million that jumped 8.1% year over year and also came ahead of the Zacks Consensus Estimate of $5,816 million. Further, same store sales rose 2.6% in the quarter.

Key Events: The company bought back nearly 1 million shares in the reported quarter. Since the commencement of the share repurchase program in Dec 2011, the company has bought back 76.7 million shares aggregating $4.7 billion. At the end of the quarter, the company has an outstanding authorization of nearly $770 million. Further, the Board announced a quarterly dividend of 26 cents per share that will be payable on Oct 24, 2017 to shareholders of record as on Oct 10.

Further, management has approved the buyout of the Acquired Stores, which reflects a rise of nearly 285 new stores across 35 states. By November 2017 end, it expects to convert these store sites to the company’s banner.

Outlook: Management continues to anticipate net sales to rise in the band of 5-7%. Same-store sales growth is still anticipated in the band of slightly positive to 2% for fiscal 2017, but expects the same to be at the higher end of the guided range. Further, GAAP earnings are projected in the band of $4.35 to $4.50 per share versus $4.25 to $4.50, guided earlier.

Moreover, the company continues to expect share buyback of nearly $450 million in fiscal 2017, and intends to introduce roughly 1,285 new outlets, relocate or remodel 760 stores.

Zacks Rank: Currently, Dollar General has a Zacks Rank #2 (Buy), which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Check back later for our full write up on Dollar General’s earnings report!

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today.

Learn more >>

Dollar General Corporation (DG): Free Stock Analysis Report

Original post