The financial markets remained rather mixed this week so far. Risk appetite was firm with S&P 500 breaching 2000 handle to 2001.95 overnight and closed at 1997.92, up 9.52 pts or 0.48%. DJIA also closed higher by 75.65 pts, or 0.44% and is heading back to historical high. Such sentiments didn't carry on to Asian equities as major indices are trading in red at the time of writing, with Nikkei 225 down -0.5%. In spite of the rally in US stocks, treasury yields lost some more ground with 30 year yield back at 3.135 and 10 year yield slightly lower at 2.387. In the currency markets, dollar is generally firm against other major currencies but lacks follow through buying in spite of earlier rally. Euro is generally soft but we don't see follow through selling neither. Some more fresh stimulus is needed for the markets to extend recent trends.

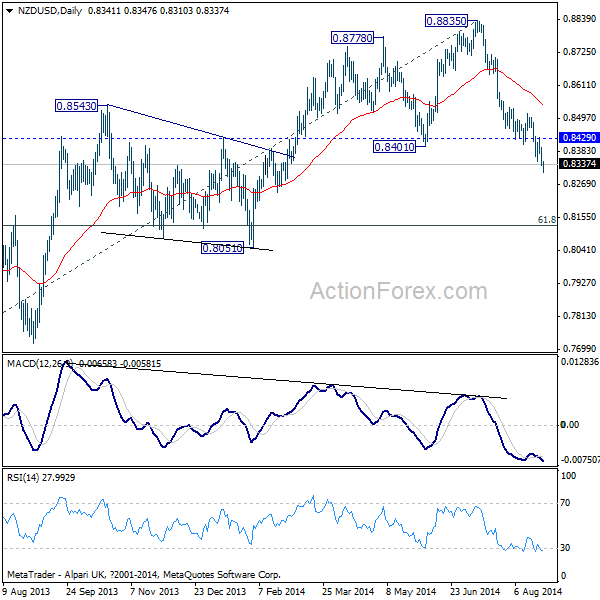

NZD weakens in Asian session as the country reported larger than expected trade deficit of NZD -692m in July. That compared to consensus of NZD -475m and prior month's NZD 242m surplus. That's also the first deficit in nine months. Export dropped -3.3% yoy to NZD 3.7b, lower than expectation of NZD 3.98b. Imports dropped -4.8% yoy to NZD 4.4b, close to expectation of NZD 4.5b. NZD/USD dropped to as low as 0.8310 so far today and near term outlook stays bearish. The current fall from 0.8835 medium term top should extend to 61.8% retracement of 0.7682 to 0.8835 at 0.8122. And outlook will stay bearish as long as 0.8429 resistance holds.

Elsewhere, Japan corporate service price index rose 3.7% yoy in July. China conference board leading indicator rose 1.3% in July. The European calendar is empty today. Focus will be on US data today. Durable goods are expected to grow 7.4% in July while ex-transport orders are expected to grow 0.5%. House price index is expected to rise 0.3% mom in June while S&P Case-Shiller 20 cities hour price is expected to grow 8.2% yoy in June. Conference Board leading indicator is expected to drop slightly to 89.1 in August.