Dollar stays firm in Asian session as markets open the week quietly. The greenback is pressing last week's high against Euro, Sterling, Loonie and Aussie and is staying in tight range. The dollar did edge higher against Swiss Franc but there is no follow through buying yet. In other markets, Nikkei is up 200 pts at the time of writing but lacks decisive momentum to take out 16000 handle yet. Hong Kong HSI recovers mildly and is trading around 100 pts up. Gold opened lower and reached as low as 1183.3 but is back pressing 1190 for the moment. Crude oil struggled in tight range below 90 handle.

Released from Australia, TD securities inflation rose 0.1% mom in September. The economic calendar is relatively light today. German factory orders is expected to drop -2.4% mom in August. Eurozone Sentix investor confidence is expected to drop further to -11.8 in October and retail PMI will also be featured. Canada Ivey PMI is expected to rise to 53.4 in September.

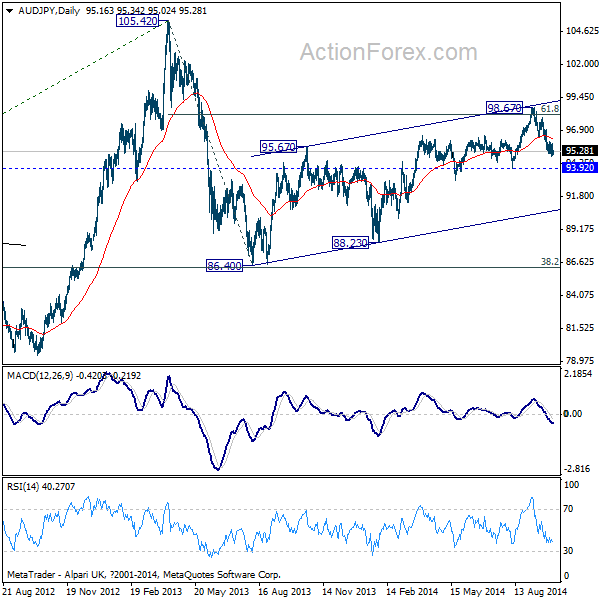

The next main focuses are indeed in the BOJ and RBA rate decisions tomorrow. Both central banks are expected to keep policies unchanged. Some volatility was seen in AUD/JPY last week but the outlook is generally unchanged. The consolidative pattern from 86.40 should have completed with three waves up to 98.67 after hitting 61.8% retracement of 105.42 to 86.40. Near term outlook remains bearish for a test on 93.92 support first. Break will confirm our bearish view and target 86.40 again in medium term.

Looking ahead, FOMC minutes and BoE rate decision will be the major focus of the week. The FOMC minutes are expected to show how close policymakers were to drop the "considerable time" language in the post meeting statement. While, the expectation on the timing of the first hike is generally unchanged, markets would look for clues on the pace of tightening after the first hike. BoE is expected to keep policies unchanged and would likely release just a brief statement. Meanwhile, Australian dollar and Canada dollar will look into job data from their countries. Here are highlights of the week.

- Monday: Eurozone Sentix Investor Confidence; Canada Ivey PMI

- Tuesday: BoJ rate decision; RBA rate decision; Swiss foreign currency reserves, CPI, retail sales; UK productions; Canada building permits

- Wednesday: Swiss unemployment; Canada housing starts; FOMC minutes

- Thursday: Australia employment; German trade balance; BoE rate decision; US jobless claims

- Friday: BoJ minutes, tertiary industry index; UK trade balance; Canada employment