On July 17, 2024, I wrote an article with the title Is Silver About to Break Out – The Dollar Index Points to YES. The dollar was at a 3-month low of 103.80 and today we crashed through support after the NonFarm Payroll and Unemployment Data came out worse than expected.

The last report's data was also revised lower. Unemployment rate rose to 7.8%. Factory orders fell -3.3% in a report that just came out as well versus -2.7% expected.

The dollar hit 103.48 as of this writing. The next target is the 52-week low of 100.62. Break that and all hell breaks loose. Metals will most likely not see these prices for many years.

Silver is on the move lower today but is still priced well for adding to your portfolio. With the dollar falling to fresh lows, don’t be of the mindset that you are waiting for another drop to buy any silver or gold.

Silver Has a Lot of Catching Up To Do

Silver is still under $30 an ounce for spot but this won’t last much longer. There were two times in the last 53 years that silver outpaced gold. From 1971-1980 and from 2000-2011. Both times silver topped out around $50 an ounce and today you can buy silver at a 42% discount to those highs. In fact, to get to 50 from silver’s current price is a 72% return.

With the stock market falling, do you actually think you can do better with stocks than silver? The chart below shows the Nasdaq getting hit hard today and since July 10th when it was 20983.75.

Yes, a bounce will come in the stock market most likely into the election but it doesn’t matter who gets elected, silver will be much higher as the debt of this nation, now over $35 trillion, See Is America Headed for Bankruptcy? And after this run up in stocks into the election, you can bet that the party will be over for stocks except for a select few.

I have been following my trading system of making calls the last month and there were no new buys but just sells (shorts) and exits. While I took time off to write my book and didn’t write any articles here for a while, you can see I am adamant about the markets and metals since December of last year. It’s because I see what’s coming. And what’s coming isn’t good.

The timing of it should start to escalate as we get close to the election. Market makers will come in and save the day for the stock market. They will also try and keep the “truth” of what metals represent subdued. But it won’t last. Fed Chair Powell will lower rates come September, if not before, and the dollar will fall further.

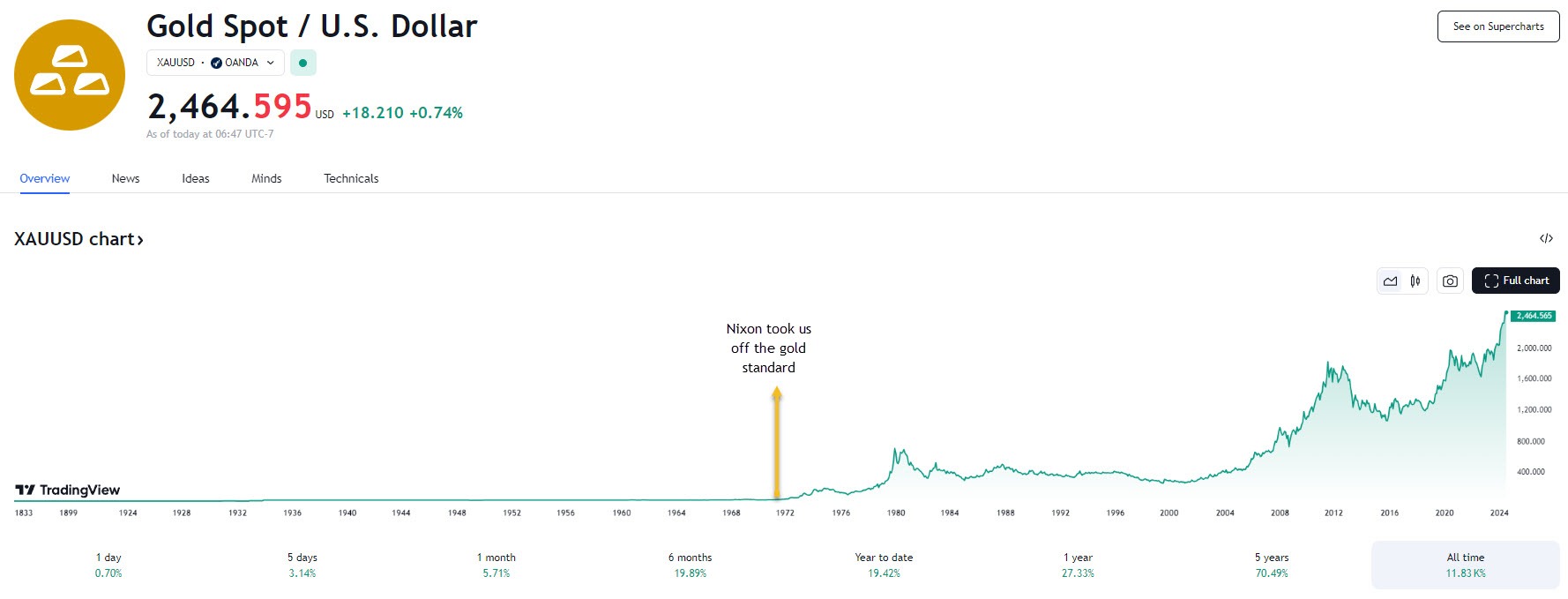

Nixon took us off the gold standard in 1971 and you can see what gold has done since then. But the last 2 decades of gold overall moving higher is representative of the national debt seeing annual increases with no cuts by anyone in power.

Neither Democrats or Republicans have cut the national debt at any point in the last 20 years. There is no changing this as bills have to be paid right? So print more money is all Congress knows how to do. But what are the consequences of this spending? I wrote about that in my article Will the U.S. Follow Argentina’s Disastrous Inflation?

Any country that has out-of-control debt has one outcome and that is the destruction of their currency. This is true without exception. What makes it different this time? Is the U.S. Congress going to stop spending? Will they make cuts to anything? Hard choices won’t come easy unless their hand is forced. What will force their hands?

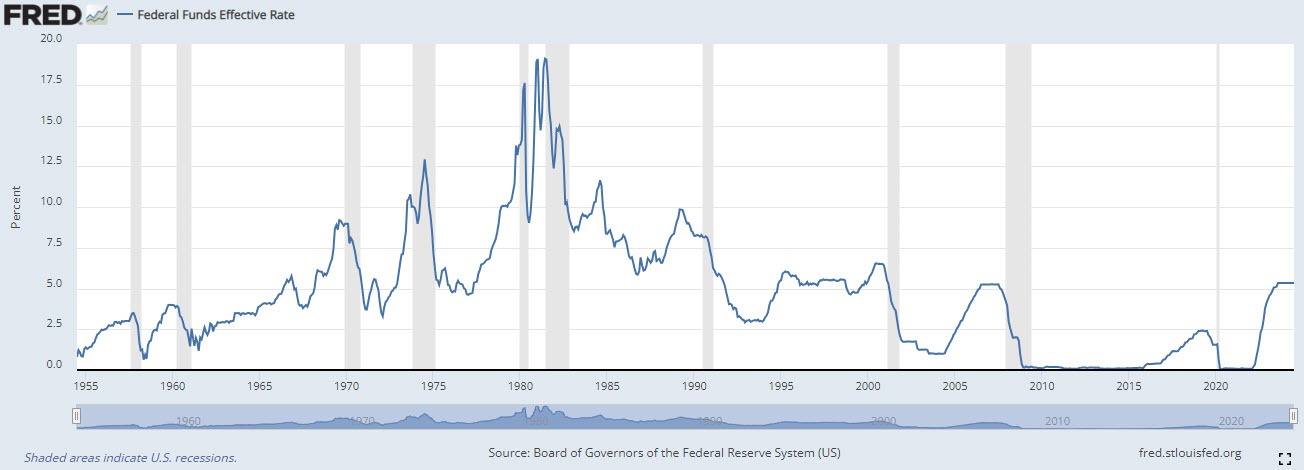

The answer lies in interest rates as I pointed out in my America going bankrupt article. But let’s expand on that a bit so you see why the Fed will be forced to lower rates soon with the result being a lower dollar and higher price for metals.

The interest paid on the debt has been rising with the rate increases by the Fed to fight inflation.

The national debt is 35.1 trillion and the interest charged is costing us $890 billion at a rate of 3.28% presently. The 2023 interest cost was $658 billion.

Overall, interest rates are still low comparatively speaking as you can see from the Fed Funds chart below with the current rate at 5.53%.

The CBO has projected that the interest on the debt will be $1.7 trillion by 2034. Note, we got as high as 19.04% in July of 1981. While the Fed is destined to lower rates soon, and may even do an emergency cut to save this crashing stock market, they eventually will have to raise rates to fight potential runaway inflation. Even as I type this the market has fallen further and the dollar has fallen to 103.18.

Silver is also taking a hit but Avi Gilburt from Elliott Wave Trader called a low last week and since I have known him, once again he has called the low (July 25th).

We haven’t retreated below that low even though market makers are playing games today with silver right now, letting it rise, only to lower it again in sharp fashion.

That’s how they make money. But the declines shouldn’t scare you at all. They are buying opportunities.

In 2009 we saw the market crashing and it took silver down a bit too, but silver recovered quickly and went from around 12 to over 48 by January 2011. We have another move coming like that for Silver.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.