A collapse is developing in Chinese markets following the continued tightening of regulations on large technology companies. The Hang Seng has lost all its gains from November last year, losing more than 10% in three days. But investors still see these fluctuations as a local story while US indices update all-time highs on Monday. European indices and US index futures are slightly down today.

However, investors in much of the world should not ignore this decline. All too often, the initial problems in China have set off a chain reaction in world markets. This applies both to the US-China trade disputes and the coronavirus recession, which developed markets ignored for more than a month before the violent sell-off of February 2020 began.

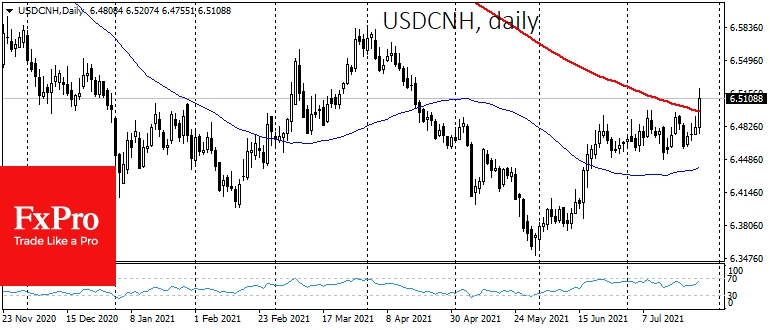

Notably, the increased volatility in the Chinese market has removed one of the last obstacles to declaring a bullish recovery in the dollar and traction in defensive assets in equity markets. The USD/CNH pair crossed the 200-day moving average today.

In our view, the bullish trend in US equities is mainly due to inactivity, with investors selling off the Chinese market and buying the US market. But history has taught us reliably in recent years that globalisation has caused markets to shift very quickly into a sell-off mode with sustained pressure on a single major market.

Investors should pay attention not only to falling Chinese equities but also to the general pull into defensive assets in the form of falling developed country government bond yields. And all this despite the expectation that the Fed will discuss a tapering of stimulus, which in normal times would put pressure on bonds and increase their yields.

This correlation cannot be ignored by the Fed, whose monetary policy meeting is due later this week. The wide eyes of the American central bank on hidden market trends could radically strengthen and expand the pulling into protective assets in the form of a sell-off in equities and a further appreciation of the dollar.

There are increasing signs that the dollar is clearing its way upwards, proving its status as a haven currency in times of financial market turbulence. The Fed can mitigate this turbulence or give reasons to intensify it in case there are hints that the stimulus is about to be withdrawn.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Dollar Clears The Way Upwards, And Fed May Spread Turbulence In The Market

Published 07/27/2021, 08:54 AM

Updated 03/21/2024, 07:45 AM

Dollar Clears The Way Upwards, And Fed May Spread Turbulence In The Market

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.