- US dollar stays on the backfoot even as jobless rate unexpectedly dips in April

- Fed rate cut bets still elevated; will inflation data alter anything?

- US bank stocks rebound but worries persist, debt ceiling standoff adds to jitters

Markets unfazed by strong US jobs report

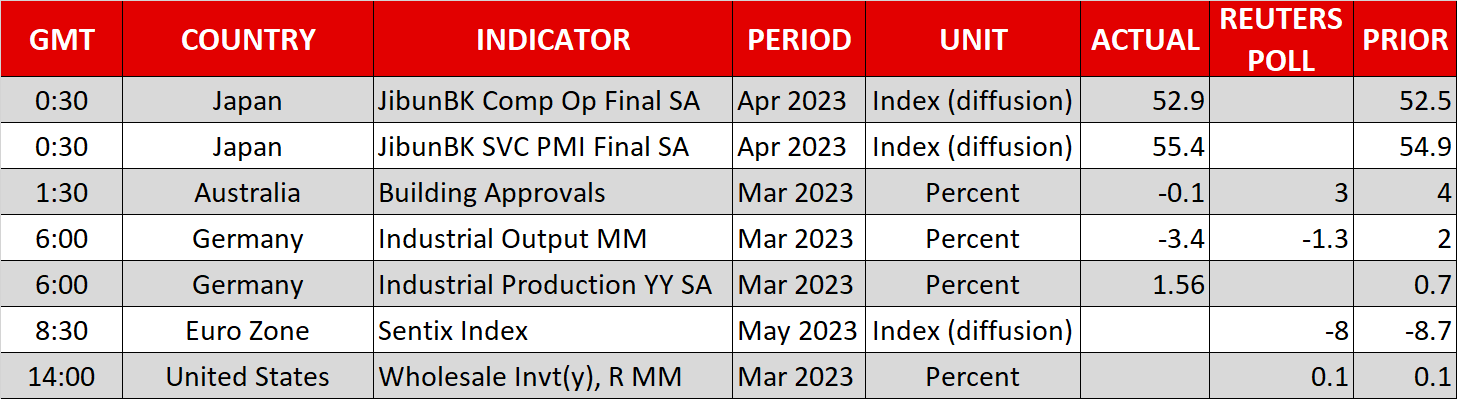

It was another allrounder strong payrolls report on Friday as the US economy added an impressive 253k jobs in April, beating the consensus forecasts. More significantly, the unemployment rate unexpectedly edged lower to a five-decade low of 3.4% and wage growth accelerated.

However, investors seemed to have put more emphasis on the downward revision to the prior month’s figure, which nullified the upside surprise in the April reading, and Fed rate cut expectations finished the day little changed.

After the Fed hinted at a possible pause in June, the NFP beat should have generated more volatility. Instead, it made markets less worried about a hard landing and some investors still expect the Fed to enter a loosening cycle as early as the July meeting.

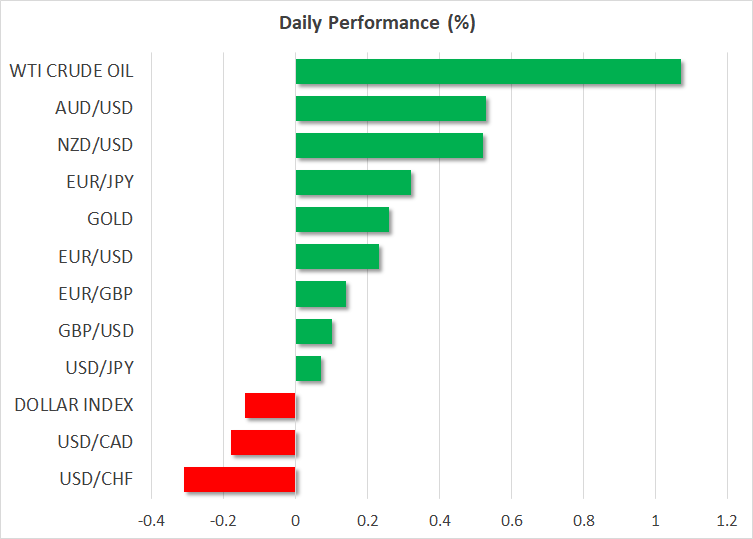

The reaction in bond markets was somewhat more notable. The 10-year Treasury yield gained almost 10 basis points on Friday, but only because it had slumped in the preceding days following the FOMC decision. The US dollar fell sharply against the pound and the commodity-linked aussie, loonie and kiwi. It’s extending its slide today against a basket of currencies.

Lending data could be crucial ahead of CPI release

The focus now moves onto Wednesday’s CPI report, which may go a bit further in shaping expectations about the Fed rate path than the payrolls numbers did. The headline rate of CPI is anticipated to have remained unchanged at 5.0% in April, potentially signalling slowing progress in getting inflation back down to 2%.

In the meantime, though, there is another crucial piece of data on the way as the Fed will publish its Senior Loan Officer Opinion Survey later today. Should the survey point to tightening credit by US banks over the last three months, rate cut odds are likely to intensify and pummel the dollar.

However, it’s unlikely that there would be anything too worrying in the survey as the Fed wouldn’t have raised rates last week if there was, nor would it have kept the door open for further rate increases. But given the ongoing anxiety about the state of regional banks and the deposit flight, any surprises could spark some volatility.

Banking fears ease as debt ceiling deadline looms

Wall Street managed to stage a big rally on Friday, buoyed by an earnings beat from Apple (NASDAQ:AAPL) and a massive rebound in PacWest’s shares. After several days of selloff prompted by the collapse of First Republic Bank (OTC:FRCB), banking stocks went into reverse on Friday as concerns about deposit outflows began to ease.

The S&P 500 closed up 1.9%, while the tech-heavy Nasdaq notched up gains of 2.3%.

However, it’s still too early to predict an end to the banking turmoil as confidence remains extremely fragile, undermining the broader somewhat more optimistic mood, particularly in the tech sector.

Aside from the uncertainties about the health of US regional banks and the likelihood of a recession, investors also have to brace themselves for more political drama as time is running out for Congress to reach a deal on a new debt limit.

President Biden is due to meet Republican House Speaker Kevin McCarthy on Tuesday to discuss possible compromises for a deal at raising the debt ceiling. The issue is unlikely to be resolved quickly but markets will probably not take notice until negotiations run into the 11th hour.