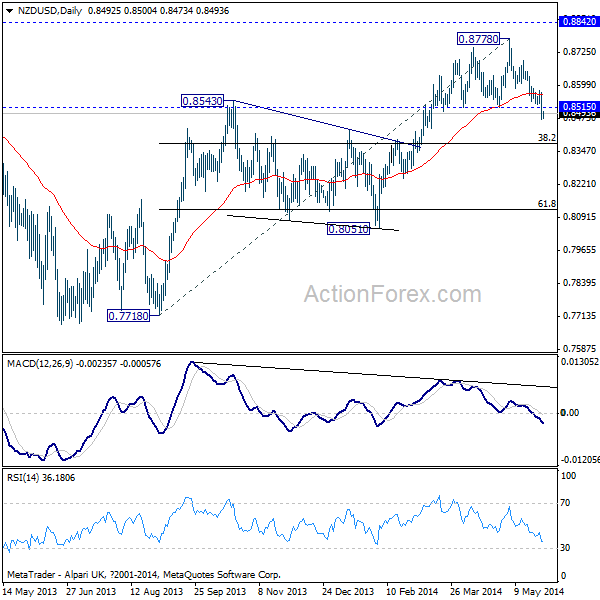

The US stock market extended its record run overnight but lost momentum before closing. The S&P 500 hit a new record of 1914.46 before retreating to close slightly down by -2.13 pts at 1909.78. The Dollar Index followed and reached as high as 80.58 but is back below 80.50 handle at the time of writing. In the currency markets, strength in seen in the Japanese yen, in particular against European majors. Sterling was weighed down by cross selling against euro and dipped through 1.6731 support against dollar, which signals near term weakness. New Zealand dollar took out near5 term support of 0.8515 against dollar will suggests trend reversal. And cross buying in AUD/NZD helps lifted AUD/USD.

Regarding the outlook in NZD/USD, it should be first noted it's staying in multi-year range below 0.8842 high. The medium term trend from 0.7718 could merely be just a leg inside the range pattern and strong resistance was seen below 0.8878. This week's break of 0.8515 support argues that such trend is likely finished at 0.8778 and is reversing. The near term outlook is turned bearish for 38.2% retracement of 0.7718 to 0.8778 at 0.8373. And break there will solidify this bearish case.

In the UK, BoE MPC member Weale hinted that the central bank could start rates hike sooner rather than later. He noted that the economy has "sustained fairly rapid growth in demand" and risks became "more balanced." He said before that the slack in the economy was around 0.9% of GDP and has dropped since then. The answer to the question on interest rates is "less definite" than it was six months ago. But, he said that "if you want to have baby steps you do have to start sooner." While Weale said the central bank can "wait a bit longer," he's not sure how much longer.

Released from Japan, retail sales dropped -13.7% mom, -4.4% yoy in April. That's weaker than expectation of -11.7% mom and -3.2% yoy. Also, the month-to-month decline was the steepest in at least 14 years, as a result of the tax hike. But economists noted that demand will bounce back even though pace could be slow.

Looking ahead, the European calendar is empty today with Swiss, France and Germany on holiday. In the US, Q1 GDP revision, jobless claims and pending home sales will be released.