As we continue to work our way through earnings season, we see the revenue story playing out as we and many analysts have anticipated since early this year: a strong US dollar is proving to be a headwind for U.S. companies -- and conversely, a weak euro is providing a tailwind for European multinationals. Although we expect a correction in the U.S. dollar to continue to develop, longer-term the dollar may once again renew its rise.

The size and rapidity of the dollar’s move is historically unusual, emphasizing the extraordinary monetary environment in which we’re living, shaped by almost unprecedented central bank policies and by the international fund flows that are responding to them.

This would suggest a simple conclusion: reduce exposure to U.S. companies which earn more of their revenues overseas; increase exposure to European companies which earn more of their revenues outside of Europe.

Let’s look at the U.S. and Europe to see if this conclusion is warranted.

How Are U.S. Earnings and Revenues Shaping Up?

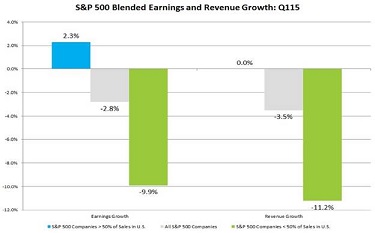

As of last Friday, 201 companies from the S&P 500 had reported earnings. Broadly, the expected picture is indeed playing out: 53 percent of those who had reported missed consensus sales estimates. For the S&P 500 as a whole, including actual results for companies that have reported and estimates for those that have not, revenues are tracking a 3.5 percent year-over-year decline, and earnings a 2.8 percent year-over-year decline.

Further, if you break earnings and revenue results for the S&P into two groups -- companies with greater than 50 percent of sales overseas and companies with less than 50 percent of sales overseas -- there’s a stark difference.

Companies with predominantly U.S. sales are eking out earnings growth on flat revenues by continuing to improve margins, albeit at a slower pace.

S&P 500

For reasons we note in our next section, although the dollar is consolidating after its recent run, we believe that the macro forces supporting its rise are still in place, and that this rise will resume. In short, this will not be the last quarter of earnings adversely impacted by dollar strength, nor the last quarter of differential between foreign-heavy and U.S.-heavy performance. The market is a discounting mechanism, but it is not entirely rational -- and we suspect that the continued revenue weakness of foreign-heavy companies will weigh on their shares’ performance throughout the current quarter and perhaps into the next.

Other Forces At Work

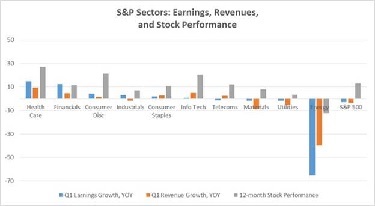

The overall picture painted above -- with the S&P as a whole posting a 3.5 percent decline in revenues and a 2.8 percent decline in earnings for the first quarter -- is too bleak. Most of the weakness in S&P revenue and earnings growth is coming, as we might suspect, from a single sector: energy. Broken out by sector, performance looks better:

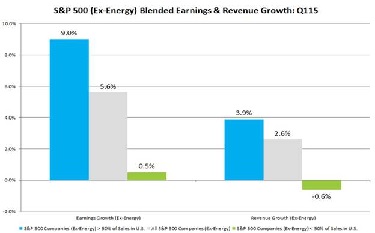

With energy as the clear laggard, we can remove it, and look at the remainder of the S&P again broken down by where revenues are generated, within or outside the U.S. This shows that U.S. revenues as a whole are not tanking from dollar strength -- but the advantage is still with companies that have more domestic revenues:

In short, the earnings data so far confirm our general view of the U.S. We are modestly bullish on the U.S., and believe that investors should structure their U.S. holdings to have greater exposure to companies whose revenue is predominantly domestic.

What About Europe?

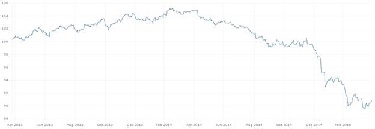

Under the promise, and then the reality, of European Central Bank (ECB) QE, the Euro has dropped dramatically. The index in the chart below, constructed by the ECB, tracks the Euro’s strength against the currencies of 19 of the Eurozone’s trading partners. Just as the dollar has gained, the euro has fallen -- 13.3 percent in the past 12 months:

We would expect the Euro’s fall to translate into better revenues for European exporters, and that thesis is indeed playing out. Where U.S. companies, ex-energy, are running at 5.6 percent earnings growth, the companies in the broad STOXX 600 Europe index (also ex-energy) are running at 19.6 percent earnings growth. Analysts are revising earnings estimates up -- more upgrades than downgrades for the first time in four years.

And again, although the euro has spent several months consolidating after its precipitous decline at the end of last year, we concur with analysts who view the trend as ongoing. The revenue tailwind provided by Euro weakness is not likely to be confined to the current quarter.

Europe has other complicating factors, as we always point out -- the ebb and flow of sentiment around Greek woes and Russian saber-rattling. On the plus side, Euro QE may actually start to have an economic impact, boosting inflation and growth.

Currency Helps Japan, Inc. As Well

As a note, corporate Japan is also benefitting from currency tailwinds. Since Japan’s Prime Minister, Shinzo Abe, set his country on the course of the world’s most aggressive QE program, the Yen has dropped dramatically, although it has rallied slightly in 2015

Dow Jones FXCM Yen Index -- the Yen vs. a Basket of the Euro, U.S. Dollar, and Aussie Dollar

Source: Financial Times

Goldman Sachs anticipates that in Yen terms, Japanese companies will see 22.1 percent year-on-year profit growth for fiscal 2015. (Japanese analysts and Japanese firms are typically much more circumspect in their forecasts.) As with Europe, exporters should continue to benefit the most from these tailwinds.

Investment implications: U.S. revenues and earnings are coming in mediocre. However, when you strip out energy, and look at companies making most of their sales within the U.S., the picture becomes a little less gloomy. European firms, though, are showing very strong revenue and earnings growth. If Greek and Russian problems remain constrained, this will likely not be the last quarter of accelerated earnings growth. We continue to believe that large European and Japanese exporters remain attractive, and that the dollar will continue to be a headwind for U.S. exporters.