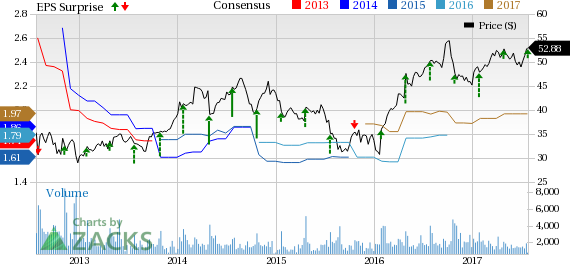

Dolby Laboratories, Inc.’s (NYSE:DLB) third-quarter fiscal 2017 adjusted earnings per share came in at 75 cents, which beat the Zacks Consensus Estimate of 65 cents by 15.3%.

The company’s non-GAAP earnings were up 13.2% to 86 cents on a year-over-year basis, steering past the projected range of 75–81 cents. The earnings growth is attributable to lower effective tax rate and an impressive top-line performance.

Inside the Headlines

Total revenue of $305.7 million beat the Zacks Consensus Estimate of $297 million and was up 10.1% on a year-over-year basis. Healthy increase in revenues across all the three segments namely, Licensing, Products and Revenues contributed to the decent rise in the top line.

The company’s Licensing revenues were up 9.9% to $278.1 million year over year. Solid growth in Mobile devices (up 18%) and Consumer Electronics (up 15%) sales drove Licensing revenues. While, higher revenues in DMAs and sound bars drove Consumer Electronic sales, Mobile devices grew on the back of higher recoveries. Broadcast revenues increased 3%, thus adding to growth.

Licensing in “other markets” was up a robust 33% in the reported quarter thanks to decent performance by Dolby Cinema and higher recoveries.

In the fiscal third quarter, Product revenues came in at $22.6 million, up 9.7% on a year-over-year basis. Further, the Services segment rose 25.6% year over year to $4.9 million. Growing demand from exhibitors for digital cinema products increased the Products and Services sales.

During the reported quarter, operating margin of Dolby expanded 200 basis points (bps) to 31.3%.

Liquidity

As of Jun 30, 2017, Dolby had cash and cash equivalents of approximately $592.6 million, up from $516.1 million as of Sep 30, 2016.

In addition, net cash provided by operating activities came in at $292.5 million, up from the year-ago figure of $284.0 million.

Dividend

Concurrent with the earnings release, Dolby announced a cash dividend of 14 cents per share of Class A and Class B common stock, that will be payable on Aug 15, 2017, to shareholders of record as of Aug 7, 2017.

Guidance

Concurrent with the earnings release, Dolby issued the guidance for fourth-quarter fiscal 2017 earnings and revenues. The company estimates non-GAAP earnings in the range of 36–42 cents, while revenues are projected to lie in the band of $230–$250 million.

Moreover, the company projects non-GAAP gross margin in the 88–89% band. Similarly, operating expenses are likely to be between $158 million and $162 million on a non-GAAP basis.

For fiscal 2017, the company foresees total revenues of approximately $1.08 billion, at the midpoint of the total revenue guidance range of $1.06–$1.10 billion.

While revenue initiatives such as Dolby Cinema, Dolby Voice and consumer imaging programs are expected to fuel growth, declining demand for PCs, DVD, Blu-ray and home theater equipment are expected to play spoilsport.

Additionally, the company expects Mobile licensing to be a key growth driver this year. The company also reiterated its non-GAAP operating expenses for fiscal 2017 at $635 million.

Our Take

Dolby delivered better-than-expected results, with both top- and bottom-line beats. The company has maintained its long-standing partnerships with industry frontrunners like Apple Inc. (NASDAQ:AAPL) , Amazon.com, Inc. (NASDAQ:AMZN) and Netflix, Inc. (NASDAQ:NFLX) to offer best-in-class services and fend off competition.

Impressive market traction of offerings under three of its new businesses – Dolby Voice, Dolby Vision and Dolby Cinema – is expected to boost growth. The content pipeline for Dolby Cinema continues to grow at an accelerated pace, adding to the company’s strength. Also, the Zacks Rank #3 (Hold) company’s solid financial health and strategic capital allocation are likely to augment its growth momentum.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Dolby Laboratories (DLB): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Original post