The S&P 500 has been on a tear the last 6 weeks. The SPDR S&P 500 ETF (NYSE:SPY) rose over 14% from a low February 11th to last Friday’s close. I had been talking about the “W” that was forming standing for Winning. And it sure was winning. But what about now? The price action this week seems to show “W” may stand for worn out.

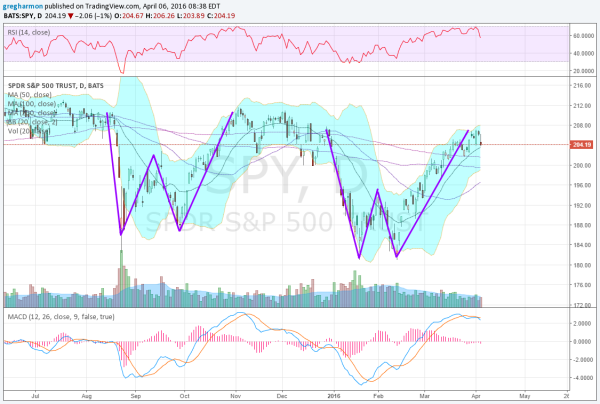

The chart below shows that “W” and the “W” before it from last fall. This one chart is both exciting investors and traders and making them extremely scared of the markets. There are always those with a bullish bent and those that are bearish. But the extreme views are really unusual. How can it be that so many see a crash coming while an equally large camp are looking for new all time highs?

The short answer is that one chart cannot tell the entire story of the market. The best we can do as traders and investors is have a plan and manage risk. There are a lot of signals of weakness in this chart. The RSI is rolling over along with the MACD, showing momentum has faded and is growing to the down side. But both of these are also positive and in the bullish range. They could just be resetting for another leg higher.

Clearly the trend since early February is higher and so we give the benefit of the doubt to it continuing until proven otherwise. But a top in the S&P 500 at these levels creates a second lower high in the long term chart. That is not a positive sign. The short term path may be difficult but it also the only path that can be followed. Time for protection during this rest. Tighten stops, add puts or collars. The S&P 500 may rebound and be at all-time highs in 2 months, or it may make a new lower low. All you can do is be prepared.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.