- Annual consumer inflation decelerated in August to 2.5% from 2.9% in July, giving the Federal Reserve (Fed) flexibility to focus on the job market.

- In the Fed’s eyes, the balance of risk shifted more toward the labor market.

- Fifty is probably not the new 25. Officials will likely cut a quarter percent in future meetings unless the job market deteriorates.

- Markets are pleased that the Fed is taking meaningful steps to recalibrate policy, so it’s not surprising that small caps rallied shortly after the decision.

The Fed delivered a 50 basis-point cut in rates with a clear message they are committed to full employment. The decision to cut rates was not unanimous, but Chairman Jerome Powell mustered some consensus among the hawks and doves on the Committee. Still, Federal Reserve Governor Michelle Bowman dissented, the first time a governor has dissented since 2005.

The risks to achieving its dual mandate have shifted toward a greater risk that businesses will slow hiring in the near term. Despite the weakening in labor markets, the Fed, in its efforts to quell market fears, wanted to convince investors that the decision to cut by a half of a percentage point was merely a “recalibration” of policy.

Markets responded favorably to the decision as the Fed cut aggressively. This sets the stage for a risk-on response. Historically, the S&P 500 has risen 2% on average six months after the first cut, with a median gain of 8.6%.

Growth projections were unchanged, but members of the Federal Open Market Committee (FOMC) now expect unemployment rates to rise higher and faster than they did in their previous projections. This scenario plays out as productivity gains continue.

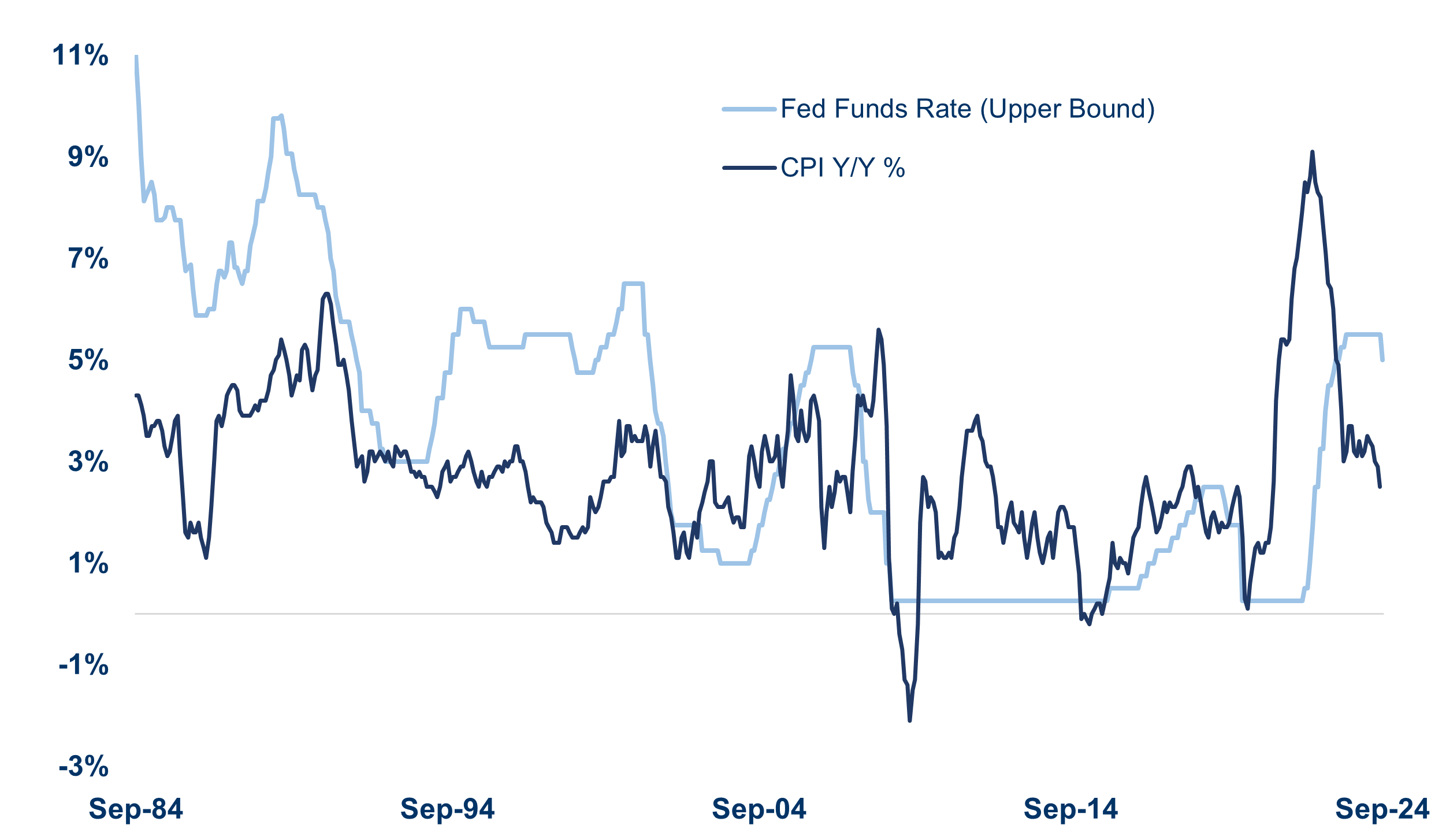

We learned from the latest Summary of Economic Projections (SEP) that the Fed is interested in getting to a neutral fed funds rate as quickly as possible. Given structural shifts in the global economy, committee members forecast the Fed funds rate will approach 3.50% by the end of next year. Looking ahead, the Fed has plenty of room to further normalize rates as inflation decelerates.

Fed Can Cut Further, Yet Remain Restrictive

Source: LPL Research, Federal Reserve, Bureau of Labor Statistics 09/25/24

So What’s the Word on the Street?

In a recent interview, Minneapolis Fed President Neel Kashkari confessed Fed members are not implying “mission accomplished.” Kashkari, a traditionally more hawkish member, feels the downside risk to the labor market is greater than the upside risk to inflation.

FOMC members are likely prepping investors for a steady pace of cuts for the next several meetings. Inflation data show the economy is on a good trajectory for approaching the 2% target.

Fifty is probably not the new 25. Officials will likely cut a quarter percent in future meetings unless the job market deteriorates. Markets are pleased that the Fed is taking meaningful steps to recalibrate policy, so it’s not surprising that stocks moved higher on the news and small caps outperformed last week.

Inflation Is Less A Risk in the Near Term

Annual inflation decelerated in August to 2.5% from 2.9% in July, giving the Fed flexibility to focus on the job market. Energy prices fell 0.8% over the month as global weakness suppressed oil demand. Excluding food and energy, consumer prices were up 3.2% from a year ago.

- Motor vehicle insurance continues to rise as paying customers cover the costs for noninsured and underinsured motorists.

- Grocery prices – officially dubbed “food at home” – were unchanged in August, giving consumers some relief.

- Services prices excluding rent have remained well-contained for five consecutive months and should further abate.

Inflation trends will give the Fed an opportunity to pivot toward the employment mandate for the rest of this year. Prices for U.S. imports fell 0.3% in August, the largest monthly drop since December, and it wasn’t just because of lower fuel prices.

Indeed, Fed policymakers should shift focus to job market conditions as they set policy in the coming meetings.

Retail Sales Bolstered by Online Purchases

August retail sales were bolstered by online purchases, revealing a more cost-conscious consumer avoiding traditional department stores. Only five out of 13 categories rose in August as sales were mixed across sectors. Last month, 10 categories gained sales.

Restaurant spending was unchanged in August as consumers started to pull back on discretionary spending. Department store sales fell for the second consecutive month, putting pressure on retailers to attract customers.

The Fed is dealing with mixed signals as they debate how much to cut rates, and the Fed may end up falling behind the curve again if they rely too much on stale data and not enough on the forward-looking outlook.

Global Weakness

Several central banks are loosening monetary policy in an effort to stimulate sluggish business activity.

Earlier, a key German business survey fell for the fifth consecutive month as broad-based weakness showed the economy may already be in recession, according to the Bundesbank. The European Central Bank (ECB) will likely cut rates for the third time this year on October 17.

North American economies also showed some weakness. Canada’s private sector may already be in recession as production activity and business hiring have shrunk in recent months. The Bank of Canada has already cut three times this year.

Of course, recent news from China revealed their central bank will provide liquidity to stock investors, an extreme move to boost growth. However, the impact could have difficulty gaining long-term traction. In the near term, investors, both foreign and domestic, now have reason to take on more risk with China’s stimulus measures.

Perhaps the long and variable lag of monetary policy is not perfectly symmetrical, but investors should remember monetary stimulus could take time to filter down from Wall Street to Main Street. Portfolio allocators should consider keeping a domestic bias during these periods of flux.

Conclusion

LPL Research anticipates a period of higher volatility among both bonds and equities during this period of global uncertainty and the softer growth outlook.

Therefore, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities. We expect volatility to remain elevated over the next few months, and believe a better entry point back into the longer-term bull market is likely.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.