In the run-up to the Fed meeting, markets are keeping pressure on the dollar. The dollar index has fallen to its lowest levels since March 11. A weaker USD is often associated with market optimism. Except for a few worrying points, the current situation reflects more of an escape from dollar assets, rather than general optimism among market participants.

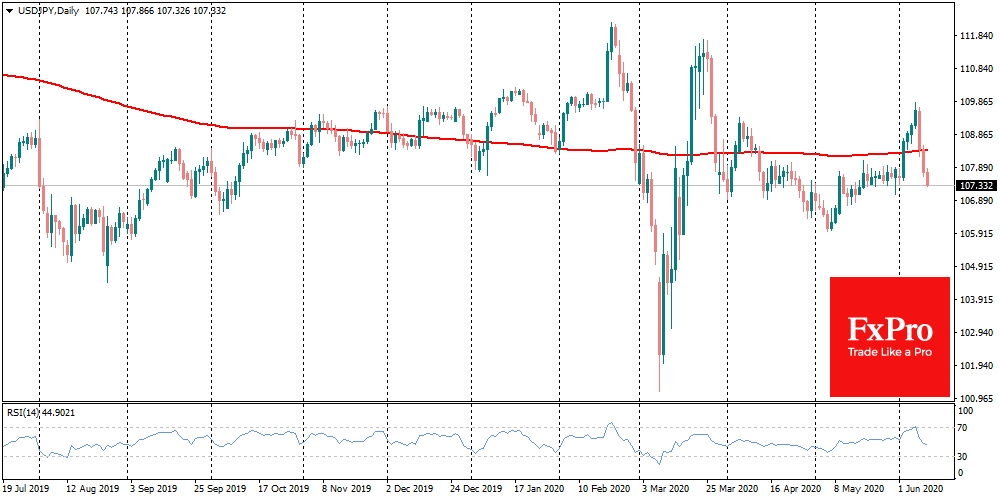

So far this week, the Japanese yen has enjoyed impressive demand. The dollar fell 2.1% against the yen after a failed attempt to rush 110 last Friday. The steady decline of USD/JPY is a clear sign of increased demand for protective assets from Asian investors. It’s still too early to sound the alarm, as the Nikkei 225 continues to rally. However, one should be treat this rally with caution, especially as the yen is also rising against the euro and other major currencies.

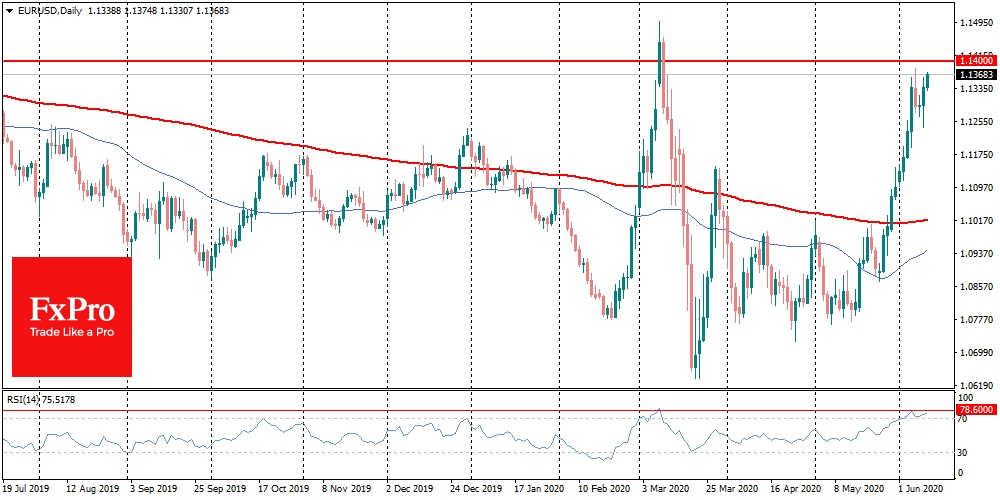

The euro, after a short pull-back, is finding the strength to gain against the dollar, having rallied in the 12 out of the last 13 trading sessions. EUR/USD is one step from Friday’s highs and only 50 points from 1.1400 – a critical resistance level.

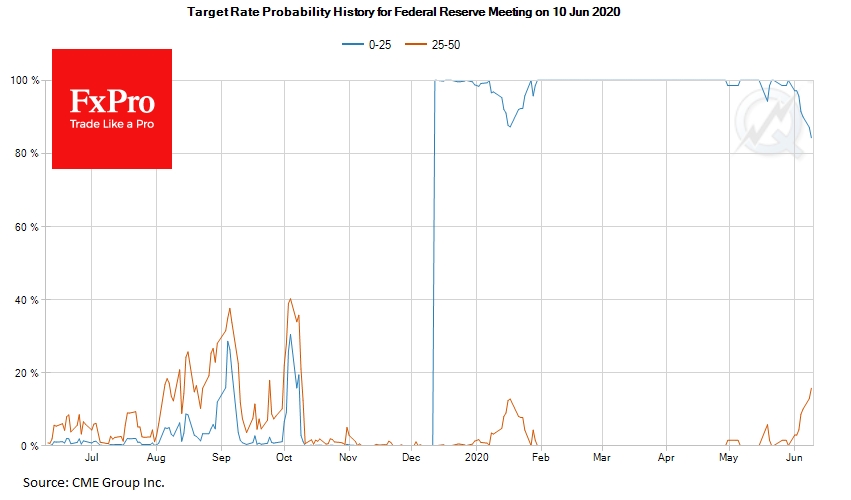

The off-loading of dollar assets is also noticeable in the US debt markets. Treasury yields have risen along the whole curve, especially at the longer end. Short-term bonds are showing an interesting distortion. The current yield reflect a 15% probability of the Fed’ raising rates this afternoon. However, this is purely technical, because the chances of an interest-rate hike do not start to materially pick up until the March 2021 meeting.

In theory, the rise in Treasury yields suggests global investors are worried about the ability of the US to pay its debts, especially in light of growing tension with China, which holds more than a trillion dollars in US government bonds.

But this theory does not stand up. After all, were that to be the case, European bonds would be under even greater pressure, as some of those countries are buried far more debt. It would also be logical to expect an outflow of investors from emerging markets, which would suffer against the backdrop of a financial system in shock.

In our view, the rise in yields reflects the expectation of higher inflation in the coming months, due to the deferred demand and higher income levels thanks to the support packages from the government.

This hypothesis will be tested later today when consumer inflation estimates for May are released. On average, analysts do not expect price changes for the month and assume a slow-down in yearly inflation from 0.3% to 0.2%.

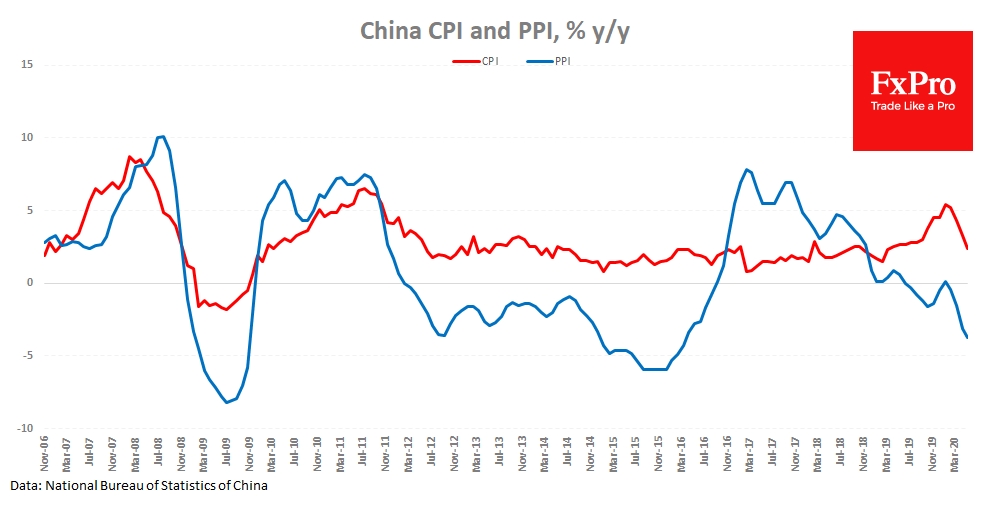

But here traders should pay attention to the figures from China, which one step ahead in coronavirus curve. Consumer inflation there slowed to 2.4% in May from 3.3% a month earlier, which is much stronger than expectations. Producer prices also continued to plunge into negative territory to -3.7% YoY, reflecting the weakness of the economy.

The FxPro Analyst Team