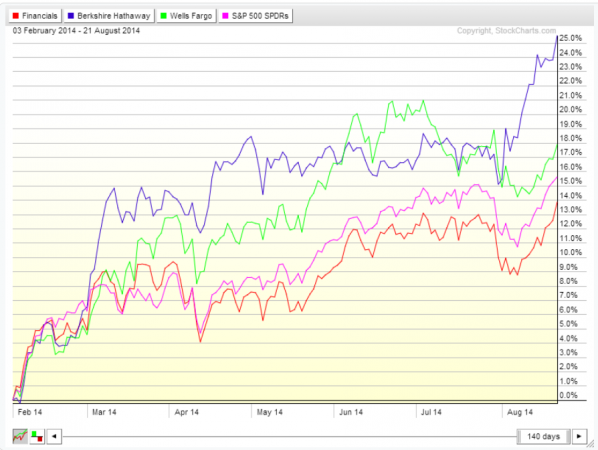

The Financial Select Sector SPDR Fund (ARCA:XLF) has had a pretty good year. It started out slow but is now up 13.8% from the low point on February 3. Thursday it broke out to new post crisis highs. With the S&P 500 up 15.60% since that date it has lagged but not by very much. There is always debate about whether the broad market can climb without the financials carrying a significant amount of the weight. So this is good news. But the performance chart below shows that both have lagged as investments when compared to the top two holdings in the XLF, Berkshire Hathaway B (NYSE:BRKb) and Wells Fargo & Company (NYSE:WFC).

Over that same period Wells Fargo is up 17.9% and Berkshire Hathaway a whopping 25.5%. What is even more impressive is that Warren Buffett is known to hold a lot of Wells Fargo stock and it is weighing down his return! So as you do your weekend work and prepare for the next great investment. Maybe it is time to consider giving it all to King Warren at Berkshire Hathaway.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.