A little more discussion on 2019 S&P 500 EPS estimates and looking into next year. Staying away from sector estimates for now, how have 2019 “bottom-up” annual EPS estimates tracked for the S&P 500 over 2018?

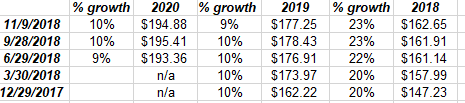

Readers should see both the “dollar” S&P 500 EPS estimates for the next few years and the expected percentage change, so you can understand the dynamics of what happens within estimate modeling.

As readers can see, the 2019 S&P 500 estimate has remained fairly stable throughout 2018, although 2019 has slipped a percentage point in expected growth the last few weeks, with the “consensus” now expecting 9% versus 10% growth for most of 2018.

Really what I think happened is that those analysts / strategists putting in a 2019 EPS dollar estimate just plugged in 10% growth for 2019 as the 2018 dollar estimate rose rapidly.

The other aspect to the numbers is that the dramatic ramp in expected 2018 EPS dollar estimates should be noted throughout this past year: as the denominator is pushed higher on the 2019/2018 growth expectation, 2019 will look marginally slower.

Summary / conclusion: The goal with last night’s and this post was not to be bullish or bearish the S&P 500, but rather to just show the numbers and let readers see how the math works.

2018’s actual y/y S&P 500 earnings growth of 23% will be the strongest since 2004’s 21% but this is now history. A return to an expected 10% S&P 500 EPS growth in 2019 is completely normal.

I do think the market at this juncture is trying to figure out what 2019 will look like in terms of the S&P 500’s expected return.

The key question is, do we see “P/E expansion or P/E contraction” in 2019?

We saw sharp P/E contraction in 2018 as tax cuts saw the S&P 500 estimate grow 23% versus last year while the S&P 500 is returning just single digits this year, as we expected last December. The S&P 500’s return in 2018 is actually a little light relative to our December ’17 forecast but let’s see what the last 6 weeks of 2018 holds.)

That’s the big question for next year – will the S&P 500 P/E expand or contract? Inquiring minds want to know.

If Fed Chair Powell calls “uncle” on tightening monetary policy and the Fed balance sheet contraction, while President Trump makes a reasonable deal with China on trade, (and President Xi made a very bullish speech about trade barriers and tariffs last Sunday night, 11/4/18, that got very little press from the mainstream financial media), you could see a double-digit return next year for the S&P 500 on what could be 9% – 10% S&P 500 earnings growth, next year.

That isn’t a forecast (yet) though.