Some are crediting me with calling the 6-day mini-crash. On the contrary. When I wrote “15 Warning Signs Of A Market Top” on August 18, the intent was to discuss micro-economic (corporate), macro-economic, fundamental and technical reasons for reducing one’s overall allocation to riskier assets. I did not predict the epic fall from grace for the SPDR S&P 500 (NYSE:SPY).

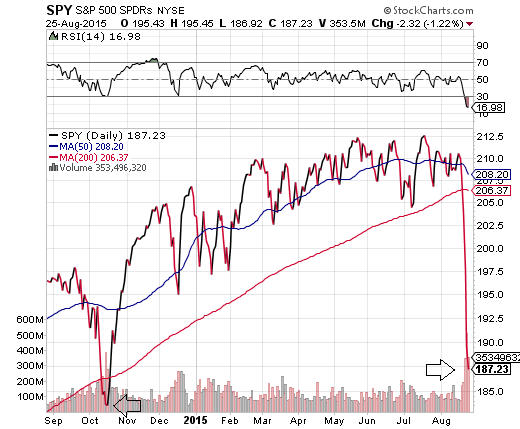

Based on a Relative Strength Index (RSI) level below 17 – based on the fact that we are approaching lows not seen since October’s “Bullard Bounce,” one should anticipate a jump higher. Equally compelling? Since the bull market’s inception (3/9/2009), the S&P 500 has only closed in its 3-standard-deviation range (0.13% chance of occurrence) twice. It happened at the tail end of the euro-zone sell-off on 10/3/2011; it happened again today, on 8/25/2015.

Yes, you’re going to see higher prices in the immediate term. Relief rallies happen.

On the flip side, it’d be foolish to think that a jump off of the floor will be enough to restore the bull market uptrend. Institutions, private clients and hedge funds will need to shift from net sellers to net buyers; they were net sellers in July and August. The pattern of decreasing revenues and decreasing dividends at corporations will need to show marked improvement. Credit spreads need to stop widening and perhaps begin to narrow, demonstrating greater confidence in borrower creditworthiness. And speaking of borrowing, the Federal Reserve will need to come up with a way to inspire as it raises overnight lending rates. A plan for a one-n-done hike across a six-month span? Perhaps an offer to move at a snail’s pace of just one eighth of a point every other meeting?

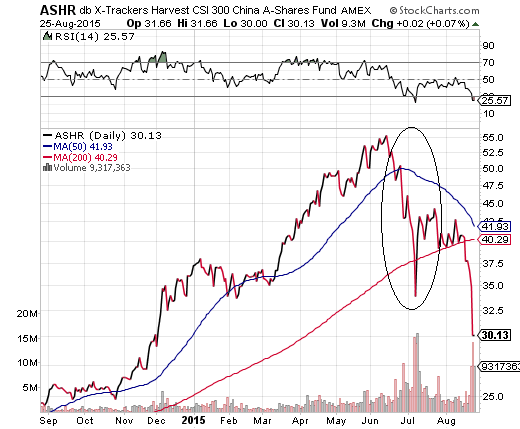

The media may choose to pin all of the blame on China’s stock market collapse. Indeed, interest rate cuts, trading halts, short-selling bans, currency devaluation, looser lending rules and share-buyer incentives have done little to stop the exodus. Keep in mind, though, Chinese equities via Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR) crashed in June and July. The S&P 500 was within 1%-2% of its all-time high less than a week-and-a half ago. It follows that there’s a whole lot more to the extreme selling pressure than drama on the Chinese mainland.

The reality is that the financial markets had been telegraphing distress in dozens of meaningful ways for months. The Dow Transportations Average had been sickly since the first quarter earnings season, suggesting that manufacturers were not delivering as many goods for worthwhile profits. By early June, broad-based energy corporations in the Energy Select Sector SPDR (NYSE:XLE) had climbed off of March lows, but they were still mired in a sector-specific bear that began in late 2014. Equally disturbing, at one point in June, the price-to-book (P/B), price-to-sales (P/S) and price-to-earnings ratios (P/E) for the ‘median’ stock on U.S. exchanges had never been higher. Not even during the delusional dot-com days of 2000.

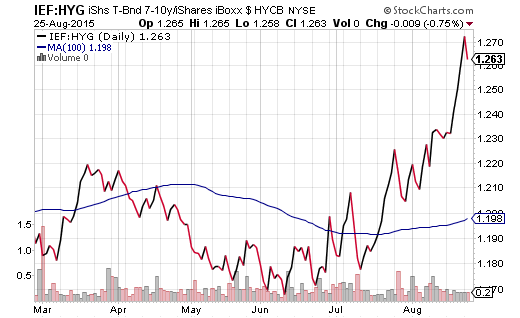

As investors were entering July, troublesome deterioration began occurring in market breadth. The Bullish Percent Index (BPI) for the S&P 500 still showed a bullish reading above 50% (59%), yet less and less S&P 500 components had been forging uptrends. Prominent sectors like the Industrial Select Sector SPDR ETF (NYSE:XLI) began pushing 8% corrective levels on weak wages and weak manufacturing data. Later in July, foreign developed stocks were dropping precipitously and diverging from the U.S. market, highlighting the fading enthusiasm for euro-zone quantitative easing (QE). And high yield bond distress was a clear indication of credit risk aversion.

The point here is, we hadn’t even gotten to August, and the signs of a probable sell-off in U.S. equities had been everywhere. You want to blame the 2nd leg down of the stock market bear in China for everything? Why ignore the 1st leg? Why dismiss free-falling commodities in the summertime, from oil to copper to base metals? Why act as though the consecutive quarters of decreasing sales and lackluster profitability at U.S. corporations hasn’t mattered? Or the anxiety about Congress and the White House with respect to upcoming budget negotiations? Or the most obvious issue of all – angst over the Fed’s explicit goal of hiking rates as early as September.

It follows that I have been discussing a tactical asset allocation shift for several months in my columns. I offered simple solutions, such as a moderate growth investor with 65% growth (e.g., large, small, foreign, etc.) /35% income (e.g., investment grade, high yield, intermediate, long, etc.) shifting to 50% growth (primarily large cap)/25% income (primarily investment grade), 25% cash/cash equivalents.

A number of anonymous commenters at sites where financial portals regularly republish my articles demonstrated a remarkable penchant for viciousness. They attacked out-of-context word choices. They slammed the evils of rebalancing through tactical asset allocation as market timing idiocy. Some merely raged against my so-called negativity. Ironically, few could debate the array of well-researched and well-presented data – fundamental, technical, micro-economic (corporate) and macro-economic information that served as the basis for my recommendation to “sell a few things high” and hold some cash to limit downside loss and prepare for a future “buy lower” opportunity.

And therein lies a problem for the complacent among us. The definition of opportunity is relegated to the “buy side.” Why should that be? When there are 30 some-odd reasons for reducing risk compared with a handful of reasons to stand like a possum in the headlights (I gave 15 in the Market Top feature from one week ago), shouldn’t we embrace opportunities to lock in profits and/or protect our principal?

I appreciate the kudos from those who have written – personally or on message boards – to thank me for “getting them out” in the nick of time. But I don’t have a crystal ball. And I did not suggest leaving risk assets altogether. I simply made the case for why the time for target risk allocations or greater-than-normal stock exposure had exited months ago.

I’m not likely to add significant risk anytime soon, short of the Fed giving us another Bullard-like moment where rate hikes are off the table and QE is back on the table. I may even sell a bit more into the oversold conditions that are likely to bring about relief rallies.

In large part, I will take cues from key credit spreads and price ratios like the iShares 7-10 Year Treasury Bond (NYSE:IEF): iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG). If the IEF:HYG price ratio is declining, a preference for risk-taking would be increasingly evident. That’s clearly not the case today.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.