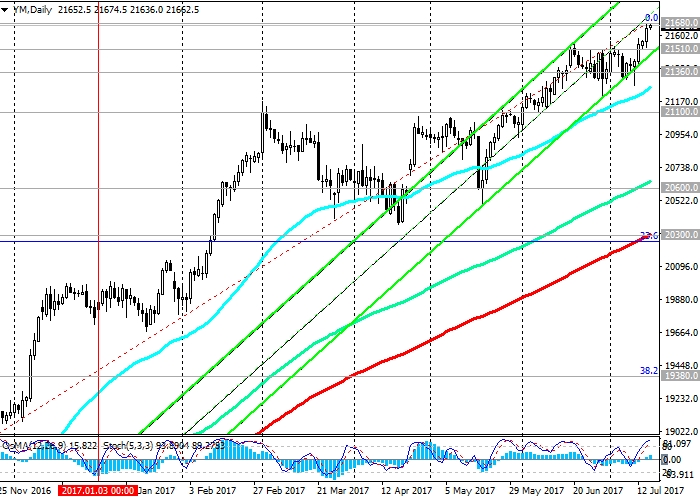

DJIA updated its annual highs on Friday and reached a new absolute maximum near the mark of 21680.0. The DJIA Index continues to grow steadily, starting from February 2016 and trading in the ascending channels on the daily and weekly charts.

So far, the index is trading above the key support level of 20300.0 (EMA200 on the daily chart, as well as the Fibonacci level of 23.6% correction to the growth in the wave from the level of 15660.0 after rebounding in February this year to the collapse of the markets since the beginning of the year. The maximum of this wave and the Fibonacci level 0% is near the mark of 21536.0), its medium-term positive dynamics is preserved. The long positions in the DJIA index trade are relevant.

Against the background of low inflation in the US and the Fed's predilection, in connection with this, to a cautious approach in the matter of further interest rate hikes, the further growth of the DJIA index is likely.

Only in case of breakdown of the support level of 21360.0 (EMA200 on the 4-hour chart) can we again return to consideration of short positions on the DJIA index. And only in case of breakdown of the support level of 19380.0 (Fibonacci level of 38.2%) can we speak about the breakdown of the bullish trend.

Support levels: 21510.0, 21360.0, 21100.0, 20600.0, 20300.0

Resistance levels: 21680.0, 22000.0

Trading Recommendations

Buy Stop 21690.0. Stop-Loss 21500.0. Take-Profit 21700.0, 21800.0, 22000.0

Sell Stop 21500.0. Stop-Loss 21690.0. Take-Profit 21360.0, 21100.0, 21000.0, 20600.0

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.