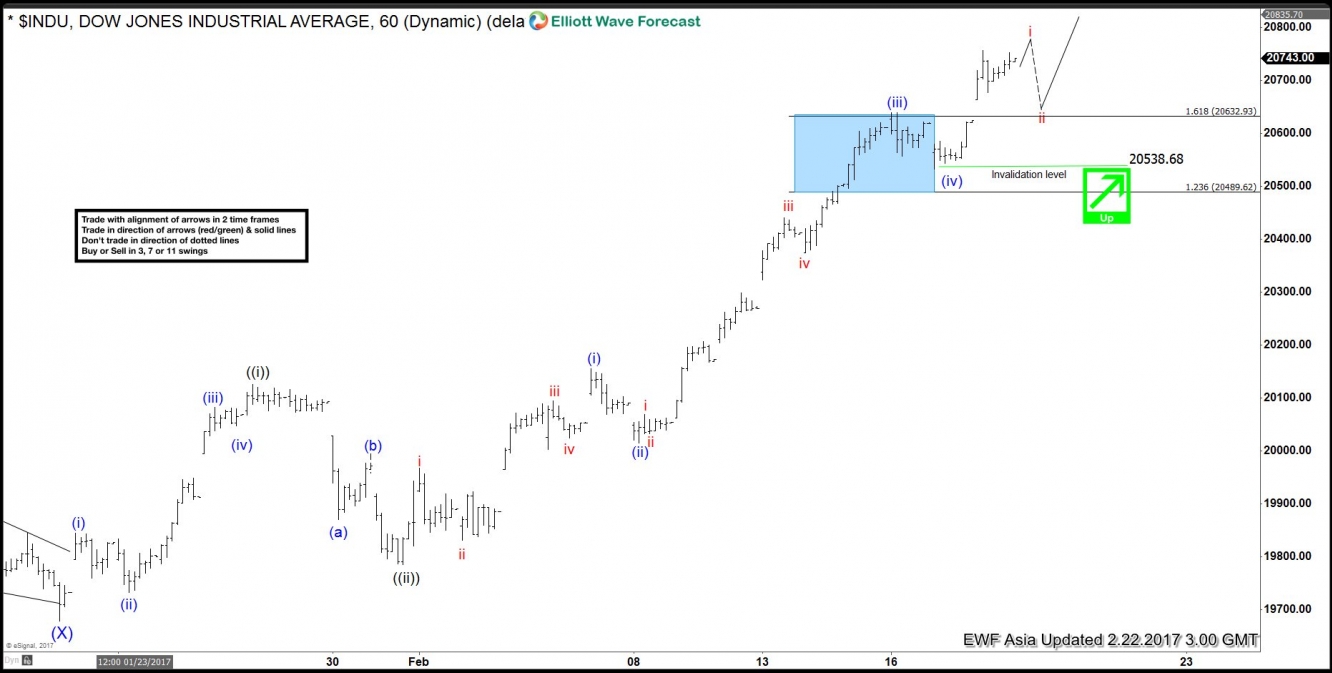

Short term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) is showing an extension and subdivided also as an impulse structure where Minuette wave (i) ended at 20155.3, Minuette wave (ii) ended at 20015.3, Minuette wave (iii) ended at 20639.8 and Minuette wave (iv) ended at 20543.2. Index has broken above Minuette wave (iii) to confirm that wave Minuette wave (v) has started. Near term, expect Subminuette wave (i) of (v) to end soon and Index should pullback in Subminuette wave (ii) of (v) to correct the rally from Minuette wave (iv) low before Index resumes the rally higher. We don’t like selling the Index and expect buyers to appear in 3, 7, or 11 swing while pullbacks in Subminuette wave (ii) stays above 20538.7. If Index breaks below 20538.7, it can be an indication that Minute wave (iii) has ended, and that Index has started Minute wave (iv) pullback.

DJIA 1 hour chart