October brought a real bloodbath to stock markets around the world. The Dow Jones Industrial Average and the S&P 500 just turned negative for the year and equities in Japan, China and Germany are also falling in sympathy. While leading indices are plunging it’s no wonder that other countries’ benchmarks are suffering as well. The Dow Jones New Zealand index, for example, is down 11% since late-August and looks especially vulnerable to further weakness.

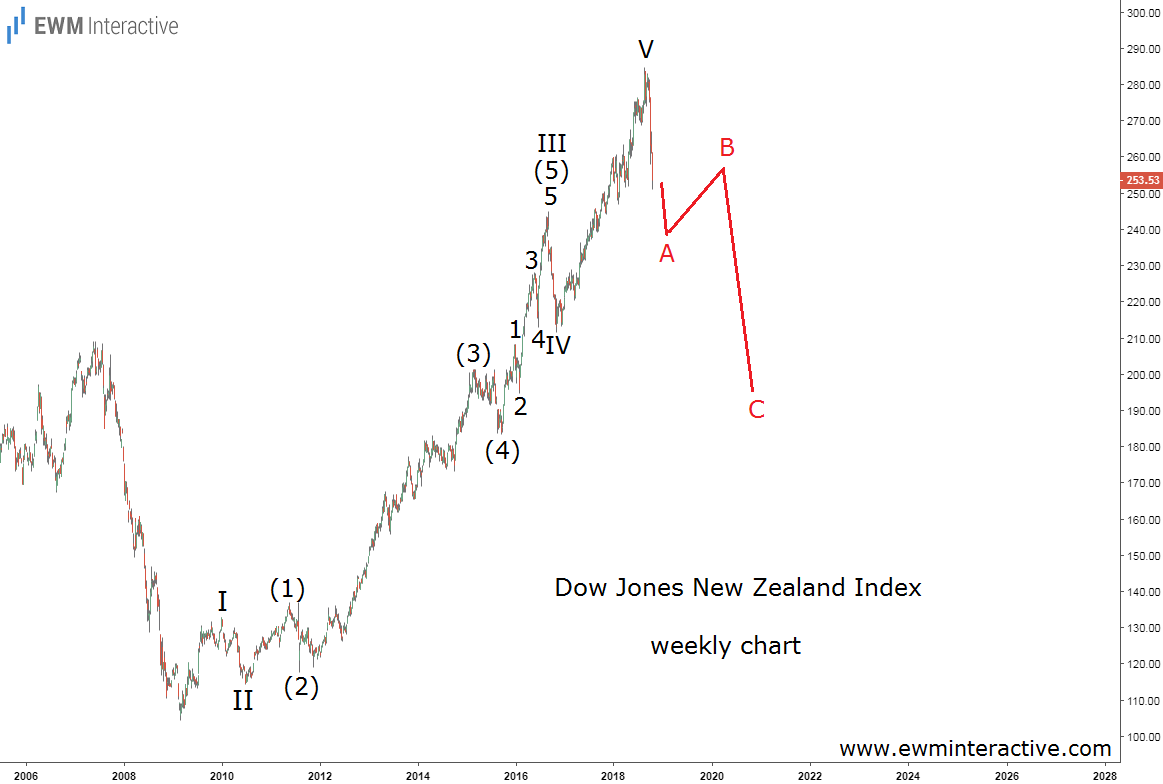

The weekly chart of the DJ New Zealand index provides an insight into the Elliott Wave structure of the entire post-crisis bull market. In less than a decade, the index nearly tripled, climbing from 104.42 in March 2009 to 284.63 in August 2018. That is a gain of 173% or 10.6% compounded annually.

The problem for investors looking to buy in now is the fact that the structure of the rally has formed a five-wave impulse, labeled I-II-III-IV-V. The sub-waves of wave III are also visible. According to the Elliott Wave theory, a three-wave correction follows every impulse.

Since the current drop is still too shallow in respect to the impulse pattern it retraces, we believe the DJ New Zealand index is still vulnerable. The bears are probably aiming at the support area left by the 2007 high near the 200 mark. In other words, another 50-60 points or 20% – 25% can disappear before the situation starts to improve.

Just because New Zealand stocks are cheaper compared to late-August does not mean they are cheap enough. In our opinion, it is too early to buy the dip. The bears remain in charge.