If you go back in stock market history, you’ll find one item that always attracted the most successful investors – dividends.

In recent years, however, most investors have forgotten about dividends as they chased the allure of futuristic growth stories.

But since late 2014, the broad stock market has gone virtually nowhere. And guess what? Boring is the new sexy and dividends are, once again, the center of everyone’s attention.

Better Than Negative

Dividend stocks are now attracting investors of all kinds in the search for income.

The catalyst being, of course, that more than $10 trillion of sovereign bonds, globally, now trade with a negative yield.

The fact is – in all developed markets, dividend stocks now provide a higher income stream than 10-year government bonds.

And in Europe, where the central bank is now buying corporate bonds, more than $36 billion worth of short-term corporate bonds currently trade with a negative yield, as well.

Corporate bonds are, therefore, quickly becoming an unattractive option.

This harsh new reality has sent a flood of overseas money to U.S. shores in search of yield. The 10-year U.S. Treasury Note now yields only 1.55% – and there are understood to be further declines in store.

With options dwindling, investors have little choice but to turn to quality dividend-paying stocks.

Performance Is Impressive

It turns out that’s not such a bad idea.

Through the first four months of 2016, companies that had grown their dividends in each of the prior 10 years produced gains of 11% on average. In contrast, the S&P 500 Index gained a mere 2%.

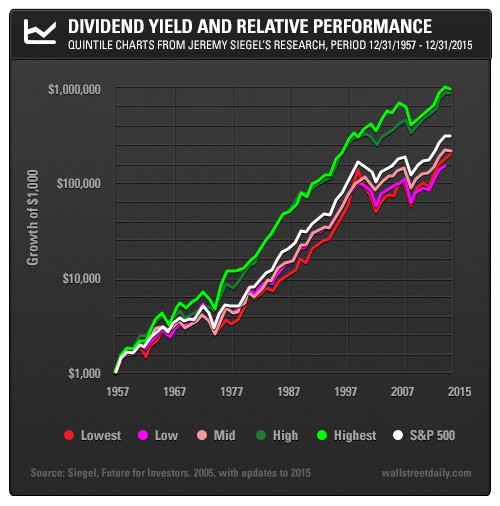

The longer-term benefits of dividends are illustrated by research from Wharton Professor Jeremy Siegel. This long-term chart shows how higher-paying dividend stocks have outperformed the S&P 500 Index.

Dividend ETFs 101

The easiest way for investors to snatch up some dividends is through exchange-traded funds (ETFs). These offer a way to own a broad basket of dividend payers with just one trade.

However, not all dividend ETFs are created equal.

Often, other factors such as value, quality, and growth are included as criteria for these funds.

I recommend that investors steer clear of two types of dividend ETFs: high yield and low volatility.

Very high-yielding stocks often represent trouble for a company that may not be able to pay future dividends. Just think about the dilemmas experienced by the master limited partnership (MLP) space, for instance.

Low-volatility dividend ETFs, on the other hand, often have a high percentage of their portfolio in utility stocks. Many of these firms are undergoing challenges to their business model, so future high payouts are in question, as well.

Two ETF Picks

I would stick with dividend ETFs based on quality, and with companies that are growing their dividends – preferably companies with long histories of growing their dividends.

One choice is the Schwab US Dividend Equity (NYSE:SCHD). It selects stocks based on cash flow to total debt, return on equity, and the five-year dividend growth rate. Top positions in the fund include the likes of Pfizer Inc. (NYSE:PFE), Exxon Mobil Corp. (NYSE:XOM), Johnson & Johnson (NYSE:JNJ), Chevron Corp. (NYSE:CVX), Pepsico Inc. (NYSE:PEP), Procter & Gamble Company (NYSE:PG), and (The) Coca-Cola Company (NYSE:KO).

For an international ETF that fulfills similar criteria, there is the WisdomTree International Hedged Quality Dividend Growth (NYSE:IHDG). As the name implies, the ETF is hedged to remove the effects of currency fluctuations. Among its top positions are well-known names such as Unilever Plc (LON:ULVR), Novo Nordisk (CO:NOVOb) A/S B (NYSE:NVO), SAP AG (DE:SAPG) O.N. (NYSE:SAP), and F. Hoffmann-La Roche AG (ROG).

There are a number of other similar ETFs to choose from, but be sure to do due diligence before investing. Stick to the ETFs that focus on quality and long dividend-paying histories for their companies.

Owning such ETFs will offer extended profits in today’s unusual market – at least until the world’s central bankers decide to stop experimenting with negative rates.

by Tim Maverick