Dividends are back. And here are 54 secure payouts that are due for a raise between now and March.

The S&P yields a lousy 1.6% as I write. It’s sad to imagine a hefty million bucks in stocks could toss off a mere $16,000 in annual income. So, we income investors need a better play.

And that, my friend, is where these rising dividends come in. They are a “double threat” because we have two ways to win:

- The current yield, which (in many cases) will clear the 1.6% I mentioned. Plus,

- The price appreciation that comes along with the dividend increase.

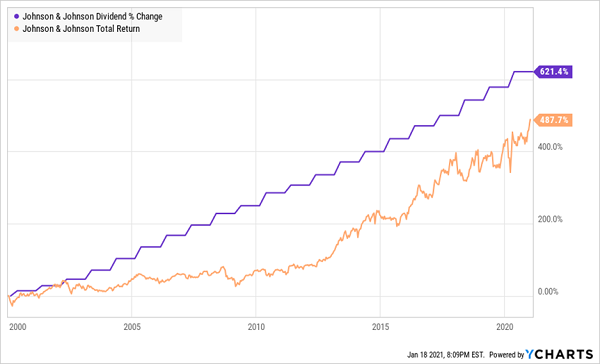

Markets have a reputation for looking ahead, but they’re slow to react when it comes to payout hikes. Over the long haul, stock prices tend to follow their payouts higher. This is why a “boring” company like Johnson & Johnson (NYSE:JNJ) mints millionaires overtime.

JNJ is the perfect way for uber-conservative investors to become filthy rich. Its six-decade string of dividend growth is just what the doctor ordered. J&J might have the occasional slip-up, and its stock isn’t always a steady riser. But it grows over the very long term, and investors never wonder whether their next income check will arrive.

Death, Taxes and J&J’s Dividend

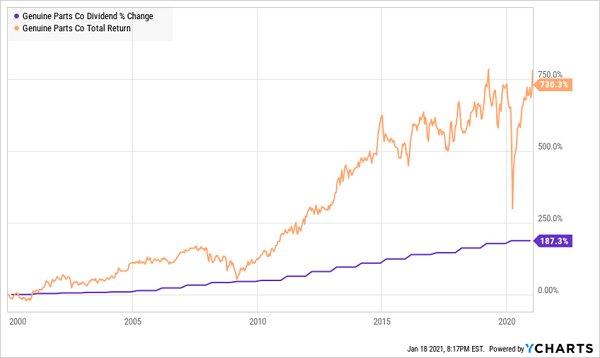

Same goes with fellow “Dividend King” Genuine Parts (NYSE:GPC):

Investors Keep Gravitating Toward Steady GPC

As for our upcoming 54 hikes?

What we’re looking for is “meaningful raises,” which I define as high-single-digits or better. That said, some companies might play their 2021 raise conservatively given that many of them are still dealing with this aggressive pandemic.

On the other hand, aggressive raisers will stand out even further. If they’re raising now, what might 2022 and 2023 hold?

Let’s look at these dividend growers, in four groups: real estate investment trusts (REITs), infrastructure plays, Dividend Aristocrats and other noteworthy stocks. And in each group, we’ll put one dividend payer on our hot seat for further analysis.

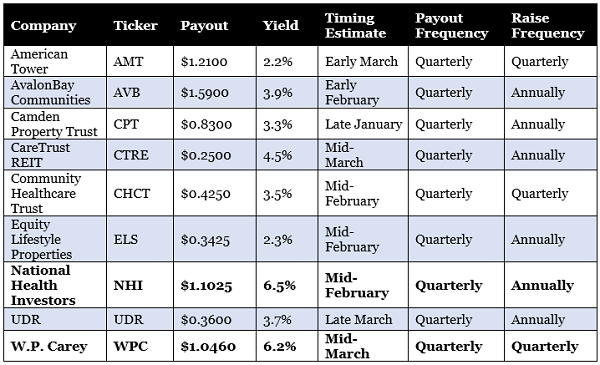

REITs

Featured Stock: CareTrust REIT, 4.5% Yield)

Before I look at Caretrust REIT (NASDAQ:CTRE), I want to acknowledge that this is a thin list of REITs. Yes, a couple of the space’s biggest names have been elevated to the ranks of the Dividend Aristocrats, but part of the reason there are so few real estate plays on this list of anticipated hikes is because a large number of them slashed or eliminated their payouts to survive the downturn.

One company that should have no such issue is CareTrust REIT, a $2 billion healthcare real estate owner and operator whose main business is skilled nursing facilities (72%), but who also owns assisted living and independent living facilities (19%) and healthcare campuses (9%).

CareTrust has been a rosy performer, actually putting up a small 5% gain over the past year while many of its competitors have been raked over the coals by COVID. While many rivals were withdrawing guidance, CTRE didn’t, with CEO Greg Stapley saying back in May that “the act of withdrawing guidance could be regarded as a form of guidance in and of itself.”

Fast-forward a few months, and CareTrust could actually squeeze out a little earnings growth for full-year 2020, and is expected to boost profits by high single digits this year. Thus, CTRE could very well continue a multiyear pattern of roughly 10% hikes, which would show up many of the other REITs in this hurting industry.

(Note: Bold names in the table below indicates a yield of 5% or more.)

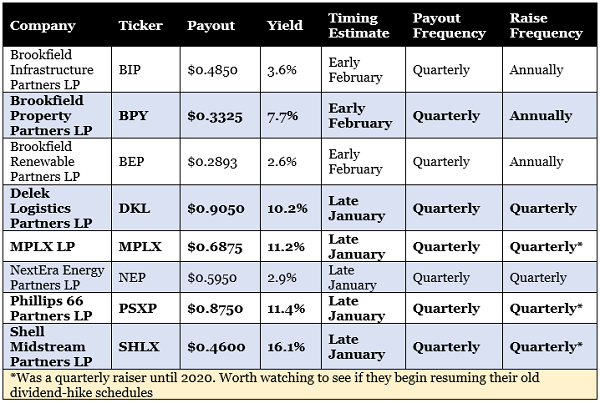

Infrastructure

Featured Stock: :Brookfield Renewable Partners, 2.6% Yield

Infrastructure is a sector that is all over the place. When we consider the energy master limited partnerships (MLPs) on this list, we see that several had a habit of consistent quarterly distribution raises before 2020 struck. But COVID ripped a hole in energy demand, and thus their ability to keep putting the pressure on their payouts.

That said, energy prices are rebounding, and at least part of that is demand, so it’s time to start watching a number of these names to see if they get back into their old cash-spending habits.

Brookfield Renewable Partners (NYSE:BEP) LP has nothing to do with this. Quite the opposite. One of several Brookfield properties, BEP is a portfolio of renewable power assets—nearly two-thirds of the portfolio is in hydroelectric power, with the rest in wind, solar, distributed generation and storage facilities.

It’s difficult to think of infrastructure plays that are more perfectly positioned for a bump from this new administration. That’s exciting given that BEP is already operating at a high level; the company reported a 36% jump in normalized funds from operations (FFO) in its most recent quarter, on the back of an 8% improvement in generation.

This is one to watch not just this February, when it typically announces payout increases, but every year around this time.

Dividend Aristocrats

Featured Stock: Walmart, 1.5% Yield

One penny. One penny. One penny. One penny.

That’s the feeble rate hike Walmart (NYSE:WMT) has disdainfully tossed shareholders’ way each February. Last year, that translated into dividend growth of less than 2%.

Sure. Walmart is a Dividend Aristocrat, and it’s nearing five decades of uninterrupted payout hikes. That often translates into meager increases because at that point, the company is already doling out 70%, 80% of their profits.

The misers at Walmart are paying out just 31%.

COVID was a menace to most retailers, but Walmart walked away with nary a scratch—in fact, WMT’s profits for the fiscal year covering the heft of the COVID outbreak are expected to swell 13%.

Shareholders bid up the stock more than 20% in 2020. Management needs to return the favor and share more of its cash. It’s time.

Other Noteworthy Stocks

Featured Stock: NextEra Energy, 1.7% Yield

Most utility stocks don’t have much else going for them except their dividends. It is what it is. They get to enjoy effective monopolies, and the government allows them to hike their rates fairly frequently—but because they’re delivering absolute necessities, those rate hikes don’t amount to much, and most of their cash either goes to maintaining infrastructure or paying out shareholders.

R&D? Marketing? Nope. No growth, just a slow, steady churn of profits.

And that’s what makes Nextera Energy (NYSE:NEE) a breath of fresh air.

A lot of Floridians know NextEra Energy for its Florida Power & Light Company, which serves more than 11 million residents in the state. But investors increasingly know NEE for its green-energy assets. NextEra Energy Resources says it’s the world’s largest generator of wind and sun power, capable of generating roughly 21,900 megawatts across sites in 37 states and Canada.

This business is growing like a weed in the first place, and that has driven a 250%-plus return over the past five years—well more than three times better than the Utilities Select Sector (XLU) over the same span. A renewed Wall Street focus on green energy could mean more outsized gains to come.

But one hint as to how aggressive management is feeling should come sometime in mid-February. NEE has been delivering low-double-digit payout raises for years, so something in line or better than that should be taken as a bullish signal.

Don’t Miss My “Crisis-Ready” 8% Monthly Payer Portfolio

With NextEra, timing is everything. The stock is perpetually expensive, and it’s downright lavish right now at more than 33 times forward earnings estimates. Buying in while the iron’s white-hot will result in a much steeper hill to climb—not to mention a meager yield that’s about on par with the chintzy broader market.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."