iBillionaire—the creators of the index backing the Direxion iBillionaire Index ETF (NYSEArca: IBLN)—are at again, launching a new index that tracks the dividend stocks being bought by hedge fund masters of the universe and other financial billionaires.

The iBillionaire High Dividend Index (IBD), which was just launched today, is an equally-weighted basket of 50 high-dividend stocks held by high-profile billionaires in the financial sector. iBillionaire currently tracks the trading moves of 25 billionaire investors, and recent additions include living legends like Stanley Druckenmiller, James Dinan and Nelson Peltz.

In a low-yield world in which “high dividend” is something of a relative term, the iBillionaire High Dividend Index actually lives up to its name. Its dividend yield is a solid 5.34% according to iBillionaire.

I’ve written about iBillionaire and the Direxion iBillionaire ETF before (see “Investing Like a Billionaire”), and I’m a big fan of iBillionaire’s methodology as well as those of competitor ETFs like the Global X Top Guru Holdings Index ETF (NYSE:GURU) and the AlphaClone Alternative Alpha ETF (NYSE:ALFA). I don’t believe in mindlessly copying the trading moves of other investors, no matter how storied their careers, but I do consider guru-following strategies to be a fantastic source of trading ideas.

The iBillionaire High Dividend Index comes along at an interesting time. The 30-year U.S. Treasury is scraping along near all-time lows, and most income-focused investments have gotten prohibitively expensive. This is perhaps the trickiest market in history for income investors to navigate, so it’s instructive to see what the big boys are buying.

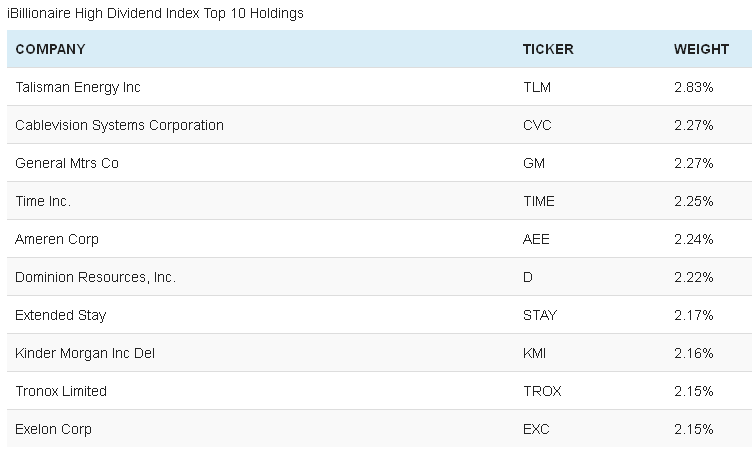

Let’s take a look at the top 10 holdings. (Note: Though equally weighted, position weights will shift between rebalancings, hence the larger allocations you see here.)

Interestingly, General Motors (NYSE:GM) is a top-ten holding of both the original iBillionaire Index and the new iBillionaire High Dividend Index.

At 24%, the iBillionaire High Dividend Index has a high allocation to energy shares. Given the volatility in the sector, that very well might change once the next batch of 13F filings is released. But there are several high-quality energy names in the index worth noting, such as Kinder Morgan (NYSE:KMI), Williams Companies (NYSE:WMB) and BP (NYSE:BP).

Also worth noting is that the index has a fairly high allocation to high-yielding mortgage REITs, such as Northstar Realty (NYSE:NRF), American Capital Agency (NASDAQ:AGNC), and Chimera Investment Corp (NYSE:CIM). Investors right now are scared to death of mortgage REITs, fearing that eventual tightening by the Fed will pinch their interest spread. It’s interesting that the billionaire masters of the universe appear to see value. (Incidentally, I noted that mortgage REITs were attractively priced earlier this month.)

So, what are we to do with this information? There is no mutual fund or ETF that currently tracks this index. That’s ok. In its current form, it gives us a “fishing pond” of good income investment ideas to research further.

Disclaimer: Long GM, KMI, WMB BP