The last time I analyzed W.W. Grainger (N:GWW), I was impressed by the company’s clear growth plan and strong expected total returns.

The company’s growth plan – which is discussed in detail in this article – along with its reasonable valuation and 43 years of consecutive dividend increases make the company a favorite of The 8 Rules of Dividend Investing.

W.W. Grainger stacks up favorably to most other dividend growth investments at this time both qualitatively and quantitatively. I am long W.W. Grainger and plan to hold the company’s stock indefinitely. I suggest other dividend growth investors consider W.W. Grainger as well.

W.W Grainger (GWW) is the leader in the United States maintenance, repair, and operations (abbreviated MRO) supply industry

The company has a network of 713 branches and 34 distribution centers. The bulk of the company’s supply chain is based in the United States and Canada.

W.W. Grainger also runs the following MRO e-commerce sites:

- MonatoRO in Japan

- Cromwell in the United Kingdom

- Zoro in North America and Western Europe

W.W. Grainger’s Growth Story

Before examining W.W. Grainger’s future growth potential, it is important to understand how quickly the company has grown historically: W.W Grainger has grown its earnings-per-share at 15% a year over the last decade.

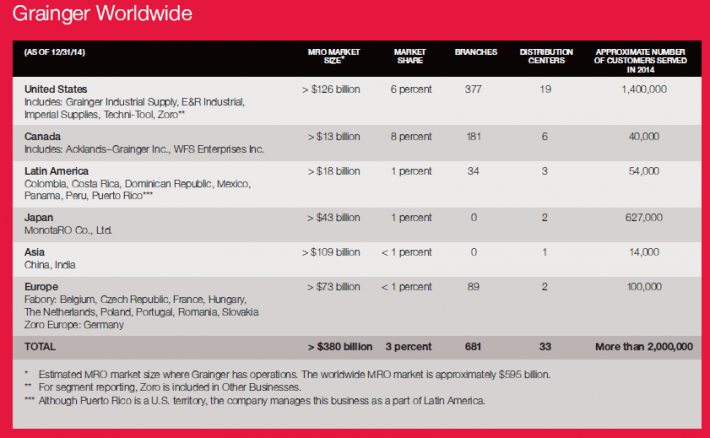

The company’s historical growth – and much of its future growth potential – come from W.W. Grainger’s slow consolidation of the fragmented MRO industry in North America. W.W. Grainger is the industry leader in North America, yet it controls just 6% if the United States MRO market and 8% of the Canadian MRO market. The image below shows W.W. Grainger’s market share by region:

Source: W.W. Grainger 2015 Fact Book

With its small market share relative to the large MRO market, W.W. Grainger has many decades of growth ahead.

The company’s well-established supply chain gives it a strong competitive advantage. W.W. Grainger can offer next day ground delivery to more than 95% of its customers in North America.

W.W. Grainger is also focusing on international e-commerce growth to grow revenue. The company is taking advantage of Japan’s small geographic size and dense population to quickly build a viable distribution network in the country. The Japanese MonatoRO MRO e-commerce site served over 600,000 customers in 2014 – and is still growing rapidly.

W.W. Grainger is expecting sales of $500 million from MonatoRO in fiscal 2015. The company expects to double sales from MonatoRO to $1 billion in just 5 years. This is not unprofitable growth. MonatoRO has a ROIC (return on invested capital) of around 40%.

W.W. Grainger’s European e-commerce operations are also performing well. European sales are expected to grow from a very small base currently to about $200 million a year by 2020.

The company’s e-commerce operations are also expected to grow rapidly in the United States. Sales are expected to more-than-triple from $300 million currently to $1 billion over the same time period.

W.W. Grainger’s Expected Total Returns

Investors in W.W. Grainger should expect double-digit total returns going forward. The company is targeting revenue growth of between 7% and 12% a year over the next 5 years. This growth will come from a mix of continued organic growth and bolt-on acquisitions, plus e-commerce growth.

The next largest growth driver for W.W. Grainger will be share repurchases. Over the last decade, the company has reduced its share count by 3% a year on average. Over the next three years, W.W. Grainger’s management is committing $3 billion to share repurchases. At current prices, this comes to share repurchases of around 7.5% of shares outstanding a year.

This spectacular level of share repurchases will not occur indefinitely. W.W. Grainger will fund some of these purchases by issuing long-term debt, which it plans to hold permanently. W.W. Grainger is targeting an extremely conservative debt-to-EBIDTA ratio of 1.0 to 1.5. After the current round of share repurchases is exhausted, I expect W.W. Grainger to continue repurchasing shares at around 3% a year.

On top of revenue growth and share repurchases. W.W. Grainger stock currently has a 2.2% dividend yield.

To summarize, the company will generate 16.7% to 21.7% annualized total returns over the next 3 years from:

- Revenue growth of 7% to 12% a year

- Share repurchases of ~7.5% a year

- Dividends of 2.2% a year

The company could potentially grow even faster if margins continue to expand (as they are expected to). W.W. Grainger’s net profit margin has grown at 3.9% a year over the last decade. Margin expansion is a result of economies of scale generated by the company’s growth. If W.W. Grainger continues to expand its margins at the same rate it has over the last decade, expected annualized returns over the next 3 years are 20.6% to 25.6%. I realize these are almost unbelievable numbers, but this is the economic reality of W.W. Grainger’s expected growth plans.

Bear Case: Recent Weakness and Potential Troubles Ahead

There is a downside to investing in W.W. Grainger (just like any stock). The expected total returns above are only applicable if the global economy doesn’t fall into a deep recession. W.W. Grainger’s earnings-per-share fell by 13.8% in 2009 during the worst of the Great Recession. In 2010, earnings-per-share hit new record highs.

W.W. Grainger’s most recent results were much weaker than expected growth over the next 3 years. The company saw earnings-per-share decline 8% in its most recent quarter. Many of W.W. Grainger’s customers in the oil and gas sector are laying off employees and restructuring their businesses. This is resulting in temporary earnings declines for W.W. Grainger. If oil and gas prices continue to fall, the company will not hit its lofty growth expectations.

Global recessions and falling oil and gas prices will delay W.W. Grainger’s growth, not cancel it all together.

The other threat W.W. Grainger is facing is a new entrant to its market – Amazon (O:AMZN). Amazon’s new business service is targeting business purchases rather than personal purchases. At first glance, Amazon is appealing more to office related purchasers. This will affect the sales of Staples (O:SPLS) and other office supply companies more than the MRO industry. Still, Amazon’s focus on business customers could slow growth somewhat for W.W. Grainger.

W.W. Grainger Is Trading Around Fair Value

W.W. Grainger has tremendous upside. The bear case for the company’s stock is much weaker than the bull case. The final question for investors looking to start (or add to) a position in W.W. Grainger is:

Is the company fairly valued?

W.W. Grainger is currently trading for a price-to-earnings ratio of 18.4. The S&P 500 currently has a price-to-earnings ratio of 22.0.

W.W. Grainger is an extremely high quality business with excellent long-term growth potential. There is no reason the company should be trading for a price-to-earnings multiple less than that of the S&P 500. At current prices, I believe W.W. Grainger to be undervalued relative to the market.

W.W. Grainger is exactly the type of business I look for – a high quality, shareholder friendly business with a strong competitive advantage that has a clear and obvious growth plan. In addition, the company’s stock is likely undervalued. Qualitatively, W.W. Grainger’s upside is much greater than its downside. Quantitatively, it ranks in the Top 10 of 180+ dividend stocks with 25+ years of dividend payments without a reduction using The 8 Rules of Dividend Investing.