Stocks were up yesterday by around 1.1% on the S&P 500, but we have gone nowhere now in a week, so the bulls are making no progress. The question in front of us is which way the index will break, and for the past several weeks, we have been able to rely on bonds to give us that answer.

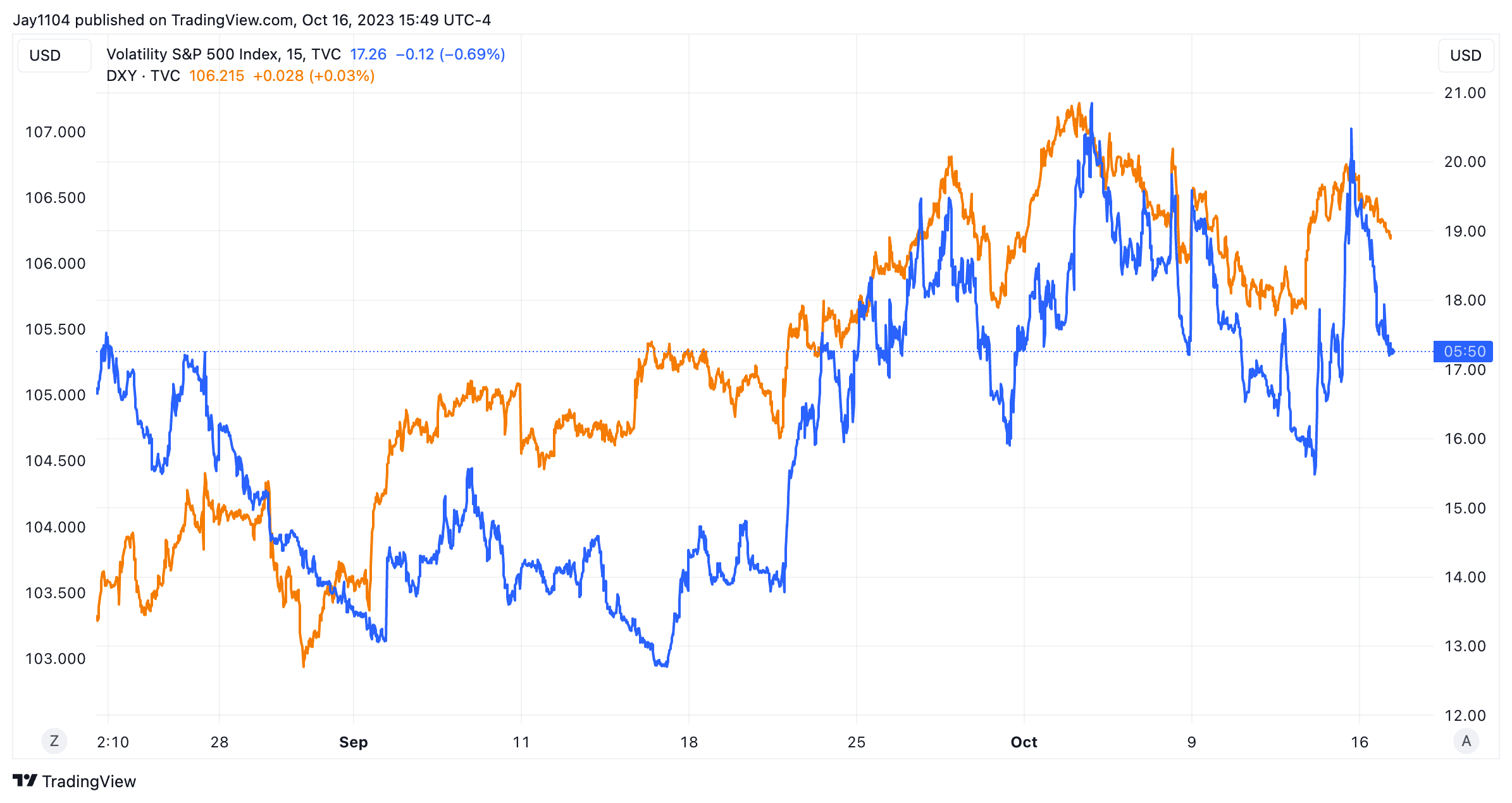

However, yesterday was strange as stocks broke from bonds and rallied despite lower bond prices. At least since mid-August, there haven’t been many times when bonds and stocks went separate ways, but yesterday was surely one of them.

From what I can tell, we have seen this happen a few times, on September 10, September 14, and September 19. Each time, the S&P 500 was lower in the following days because bond prices kept falling. If bond prices keep falling, I think the S&P 500 will find itself lower, too.

At least for yesterday, it was all about the VIX crush and the weaker dollar. That is what I think propelled stocks higher and caused the divergence. Once the VIX declines slowed, the S&P 500 rally ran out of gas.

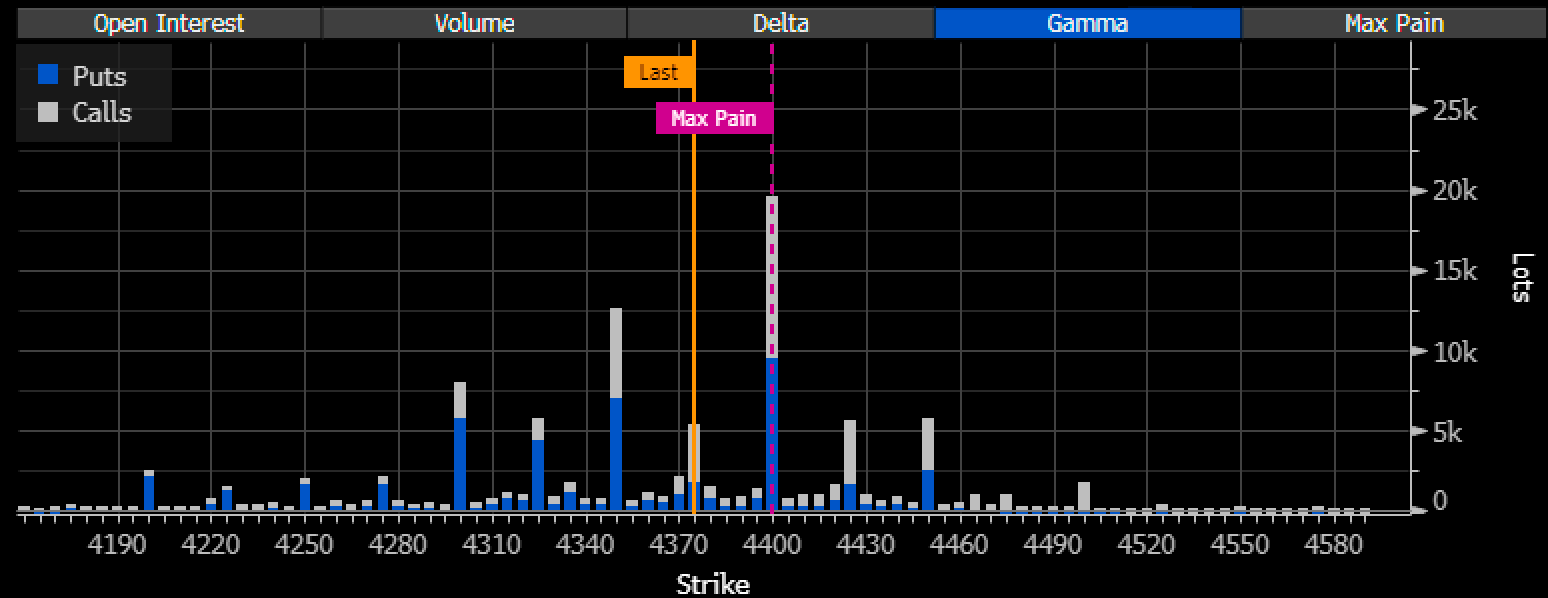

Additionally, the big gamma level for this week’s OPEX is 4,400, which will cap any further upside unless that level moves higher today or in the days ahead. Based on the options activity for Friday and what I saw, I don’t think we will likely see the 4,400 level change today.

Source: Bloomberg

The five-minute chart yesterday has a very symmetrical manufactured-looking shape, and unless the index gaps over 4,385 today, which was high for yesterday, then I would think the day’s gains are given back in the days to come this week, if not today.

Rates Consolidating Post Jobs Report

The 10-year moved higher yesterday but wasn’t able to get past. 4.73% yet. Rates have been consolidating again since the job report. A bull flag may have formed in the 10-year, but until it gets above 4.73%, the move above the trend line yesterday is uninspiring.

It is a similar look for the 30-year rate, with a push above 4.9% needed to point to higher rates above 5% and lower prices.

Ultimately, I think rates on the back of the curve continue to move higher because the yield curve is deeply inverted, and given that a recession at this point doesn’t seem present, the back of the curve still seems too low, and I think the charts reflect a steeper yield curve.

What Do Sectors Indicate About Market Sentiment?

When looking at several ETFs, it is hard to conclude whether the market is bullish or bearish at this point. The (XLF) broke below support on September 26 and has merely returned to support/resistance.

The biotech ETF (XBI) has also seen a similar move lower and higher.

It is also the same pattern for the Discretionary sector (XLY).

The recent rebounds in these sectors look like retracement, and they do not look like impulses to me, and that means that, ultimately, they should fail and turn lower.

The one point about the XLF is that JPMorgan Chase (NYSE:JPM), Citigroup (NYSE:C), and Wells Fargo (NYSE:WFC) reported what were supposed to be good results, and even still, the XLF hasn’t been able to move through resistance.

yesterday, Bank of America will report, and we will see what they have to say and whether or not their results are enough to push the XLF in a decisive direction.

A few people have asked me about oil, and at this point, the charts aren’t telling me anything.