First this article from Factset on Thursday. I thought it was a decent summary on Q1 ’16 financial results YTD.

Thomson data “by the numbers”:

- The forward 4-quarter estimate fell to $123 from $123.01 last week

- The P/E ratio as of Friday’s close is 16.6(x)

- The PEG ratio at 21(x) is way elevated given the very low forward growth rate and continues to be less meaningful.

- The S&P 500 earnings yield is back over 6%, to 6.01%, versus last week’s 5.98%

- The y/y growth rate of the forward estimate increased to +0.78% versus last week’s +0.69%, and maddeningly remains locked in this range.

Analysis: In my opinion, the year-over-year growth rate of the forward 4-quarter estimate remains one of few leading indicators around S&P 500 earnings that has some forecasting ability. That growth rate remains stubbornly locked in the -2% to +2% range for over a year now, which neatly explains why the S&P 500 is now flat over the last 18 months.

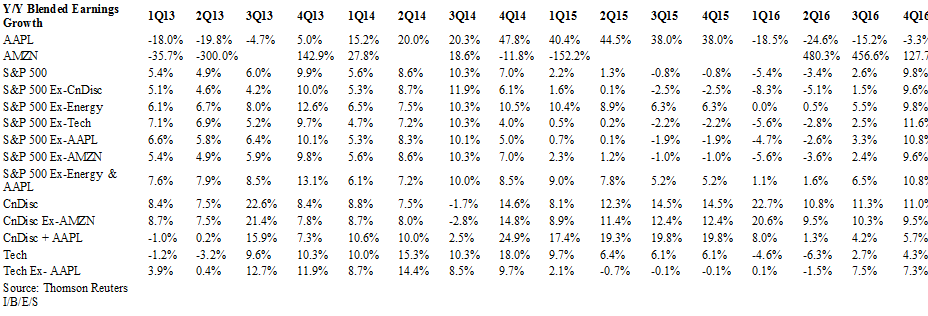

Below is a fascinating dissection of the S&P 500 earnings “attribution” from David Aurelio of Thomson Reuters sent to me Saturday, May 14th, 2016.

What surprised me is the S&P 500 “ex Consumer Discretionary” a sector with a 15% market cap weighting in the S&P 500 which shows the strength of not just Amazon (NASDAQ:AMZN), which is, from what I’ve read, about 11% of the sector’s market cap, but Ford (NYSE:F) and General Motors (NYSE:GM), as David pointed out in an email. Say what you want, the consumer seems to be strong, they are just buying differently.

Also note, the S&P 500 “ex-Energy”, which is showing positive earnings growth, and supports my thought that Q1 ’16 will be the bottom for S&P 500 earnings declines.

Finally, note “Ex-Energy and ex-Apple”: in terms of market cap weighting, Apple (NASDAQ:AAPL) is still about 4.5% of the S&P 500 and Energy roughly 7% market cap weight, so summing the two, readers have about 11% – 12% of the S&P 500 right there.

Conclusion: Readers should scan quickly the “1Q ’16” and “2Q ’16” columns for year-over-year growth rates. I continue to think a bottom is forming in terms of S&P 500 earnings growth, but the S&P 500’s continued range-bound trading and lack of a breakout above 2,135-2,150, tells me the market is unconvinced. Roughly 450 of the S&P 500 have now reported Q1 ’16 and the retailer reports as of April 30 ’16 end, aren’t that encouraging either. Walmart (NYSE:WMT) reports this week, which represents the “official” end of earnings season.

Personally, I’d like to see the US dollar continue to weaken (has rallied most of May) and the Energy and commodity sectors continue to bounce.

The best trades for clients this year have been the iShares US Energy (NYSE:IYE)/Energy Select Sector SPDR (NYSE:XLE), the iShares MSCI Emerging Markets (NYSE:EEM)/Vanguard FTSE Emerging Markets (NYSE:VWO), and the iShares MSCI Brazil Capped ETF (NYSE:EWZ). (Long all ETFs in many accounts.)

These positions can change at any time, but these ETFs represent the bigger picture of weaker dollar, rising commodity prices, and – well – Brazil was a catch-weight for just about everything that didn’t work in the last 5 years (i.e. energy, commodity, currency, corrupt government, and the hope of the Olympics ’16).

The Energy and commodity charts are at a critical juncture. It merits a separate post tonight or tomorrow.

2016 has been all about rotation – “from the worst (of 2015) to the first (in 2016)” – and for a healthy market, this rotation needs to continue.

Back with more shortly.