Full year results in line, outlook positive

Diploma's, (DPLM) FY13 results were in line with our expectations: top-line growth was driven by an excellent performance in Life Sciences, while group-level operating margins reduced as a result of the group’s ongoing investment programme. Overall, we continue to have a positive view on the company and believe it is well positioned to outperform on a longer time horizon. However, with the rating close to the top end of its historic range, we see limited scope for further significant share price uplift in the short term.

FY13 results in line with our expectations

Diploma posted FY13 revenues of £285.5m and adjusted PBT of £54.3m, in line with our forecasts of revenues at £286.3m and adjusted PBT at £54.4m. Performance was particularly strong in the Life Sciences division with an underlying revenue growth of 15%. The Seals division posted 2% top-line growth due to tough H1 comparatives in the previous year, but management sees growth returning to the long-term target of ‘GDP plus’ level of around 5-6% in FY14. Controls continued to be the weakest of the segments due to the challenging economic conditions persisting in Europe, leading to a 3% decline in underlying revenues. However, there are some positive signs as activity started to pick up in Germany and the UK from Q4 onwards. Operating margins, as expected, have contracted to 19.0% in FY13 (from 20.3% in FY12) due to the group’s investment programme.

Acquisition activity showing signs of acceleration

The group announced today that it has signed a contract for the acquisition of 80% of Kentek Oy for a maximum consideration of £11.2m. Kentek will sit in the Seals division and is engaged in the distribution of filters for heavy mobile machinery and industrial equipment, with a significant exposure to the mining and oil and gas equipment markets. The company is based in Helsinki with operations in the Baltic states and Russia with c €20m of annual revenues and c €2m of EBIT. Gross margins in the business are strong and there is significant potential for Diploma to improve operating margins by optimising operations and driving synergies. Given Diploma’s strategic focus on value-accretive acquisitions, the pipeline for inorganic growth is of key importance, and we believe today’s acquisition, coupled with management’s positive outlook on further opportunities, is encouraging.

Estimates and valuation

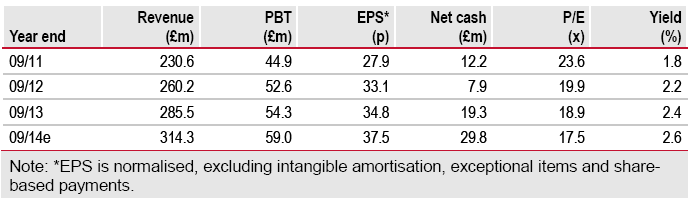

We make minor adjustments to our numbers to reflect the group’s latest acquisition, the progress of the group’s investment programme and divisional trends, leading to our FY14 PBT rising to £59.0m (from £58.7m) and EPS increasing to 37.5p (from 36.3p). Due to the small increase in our numbers and the re-rating of the peer group, our valuation rises to 674p, giving a 2% upside to the current share price.

To Read the Entire Report Please Click on the pdf File Below.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI