The US dollar traded higher against most of the major currencies over the past week. No thanks to Yellen's testimony before Congress. Market participants took away from her words a reduced chance of a mid-year rate hike.

We disagree with the interpretation, seeing her comments as 1) playing down lowflation as transitory and 2) seeing the global influence being overall balanced as the decline in oil prices and interest rates offset the dollar's appreciation. We continue to expect the FOMC to drop its "patient" forward guidance at its mid-March meeting.

The main impetus for the dollar appeared to come from the sharp drop in European interest rates. Germany auctioned 5- and 7-Year bonds with a negative yield. Record low 10-year yields were recorded in at least eight eurozone members. This includes Ireland's 10-Year benchmark yield falling below 1% and Portugal's 10-Year yield falling below 2%. Spread compression continues. It is being driven by anticipation of the ECB's sovereign bond purchases.

The ECB's bond buying program is expected to be launched after next week's policy making meeting (in Cyprus). It still appears to need some necessary technical and legal details to be worked out before the Eurosystem can begin implementing the new program.

The Dollar Index held support seen near 94.00 and moved within spitting distance of the high set in late-January, just above 95.50. The MACDs are poised to cross higher, as are the slow Stochastics, but the RSI is neutral. On balance, we view the consolidative phase in recent weeks as building a base for a new leg up.

Over the past month, the market tried several times to push the euro through the $1.15 level. It failed. Previous support in the $1.1265 area may now offer resistance. It is difficult to talk about strong support. The push below $1.11 in late-January was brief. That area remains the next immediate target, but we suspect the $1.10 area may be more important psychologically.

We often argue that the dollar-yen is a range-bound currency, and when it looks like it is trending, it is moving from one range to another. It has been in narrowing range since December. Indeed, the January range was inside the December range, and the February range was inside the January range. The technical indicators that we use do not give us much hope of a near-term break of the JPY118-JPY120.50 trading range. On the medium-term, we continue to anticipate an eventual upside break.

The technical tone of sterling remains constructive. Since pushing above the 20-day moving average on February 3, sterling has stayed above it and managed to poke through $1.55 for the first time since the start of the year. Although it failed to establish a foothold above there, we do not think the market has given up on it. Our reading of the technicals suggests that there may be one more leg up that could get sterling closer to $1.56. Firm PMI readings in the week ahead could help solidify expectations that the BOE will be the next major central bank to hike rates after the US.

Over the past two weeks the dollar has tested its 100-day moving average against the Swiss franc. It is found near CHF0.9550, and the dollar has stalled. Technical indicators are not generating strong signals. The potential key reversal on February 20 did not spur any follow-through dollar selling. Recall that the euro also posted a key reversal on February 20. The euro did not make a new high and spent most of the week within the February 20 range. The euro has held above CHF1.05 since February 13.

The US dollar has been carving out what appears to be a consolidative triangle pattern vs the Canadian dollar throughout February. The bottom of the triangle is fairly flat, around CAD1.2350. The down-sloping top of the triangle comes in near CAD1.25 by the end of the week. The key drivers may be whether the Bank of Canada takes out additional insurance next week by cutting rates again and whether oil prices recover further. A strong US employment report at the end of the week could renew speculation of a Fed hike in June. We anticipate a breakout to the upside but are also aware that the pattern is notorious for false breaks.

Ideas that the Reserve Bank of Australia may not cut rates in the coming week helped to briefly push the Aussie through $0.7900. However, weak capex has kept the OIS, and forward markets nearly evenly split. If the RBA does not cut rates in March, it will simply raise the conviction levels that a cut will be delivered in Q2. A number of participants expect two cuts to be delivered. We are more inclined to sell into Aussie gains, which the technical indicators still are consistent with, toward $0.7940-50 on ideas that resistance around $0.8000 will be formidable.

The April crude oil futures contract (WTI) spent the month in February in a wide but clear trading range. The bottom around $47.50 was approached at the end of last week. The upper end of the range is near $55. Many participants are suggesting a key low is in place and appear to be better buyers on pullbacks. The MACDs are turning down. The slow Stochastics are falling but in neutral territory. The RSI is neutral. Prices need to rise above $51.50 to be anything noteworthy.

U.S. 10-Year Treasury yields rose from 1.64% at the start of February to a high of 2.16% on February 18. The push down to 1.92% at the end of last week nearly retraced 50% of the increase in yields. Key to the outlook is the U.S. jobs report, which the ADP estimate steals much of the thunder. The yield can rise toward 2.07-2.10% ahead of the data.

The S&P 500 set new record highs on February 25, just shy of 2120. The MACDs and slow Stochastics warn of the loss of upside momentum. The RSI is more neutral. Since closing above 2100 on February 20, this has become support. Our reading of the technical condition suggests risk of a pullback into the 2080-2090 area, which would not damage the larger constructive tone.

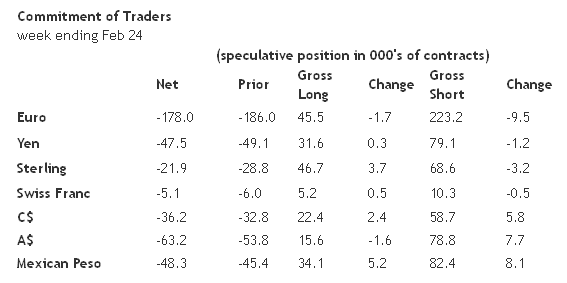

Observations from the speculative positioning of the futures market:

1. For the second consecutive week, there were no significant position adjustments among speculators in the currency futures, which we define as a shift of at least 10k contracts in the gross position. The gross short euro position was the closest at 9.5k contracts were covered, leaving 223.2k open. The gross short euro position has fallen by about 21k contracts this month as the downside momentum faded.

2. To the extent that there was an overall pattern, speculators reduced gross short positions in the majors and added to them in the dollar-bloc and peso. Gross long positions were mostly added to, with the exception of the euro and the Australian dollar, both of which fell by less than 2k contracts. This is consistent with the consolidative tone seen in the spot market.

3. Although the week-to-week gross position adjustments in February have been modest, the adjustment have trended. This was the third week that the net short euro position has fallen. It has been driven more by short covering that bottom picking. The net short yen position has been reduced for six consecutive weeks. At -47.5k, it is half of the size it was at the start of the year. The net short sterling position extended its falling streak to five weeks. It has been halved since the end of January to 21.9k contracts.

4. The net short 10-year Treasury futures position swelled to 110k from 67.2k contracts. However, the gross short position hardly changed. It slipped by 500 contracts to 469.8k. What happened was the longs jumped out: The gross long position fell 43k contracts to 360k.

5. The net long speculative light sweet oil futures position fell by nearly 10% to 270k contracts. The bulls and bears saw things they liked. The bulls added 12.2k long contracts to give them almost 491k. The bears added 41.7k short contracts giving them 221k.