Stocks are now in very serious trouble.

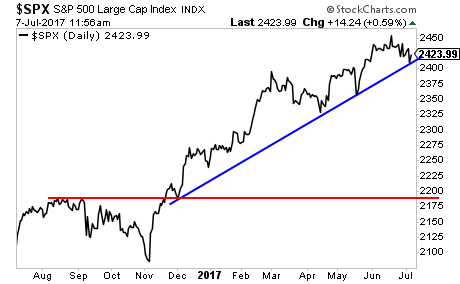

The S&P 500 has fallen to test its “election rally” trendline. If the market breaks down here, there’s essentially one giant “air pocket” down to 2,200 or so.

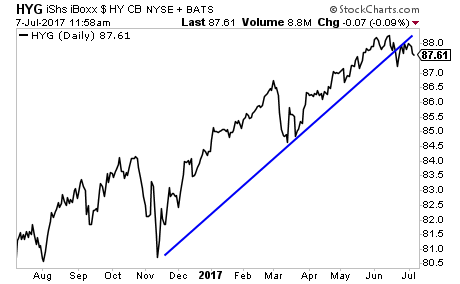

The bad news is that high yield credit (iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG)), which leads the S&P 500, has already broken its respective trendline. This is a serious “risk off” signal.

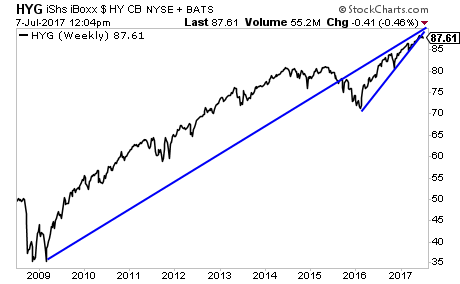

Indeed, it gets worse. HYG is in fact breaking out of a massive rising wedge pattern that could very well mark the end for the 9 year bull market in risk.

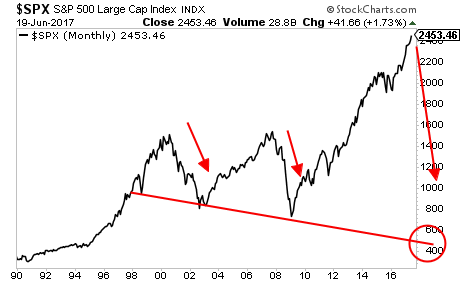

What would this mean for stocks?

The 3rd and biggest Crisis 20 years.

A CRASH is coming.

And smart investors will use it to make literal fortunes.