The stock market flash crash on August 24 was one for the record books. In fact, the last time the market fell so sharply in a single day was back in 2011.

But the real question is: Has this impressive bull market finally reached its end?

Despite the pundit’s best guesses, no one truly knows. Some say the current market volatility is all China’s fault. Others place the blame on large-scale algorithmic trading programs designed to buy and sell with minimal human intervention.

And some have even tied the volatility to an obscure seven-year cycle with biblical connections…

Unlucky Number Seven?

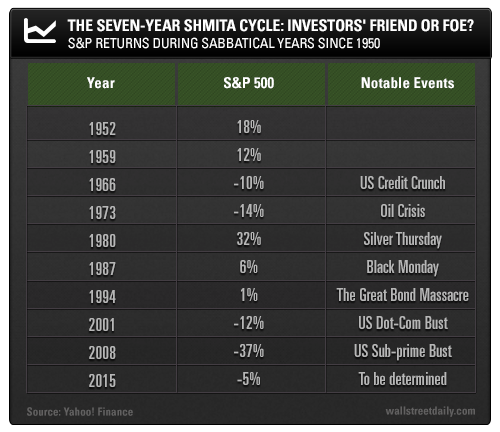

For nearly six decades, the stock market has contracted, in some way, every seven years. Some of the corrections have been small while others have been vicious – but either way, the pattern has persisted.

Perhaps this makes sense. After all, the number seven is everywhere in nature.

There are seven seas, continents, and natural wonders in the world. There are also seven classical planets in the solar system.

How about a deeper connection?

According to scripture, the Jewish calendar moves in seven-year cycles from creation. The seventh year in the cycle is known as the sabbatical year, or “Shmita.” The sabbatical year is one of rest, forgiveness, and reflection. In Israel, farms must go uncultivated. Personal debts are forgiven, and commitments to faith are renewed.

But what does this have to do with the stock market? Well, in a Shmita year, the stock market takes a rest, too. Believe it or not, some of the biggest stock market pullbacks have synced up with sabbatical years.

Now, I want to stress that correlation is not causation here. That said, the seven-year pattern is a connection worth exploring.

Since 1950, the average return on the S&P 500 during sabbatical years is -0.04%, excluding dividends. In fact, over the last four cycle years, returns have gotten progressively worse. This year – the latest sabbatical year – the S&P 500 is currently in the red.

But, as you can see above, it’s not all bad. The S&P 500 has posted positive returns in half of the cycle years. So how can we use this information to guide our investing decisions?

Next week, I’ll reveal how these stock market “sabbatical” years can provide some of the best plays for the opportunistic investor. And, more importantly, I’ll show you when to pounce on them.

On the hunt,