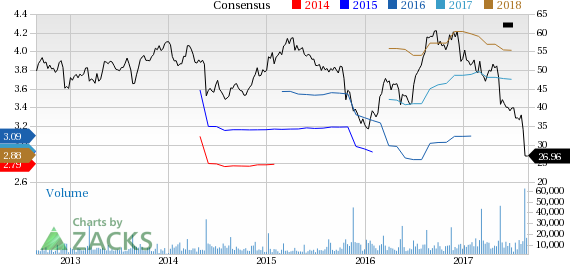

Once an industry outperformer, Dick's Sporting Goods Inc. (NYSE:DKS) now seems to be in doldrums. This Pennsylvania-based retailer has slumped 22.8% since it reported second-quarter fiscal 2017 results on Aug 15. Further, this stock has crashed 47% in the past six months, much wider than the Zacks Miscellaneous Retail industry’s 14.7% downside. So, let’s analyze the factors that have been hindering the company’s performance and led to the second-quarter debacle.

Intense Competition Mars the Sports Industry

The sporting goods space has been extremely competitive and promotional of late, owing to consumers’ rapid shift to online shopping. While most retailers including DICK’s Sporting are trying all means to boost omni-channel operations, competition from online giant Amazon.com Inc. (NASDAQ:AMZN) remains a major deterrent. Well, this has been a concern for DICK’s Sporting, as some of its significant vendors including NIKE, Inc. (NYSE:NKE) , Adidas (DE:ADSGN) AG (OTC:ADDYY) and Under Armour, Inc. (NYSE:UAA) have resorted to considerable direct-to-consumer selling. These factors, along with NIKE’s plans to sell directly on Amazon remains a major threat to DICK’s Sporting’s top line.

Apart from DICK’s Sporting, these obstacles have taken a toll on many other major sporting goods companies like Foot Locker Inc. (NYSE:FL) , Hibbett Sports, Inc. (NASDAQ:HIBB) and Big 5 Sporting Goods Corporation (NASDAQ:BGFV) . Incidentally, these big-wigs recently curtailed their forecasts after posting dismal numbers in the second quarter. Aptly, the industry stands among the bottom 6% of the 265 Zacks Industries.

Margins May Remain Pressurized

As stated above, DICK’s Sporting is undertaking several efforts to boost its e-Commerce operations, as evident from the recent relaunch of its website. While these endeavors bode well for the long term, the costs associated with these investments remain a deterrent for the company’s margin. Margins are also bearing the brunt of intense promotional activities undertaken by the company to thrive amid the mounting competition.

DICK’s Sporting’s gross margin contracted 17 basis points (bps) and 82 bps in the first and second quarters of fiscal 2017, respectively. This was largely due to higher shipping and fulfilment expenses associated with the online sales. Further, management expects fiscal 2017 gross and operating margins to decline year over year, which reflects chances of these obstacles to linger.

Softness in the Hunting Category

DICK’s Sporting’s hunting category remained extremely challenging in the second quarter. Incidentally, comparable store sales (comps) at this category fell by double digits, which was worse than management’s expectations. Also, the gross margin remained stressed here owing to increased promotions. Further, management expects the hunting business to witness tough times in the remainder of fiscal 2017. Even though DICK’s Sporting is strongly focused on capturing displaced market share from liquidation of rival firms, the company still anticipates the hunting category to remain negative.

Q2 Bears the Brunt, Outlook Hurts Estimates

All aforementioned challenges caused DICK’S Sporting to post negative earnings surprise in the second quarter of fiscal 2017. Also, the earnings of $1.00 per share was below the company’s guidance range of $1.02-$1.07. Furthermore, expectations of all aforesaid hindrances to linger compelled DICK’s Sporting to lower its fiscal 2017 earnings per share and comparable-store sales views.

For fiscal 2017, which will have an additional week, management expects adjusted earnings in the range of $2.80-$3 per share versus $3.65-$3.75, guided earlier. Despite the benefits from industry consolidation, comps for the year are anticipated to be flat to down low single-digit compared with 1-3% growth projected earlier.

This, in turn has led a downward spiral in the Zacks Consensus Estimate for the third quarter and fiscal 2017. The current Zacks Consensus Estimate of 26 cents for the third quarter has gone down by 30 cents, while for fiscal 2017 the same has fallen by 19.3% to $2.93 in the past 30 days.

Nonetheless, DICK’s Sporting’s remains committed toward implementing its new merchandise plan, as well as its strategies of augmenting digital operations and exploiting industry consolidation. However, it may take a while for these plans to offset the boulders that are currently lying in this Zacks Rank #5 (Strong Sell) company’s path.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Foot Locker, Inc. (FL): Free Stock Analysis Report

Big 5 Sporting Goods Corporation (BGFV): Free Stock Analysis Report

Dick's Sporting Goods Inc (DKS): Free Stock Analysis Report

Hibbett Sports, Inc. (HIBB): Free Stock Analysis Report

Nike, Inc. (NKE): Free Stock Analysis Report

Adidas AG (ADDYY): Free Stock Analysis Report

Under Armour, Inc. (UAA): Free Stock Analysis Report

Original post

Zacks Investment Research